Some of the TSX’s hottest stocks are still available below $50. These stocks have witnessed strong buying over the last six months and have enough fuel left that could continue to drive their stocks in the coming years.

With strong fundamentals and ample growth catalysts, these stocks are likely to outperform the broader markets in the foreseeable future and generate stellar gains for investors. Let’s take a look at three high-growth stocks available below $50.

Absolute Software

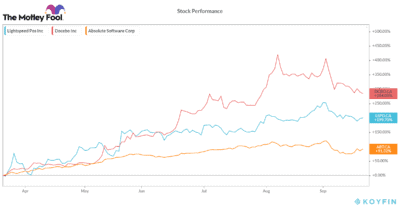

Absolute Software (TSX:ABT) stock is up over 91% in the last six months, reflecting stellar demand for its security software and overall investors’ optimism over the tech sector. Investors should note that the shares of Absolute Software remain insulated to the COVID-19 led selloff, which reflects the resiliency of its business. Meanwhile, the company has consistently performed well over the past several years, and momentum in its business is likely to sustain and drive its stock higher in the coming years.

Absolute Software’s commercial recurring revenues have grown at a healthy pace over the past several quarters, thanks to the acquisition of new customers, expansion and retention of existing clients, and favourable industry trends. The company has over 13,000 commercial customers, with more than nine million activated licences globally.

Absolute Software has a large addressable market, and with growing cybersecurity spending and lower competitive activity, its annual recurring revenues are likely to sustain high-single-digit growth. Moreover, the structural shift towards remote work and distance learning is likely to drive demand for its cloud-based security software and services.

Absolute Software’s ability to generate strong cash and debt-free balance sheet supports its payouts. The company currently offers a decent annual dividend yield of 2.2%.

Lightspeed POS

Shares of Lightspeed POS (TSX:LSPD) have soared over 199% in six months. The rally in its stock is due to the acceleration in demand for its commerce-enabling software platform. The pandemic is driving the need for its solutions as small retailers and restaurant operators are shifting from the traditional in-person selling models with online and digital strategies.

The surge in demand has created a multi-year growth platform for Lightspeed POS to drive its customer base and leverage its payments solutions. With the expansion of its customer base and surge in gross transaction volume (GTV), Lightspeed POS remains well positioned to monetize a larger portion of its customers’ GTV.

As its core solutions witness heightened demand, Lightspeed is pushing its premium offerings like analytics and accounting, which is likely to boost its monthly ARPU per customer. Sustained demand for its solutions and growth in its premium offerings are likely to support the uptrend in Lightspeed POS stock.

Docebo

Docebo (TSX:DCBO) stock has surged by a whopping 284% in six months. Increased spending on corporate e-learning and acceleration in demand for its platform amid the pandemic supported the rally in its stock.

Docebo is fast acquiring customers, while its retention rate remains very high. Moreover, the company benefits from the consistent growth in deal size and increasing tenure of contracts.

Investors should note that Docebo could continue to report strong financial numbers in the coming years, thanks to the higher recurring subscription revenue mix. Moreover, its large total addressable market and emphasis on corporate learning should support the uptrend in its stock.