The shares of the top pot producer Aurora Cannabis (TSX:ACB)(NYSE:ACB) soared more than 15% on Tuesday on higher expectations of its quarterly earnings. However, it was again the same, old story from Aurora. It reported a weaker-than-expected revenues and posted one of the biggest losses in history.

Aurora Cannabis: Yet another disappointing quarter

For fiscal Q4 2020, Aurora Cannabis reported $72 million in revenues, a decline of more than 5% from the previous quarter. Its net loss jumped to $1.8 billion driven by goodwill writedowns and asset impairment charges. The company reported $2.9 billion in impairment charges in the entire fiscal year 2020.

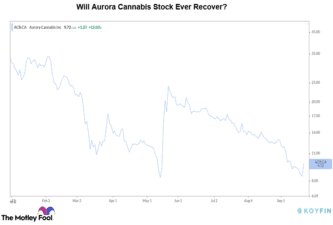

The recent gains of the top pot stock might evaporate, given Aurora’s disappointing results. Once investors’ favourite, Aurora Cannabis stock has lost almost 70% so far this year.

The company management expects $62 million in revenues for Q1 2021, lower compared to the recently reported quarter. According to management guidance, Aurora Cannabis was expected to turn EBITDA positive by Q1 2021. However, now the target has been pushed back by a quarter. On the net income front, Aurora has reported a loss for the last seven straight quarters.

Aurora announced the closure of several production facilities in June in order to increase efficiency. It currently operates an annual production capacity of 142,000 kg per year.

Aurora Cannabis was successful in lowering its production costs during the fiscal fourth quarter. It spent around $0.89 to produce a gram of cannabis, lower from $1.22 per gram in the earlier quarter.

Concern for investors

Too many players amid lower-than-expected demand have dominated the marijuana industry in the last few years. The industry once looked promising due to its steep growth prospects, but the industry as a whole has been on a decline lately.

Aurora Cannabis has some of the geographically diversified operations across the globe. However, its international sales have failed to pick up and continued to burn cash. Along with falling stock price, Aurora’s continued losses and declining revenue growth might bother investors. Additionally, a prolonged equity dilution will also be one of the major concerns for them.

A higher number of retail shops, along with an innovative recreational product range, should boost Aurora Cannabis’s sales. Product differentiation will be vital here, as many pot players are working on launching similar goods. Notably, top-line growth and consistent efforts on pruning operating costs will help the company reach breakeven.

Declining stock price

Aurora Cannabis still seems far from turning profitable. The top pot stock has dug a deep hole in investors’ pockets in the last few years. While Aurora stock has lost around 90%, cannabis stocks at large have lost approximately 55% in the last 12 months.

Aurora Cannabis is currently trading at a forward price-to-sales valuation multiple of four. This looks expensive against its average historical valuation as well as compared to peers. The stock will likely continue to trade volatile and could be a risky bet for conservative investors.