We would all like to retire rich.

Reaching the goal appears harder today than it might have been in the past, but the road to retirement wealth remains open for most people, even under the current circumstances.

How to use debt to build wealth

Debt comes in different forms. Some debt is bad and will kill your retirement dreams, while other types of debt can help you build retirement wealth.

The bad debt includes high-interest balances on credit cards. Banks charge up to 20% interest on credit card balances and you often get nailed for the interest on the full balance on the statement, even if you pay part of it down before the statement is due. Pay off the balance every month. Use the card for convenience, not credit.

In addition, avoid using debt to purchase a car. Vehicles are simply tools to get us around town. Resist the temptation to splurge on an expensive vehicle that locks you into long-term payments. Cars are terrible investments.

Good debt would include loans that help you create wealth. A mortgage is the most popular.

House prices skyrocketed in the past 20 years and continue to soar higher. At some point a price drop will occur, so it is important to buy what you can reasonably afford, not what the bank tells you is your maximum limit. Fortunately, interest rates on mortgages are now at record lows.

Owning a house remains a solid investment over the long-term. It creates forced savings and you can tap the equity for a low-interest line of credit to cover the cost of maintenance expenses or a renovation.

Borrowing to fund education upgrades might also fall in the category of good debt if the result is a significant boost in your income and career progression.

How the recession can help you retire rich

The pandemic caused the second major economic crisis in the last 10 years. While this is frustrating, it also gives investors an opportunity to build stock portfolios with top-quality holdings that pay attractive dividends.

A well-known secret for building retirement wealth involves the power of compounding. Buying high-quality dividend stocks inside a Tax-Free Savings Account (TFSA) or RRSP and using the dividends to acquire additional shares sets off a snowball effect. Each new share creates extra dividends that in turn buy even more shares.

Over the course of 20-30 years, small initial investments can grow to become large savings to help you retire rich. The trick is to have the patience to let the process work. New shares are purchased at a steady pace, taking advantage of dips in the market. Top stocks with long-track record of rising revenue and earnings tend to increase their dividends at a regular pace. In addition, the share prices normally rise over the long haul.

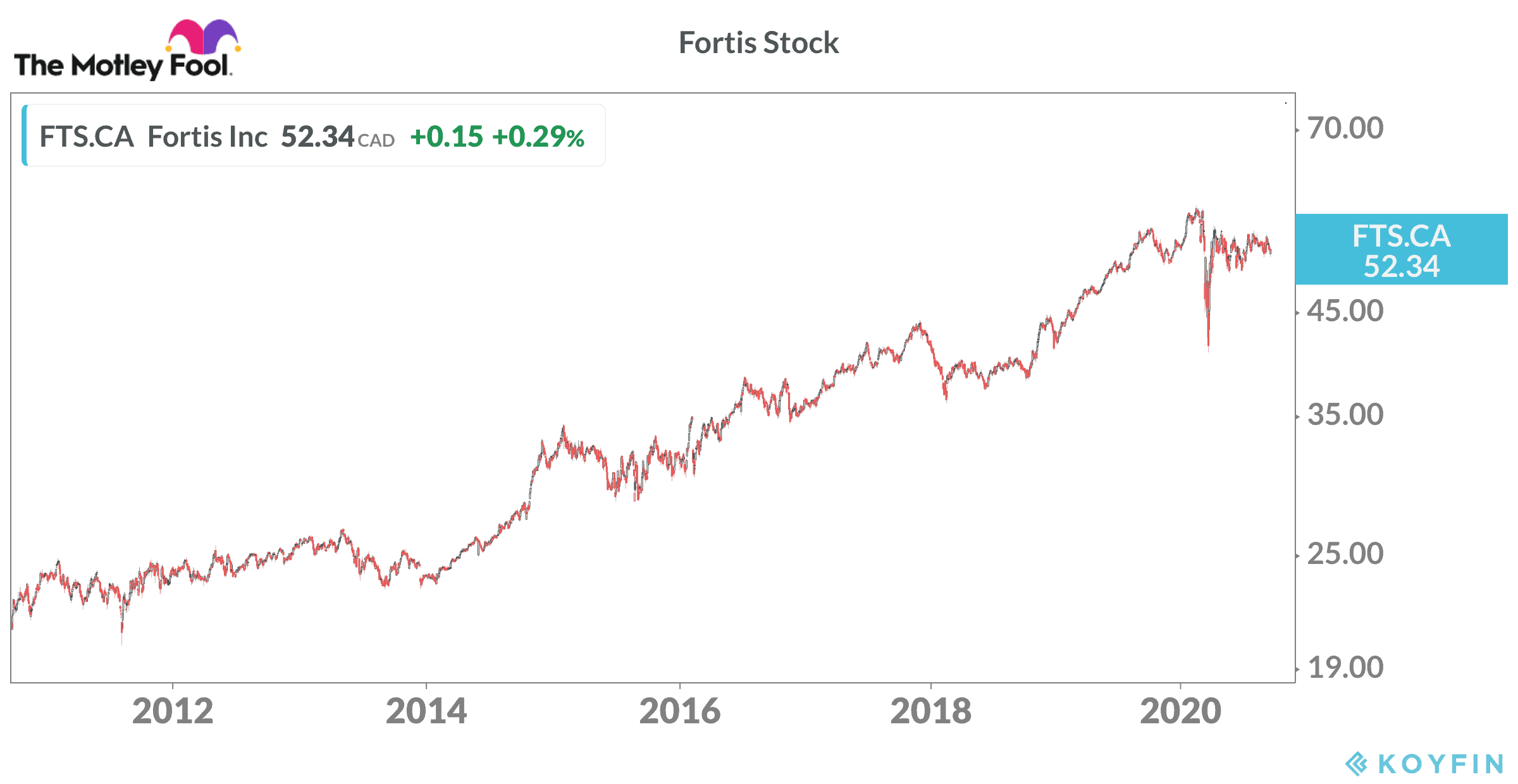

The TSX Index is home to many such stocks that appear cheap today. Companies such as Fortis, Bank of Nova Scotia and Enbridge might be worth considering.

Fortis raised its dividend annually for the past 46 years. The utility operator’s revenue comes from regulated businesses and tends to be steady through challenging economic times. A $10,000 investment in Fortis 20 years ago would be worth $120,000 today with the dividends reinvested.

The same investment in Bank of Nova Scotia would be worth $55,000 today, even after the large drop this year. Enbridge also appears oversold right now and yields 8%. The $10,000 investment in Enbridge stock two decades ago would be worth $100,000 today with the dividends reinvested.

The bottom line

Patience and smart spending choices play a big part in building a large enough nest egg to retire rich.

Fortunately, the goal of retiring wealthy lies within reach of most people with enough time to take advantage of the current era of low interest rates and harness the power of compounding.