Brookfield Property Partners (TSX:BPY.UN)(NASDAQ:BPY) is trying to reduce its costs by laying off nearly 20% of its retail segment workforce, a CNBC report claimed yesterday. The report cites Brookfield Properties retail division CEO Jared Chupaila’s recent email to employees. In the email, Chupaila called the move an effort “to align with the future scale of our portfolio.”

Why is Brookfield Properties reducing its workforce?

Brookfield Properties is a subsidiary of Hamilton, Bermuda-based real estate giant Brookfield Property Partners. It operates some of the largest malls in the U.S.

In the quarter ended June 30, Brookfield’s funds from operations fell to US$178 million — significantly lower as compared to US$335 million in the corresponding quarter of the previous year. The company blamed COVID-19-driven widespread closures of its hospitality and retail assets for hurting its funds from operations.

In Q1 and Q2, Brookfield Property Partners’s total revenue fell by 27% and 31% on a YoY basis, respectively. Analysts expect the real estate giant to report about a 24% drop in its fiscal 2020 revenue.

Will the move boost investors’ confidence?

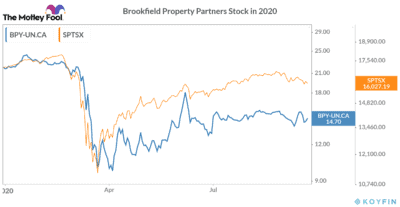

As of September 22, the shares of Brookfield Property Partners have seen 39.4% year-to-date value erosion — much worse as compared to only a 4.7% drop in the S&P/TSX Composite Index.

While its stock has seen a minor 6.4% recovery in the last three months, its overall year-to-date losses reflect investors’ worries about the pandemic-related headwinds. These headwinds might cause big damage to the company’s overall business growth in the medium term. This could be the main reason why Brookfield’s management has decided to cut its retail segment workforce by 20%, which is likely to help it regain investors’ confidence.

Why it’s a great stock to invest in right now

If you don’t already know it, Brookfield Property Partners is one of a handful of stocks — listed on TSX — with double-digit dividend yields. It currently offers a solid 12.1% dividend to its investors. And this is one of the reasons that makes Brookfield stock one of my all-time favourites.

While it’s really important for investors to carefully time your entry when buying a stock, high-dividend-yielding stocks like Brookfield Property Partners make things easier. Even if you miss the perfect timing to buy its stock, the regular income that you’ll get — in the form of dividends –makes up for it.

Foolish takeaway

The ongoing, prolonged pandemic is taking a big toll on many businesses — including Brookfield Property Partners. That justifies the company’s recent move to cut its retail arm workforce and save costs to protect its investors’ money.

From a retail investor’s perspective, I would definitely want to add this Dividend Aristocrat in my portfolio and hold it for the long term. Investors’ concerns about COVID-19-related headwinds have led to a significant decline in its stock price in 2020.

Currently, Brookfield Property Partners stock is trading at $14.68 per share on TSX. At this price, it could be a good time to buy its stock for the long term.