A second 2020 market crash could be in the works.

The rally off the March market crash caught most seasoned investors by surprise. High unemployment and brutal Q2 earning results should have meant a more cautious recovery in share prices.

However, analysts say a wave of new investors and traders flooded the sector in recent months, using government aid payments to speculate on stocks. This helped the U.S. market recover — or even surpass — most of the March losses. Tech stocks led the charge, but many sectors also bounced back in a big way.

As a result, the market trades at earnings multiples that appear rich by pretty much every measure.

When the U.S. market rallies, Canada tends to join the party. When American stocks tank, Canadian equities also get hammered.

At the time of writing, the TSX Index is off about 900 points from the late August highs of 15,900 to 16,800. This is certainly not a crash and still puts the market way above the March low around 11,000. The TSX Index started the year at 17,100, so we are not down much on a year-to-date basis.

Where things go in the coming weeks or even months is anyone’s guess. However, the worst months for the market tend to be September and October. A number of factors could extend the recent decline, including rising COVID-19 cases around the globe, expiring government aid and loan deferrals, and uncertainty connected to the coming U.S. election.

With markets still trading at historically high valuations and a variety of headwinds on the way, it makes sense to seek out stocks that pay reliable dividends with share prices that tend to hold up well when a market crash or market correction occurs.

Fortis: A top stock pick for a market crash?

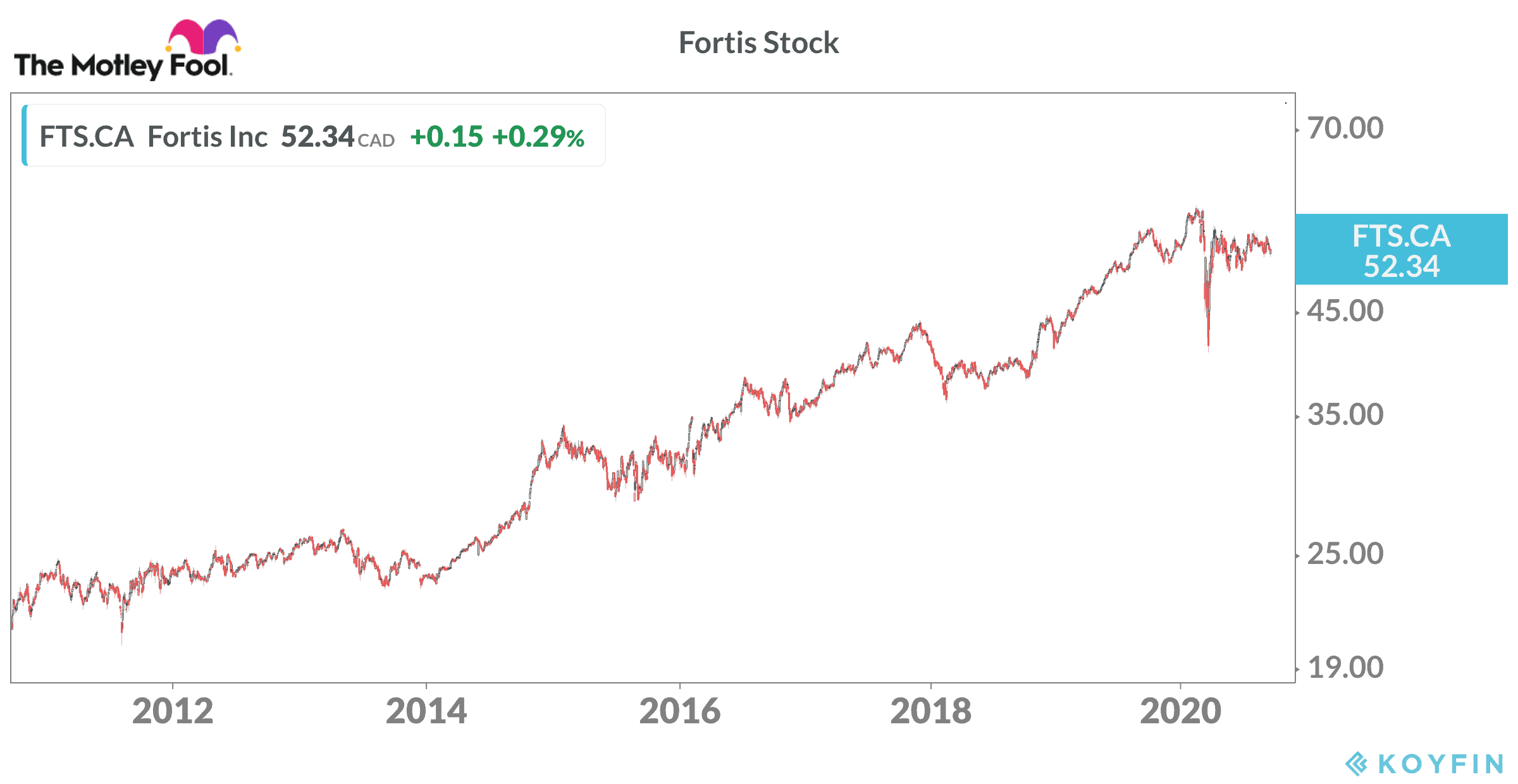

Fortis (TSX:FTS) (NYSE:FTS) is a utility company with $57 billion in assets spread out across Canada, the United States, and the Caribbean. Power generation, electricity transmission, and natural gas distribution businesses tend to be recession-resistant. They operate in regulated environments and deliver steady and reliable cash flow.

The United States Federal Reserve and the Bank of Canada intend to keep interest rates low for the next two or three years, and possibly much longer. That bodes well for Fortis and other utility companies as they can access cheap debt to fund capital projects or acquisitions.

Fortis has roughly $19 billion in capital projects in the works that will increase the rate base significantly in the next four years. In addition, numerous other growth opportunities should arise. Consolidation is an ongoing theme in the North American utility sector and Fortis isn’t shy when it comes to making aggressive moves that make strategic sense.

Fortis trades near $52 per share and provides a 3.6% dividend yield. Adjusted Q2 2020 net earnings increased compared to the same period last year. The board intends to raise the payout by an average annual rate of 6% through 2024. That’s great dividend growth guidance in these uncertain times.

While Fortis stock isn’t immune to big market moves, it generally carries less risk than the overall market. For example, the TSX Index is down about 2% for the day at the time of writing. Fortis, however, trades flat compared to the previous close.

The bottom line

Investors should prepare for the possibility of a meaningful correction, or even another market crash in the coming weeks. One way to mitigate the damage while still getting paid well is to look for stocks such as Fortis that tend to cruise through the turbulence in decent shape.