There are plenty of investors out there who are completely prepared for retirement. There are automated payments being made to a Registered Retirement Savings Plan (RRSP), maxing it out each year. Some have even opened up a Tax-Free Savings Account (TFSA) to keep retirement funds up even higher. There are even some who are able to collect a hefty pension at the end of their career.

But while many are prepared, there are those that aren’t. Not for lack of trying, but because life simply gets in the way. Take the current pandemic. You had a hefty pension coming your way — until you didn’t. Your employer was forced to let you go. Now you have to use those retirement savings to pay off debt or simply even stay afloat.

With more waves coming, that could mean you have to take out even more of those funds. Suddenly, you’re not as prepared as you once were. On top of that, we have economists telling us that $1,000,000 — heck even $500,00 — simply isn’t enough to retire. With the average life expectancy of a Canadian hitting the mid-80s, that means you could need 20 to 30 years of funds.

But don’t panic. With some planning and forethought, you can make even a small income work for you when it’s time to retire.

Use the bubble

While a housing bubble could be bursting right now, that also makes it a great time to downsize, especially if you’re willing to move out of the city. If you have a property worth millions, but not necessarily using it, downsize now! If your kids have moved out, so much the better. You don’t need the space, so use the money instead!

Also, even if you’re still working, it’s now possible to get out of the city. The work-from-home economy is booming, with more and more jobs coming online. This will make it much easier to slow down, lighten your work load, and work elsewhere. Companies are likely to downsize as well, creating work spaces designed to work at 50% capacity given the pandemic. So take advantage of the current situation and get out!

Other income

If there’s one thing many Canadians do, it’s forget about other incomes sources from the government. I don’t know why, but we seem to overlook that cash, and it should be a part of your plan to retire. If you’re a Canadian couple who has maxed out your Canada Pension Plan (CPP) contributions, you could be looking at a combined income of $28,000 for when you retire! As well, you could receive Old Age Security (OAS) payments of up to $7,200 per person, for a total $42,400 in payments.

While that may not be what you were making before, it’s certainly a start. That’s quite close to the average income of Canadians of about $44,000 per year! And that’s all cash we overlook when looking at our retirement.

Of course, invest!

Many Canadians looking to retire look directly to dividend stocks, and that’s great! However, don’t just buy the biggest dividend on the block. Consider what the stock has to offer, such as growth in share price and revenue. If you’re able to find a company that has predictable growth, that means the dividend is predictable as well. It’s that predictability that means you can treat your new dividend yield as your own personal pay cheque each quarter.

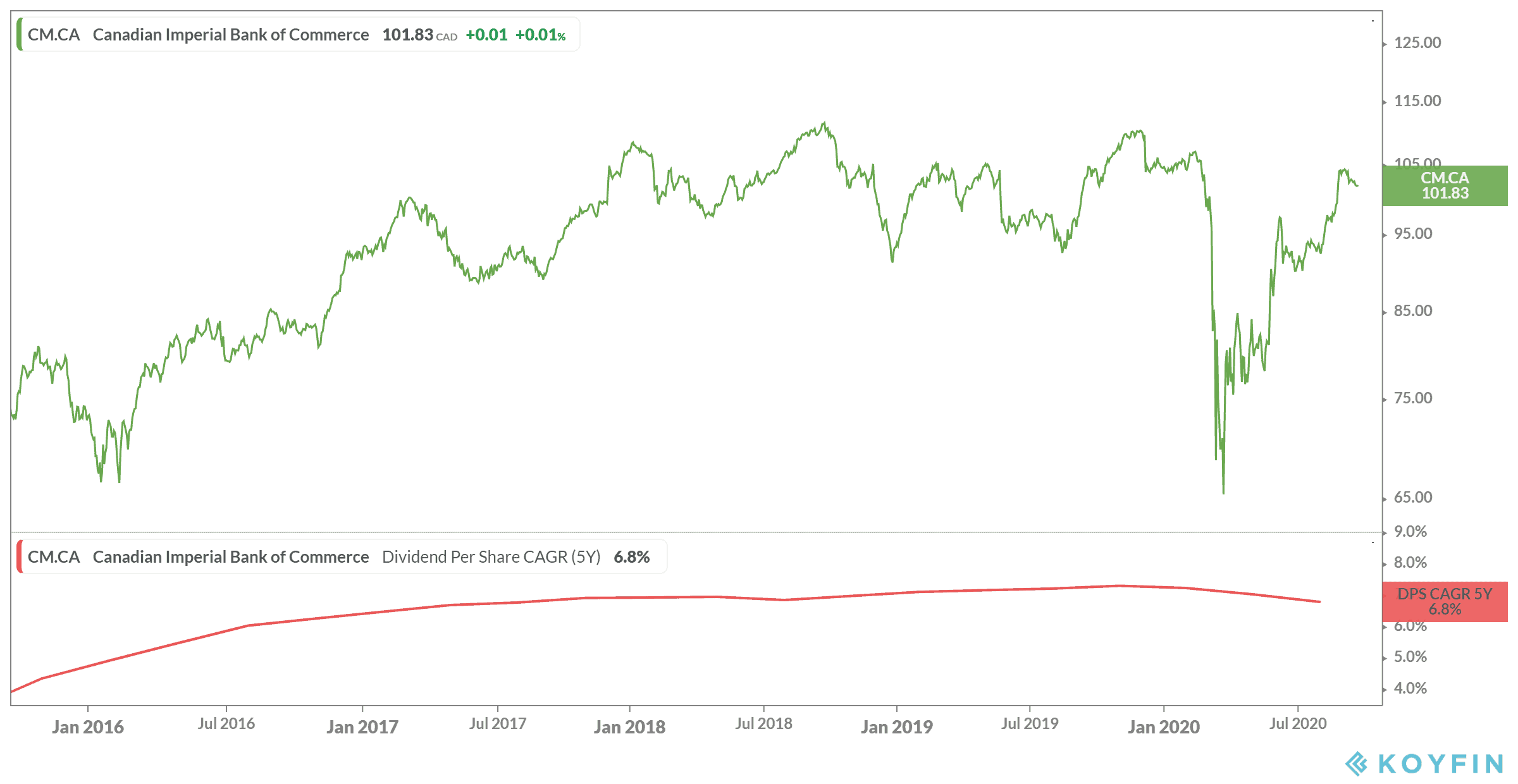

A prime example to choose today would be Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM). As one of Canada’s Big Six Banks, the company already started to prepare itself for an economic downturn well ahead of the pandemic. But CIBC is known for being the most Canadian of bank stocks, which makes it less ideal for today’s investors.

However, if you can hold onto this stock, you’re still likely to see decades of stable growth. The company has a 10-year compound annual growth rate (CAGR) of 8.32%, with a five-year return of 37% as of writing. Meanwhile, it offers the largest dividend yield of the banks at 5.72% as of writing, with a dividend CAGR of 6.8% for the last five years.