Canada’s S&P/TSX Composite Index (TSX:OSPTX) lost 217 points on Monday to close at 15,981.77 level, down 1.34% for the day following four consecutive trading sessions of losses. The country’s main stock market index was dragged down by heavy losses in energy, healthcare, and financial sector names as COVID-19 induced volatility peaks once again.

In all, there were just 311 advancers against a staggering 1,463 decliners during Monday’s trading session. Only 178 tickers remained unchanged. A reported surge in coronavirus cases in Europe and growing fears of no stimulus package deal before U.S. elections in November seems to curb investor enthusiasm.

Is the TSX stock market crashing again?

We saw more signs of a volatile but supported market than a crashing stock market on Monday. The 1.34% day decline was only a small tip of the iceberg.

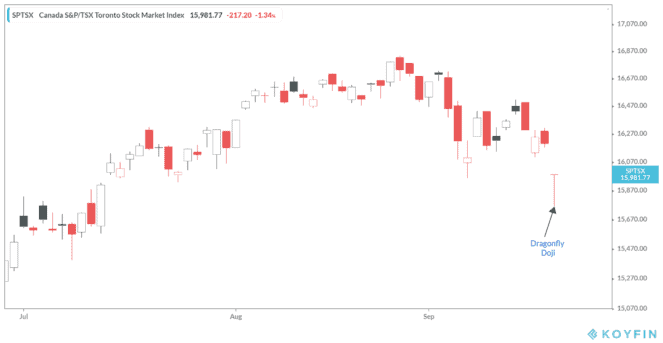

The TSX Index opened at 15,981.31, a level 1.34% lower from Friday’s 16,198.97 reading at the close last week. We saw the index fall a deep 2.7% to a low of 15,763.05 during the trading session, only to strongly recover to close at a day high of 15,981.77.

To a market technician, Monday’s trading session produced a rare Dragonfly Doji where the opening level, market high, and market close levels were virtually the same, yet with a long tail down below. Such a signal can be a bullish sign for a reversal to the upside when combined with other information. If the TSX rises on Tuesday, such a trend could be confirmed.

The sharp recovery from a 2.7% decline could indicate that buyers were later able to strongly support a market weakened by early sellers. Perhaps there are a lot of buyers ready to scoop any cheap stocks on the TSX right now. We will know more as sentiment evolves during the week.

Market crash or correction?

Down 6.3% year to date, the TSX Composite Index is still yet to recover from a March 2020 coronavirus market crash. A near 50% recovery rally from March 23 lows to recent highs on August 26 led by tech stocks was indeed hilarious. However, the local market hasn’t managed to recover to pre-pandemic levels yet.

Probably the latest weakness is a welcome correction after a hot rally. Perhaps it is, but given the mere 4.8% drawdown from the most recent highs in August, we are still far from a 10% type correction yet.

Worries are mounting over the potential duration of the pandemic. We are afraid of a second COVID-19 wave. We are unsure whether some unprecedented economic stimulus packages that drove the quickest recoveries in North American equity markets from a market crash in 2020 will be revived.

No one can dismiss the idea of another market crash this year given obtaining highly uncertain economic conditions. It’s true that humanity hasn’t prevailed over the pandemic yet. Until then, volatility in the capital markets should be a normal occurrence.

That said, given record-low interest rates and potential recoveries in corporate earnings as economies re-open, North American equity markets could find strong support from hopeful investors and a committed U.S. Federal Reserve that is prepared to do all it can to avoid market turmoil.

Even if we are in correction mode, not every economic sector is losing.

On the brighter side, the S&P/TSX Capped Information Technology Index gained a strong 1.1% on Monday. The strong show was powered by a resilient Shopify, which gained 3.8% and Constellation Software, up 1.1%. The two stocks comprise nearly half the weight of the index’s ETF. Lightspeed POS‘s share price also rose 3.2% yesterday.

Foolish bottom line

It doesn’t matter whether these are early stages of another market crash or just going through turbulence in a bull market. Long term investors should remain invested through it all. As discussed during trying times in February, history has taught us to hold onto high-quality stocks and to even buy some more during market crashes.

Those who sold into the March-April crash this year lost out.