A lot has changed with pot stocks from just a few years ago. Not long ago, these companies used to be some of the best growth stocks on the TSX.

There were huge rallies with many companies making deals to merge or acquire other producers.

At first, it was a race for the most capacity. Every company was in a race to build their capacity and become the dominant company in the industry. However, companies began overleveraging, and that started to worry investors.

So, it’s essential for investors today to find companies that are still in good financial shape without too much debt.

After huge anticipation and massive run-up in stock prices, the industry looks to be settled into a long-term range. This was to be expected after legalization. The initial rallies were always fueled by speculation about how big the recreational market could get once cannabis was legalized.

Furthermore, as me and many of my fellow Fools warned before legalization, these companies will be competing with the black market, which will push prices down and hurt profitability for years. That’s why lowering the cost to grow was so important. Between that and massive consolidation in the industry, there’s still a long way to go.

Can you make money in pot stocks, and are they worth an investment today?

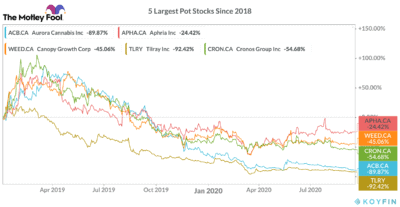

Poor pot stock performance

As you can see in the above chart, it’s been a rough couple of years for pot stocks. However, two things immediately stand out. First, the top performer, Aphria (TSX:APHA)(NASDAQ:APHA), which is down 25% since the start of 2018, was a stock that was the most conservative of the group.

This is important, because, as many others took on massive leverage in a race to the top, Aphria remained grounded and stuck to its reasonable growth plan. This is something I mentioned a while back that would be crucial for pot stocks.

It was important to try and become the most dominant stock, but companies shouldn’t sacrifice their financials in a bid to do so.

Another thing that’s also immediately noticeable in the chart is that Canopy Growth (TSX:WEED)(NYSE:CGC), by far the biggest company in the industry, is the second-best performer, down roughly 45% since 2018.

This shows investors are rewarding conservative businesses, or those they think can dominate the industry.

Another reason Aphria may not be down as much as its peers is because the stock likely didn’t have the same run-up in valuation ahead of legalization. That’s a by-product of the conservative growth from management.

Is there any value in pot stocks today?

When thinking about buying a pot stock today, investors have to understand that the times of easy gains are over. These days, an investment in the industry requires a solid long-term commitment.

There are still too many producers for the industry, and the price of cannabis remains too high, allowing easy competition from the black market.

If you are interested in an investment today, I would stick with either of the top two performers from the chart above. Canopy is a great choice if you want a company that will be dominant in the industry.

However, personally, I would be inclined to invest in Aphria. It’s my choice because I like the financials better and think it has a much more manageable long-term strategy. Therefore, I would be more comfortable with my money there when making a long-term investment.

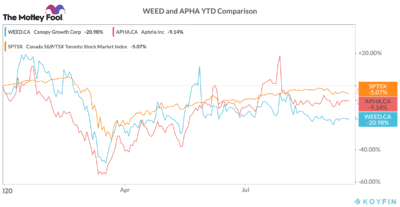

It’s clear from the graph above that pot stocks remain a lot more volatile than the market. However, they are still considerably less volatile than they were just a few years ago. This is positive for investors. You’ll still have to be careful owning the stocks, but you don’t have to worry about major price fluctuations if you take a decent-sized position.

Bottom line

There’s no question that over the long term, pot stocks will continue to grow. With more countries legalizing cannabis for recreational or medical purposes, these companies will continue to find new ways to grow.

However, with so many growing pains in the short run, you may decide to hold off for now and buy something today with a bit more momentum.