Canadians are hard workers, and the work is getting even harder. Whereas before, 65 seemed to be the year that Canadians were free from work, that has since changed. Many are working well into their 70s, whether out of enjoyment or necessity. These days, it seems to be the latter. So when it comes to your retirement plan, you want to make it work for you as best you can.

That leaves your pension. The Canadian Pension Plan (CPP) is available for Canadians starting at that golden age of 65. However, when you take it out is entirely up to you. As I mentioned, it might not be something you can consider, even if you wanted to. So before you decide to take it out, make sure you’re using this trick to get the most from your retirement plan.

First of all, the trick hangs on pushing back your retirement just until you reach 70. There is an 8.4% increase in your pension for every year that you delay taking out those benefits. That adds up to a lot over five years. Of course, that still won’t be enough to live on, even with Old Age Security (OAS) payments. So, the key to using this trick is to invest.

Blue chip is best

Your retirement plan then counts on investing in blue-chip companies. These companies have been around for decades, have plenty of growth opportunities ahead, and provide dividends, among other points. If you’re wondering what to invest in, you can simply check out CPP yourself!

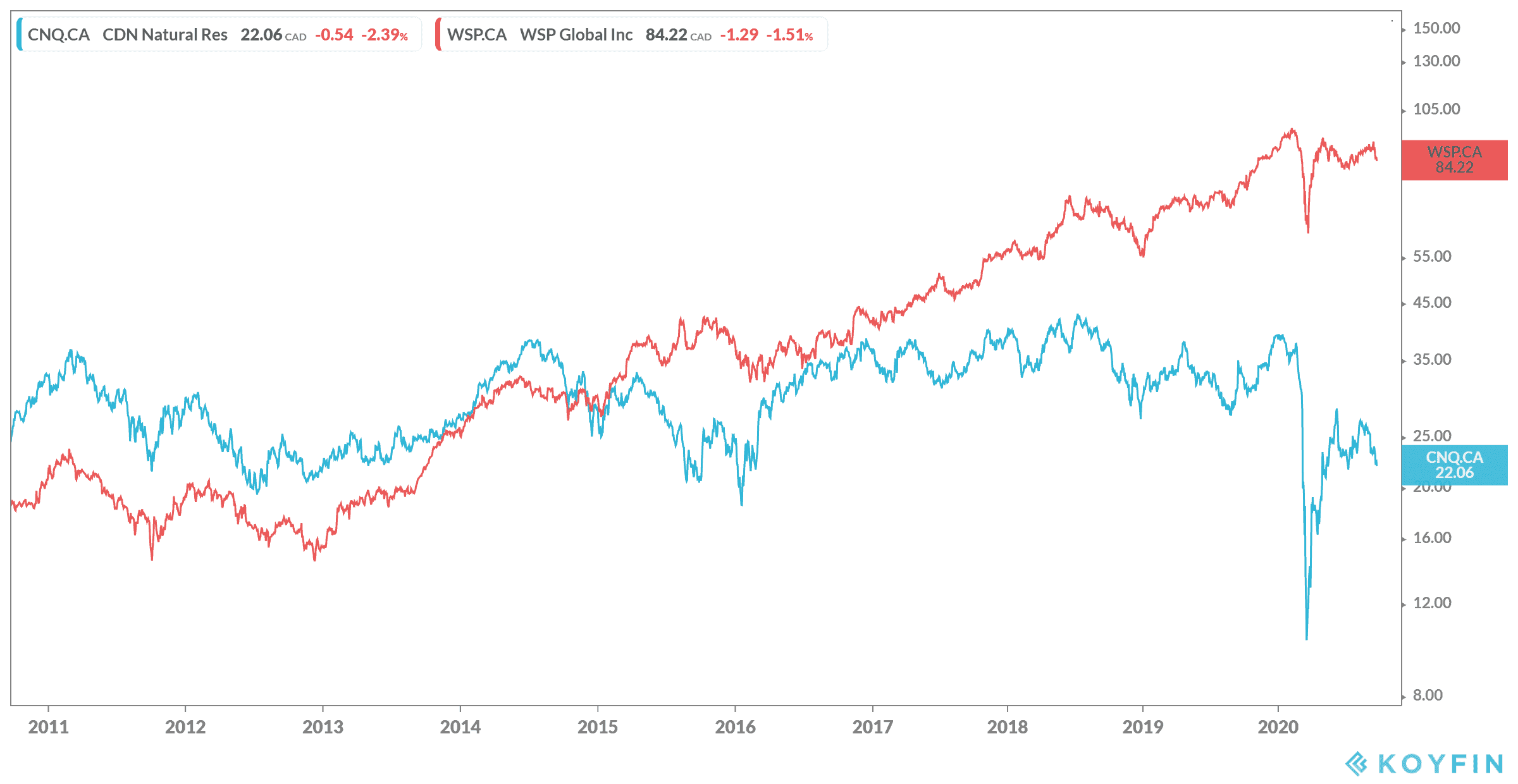

For the purpose of this article, I would recommend the top investments of CPP. CPP invests $1.683 billion in WSP Global Inc. (TSX:WSP), and $456 million in Canadian Natural Resources Inc. (TSX:CNQ)(NYSE:CNQ). So those two are a great place to start. If you had invested in these companies years ago, you would be entirely set by retirement. So younger investors: take note now! Just because you’re young doesn’t mean you shouldn’t have a retirement plan.

The stocks

As I mentioned, the CPP fund manager invests in both of these companies. So let’s dig in deeper to why an investor would want to consider them for their retirement plan portfolio.

WSP Global is a consulting firm operating around the world, hence the name. The company advises, plans, designs and manages projects for a variety of infrastructure ranging from rail transit to maritime projects, both privately and publicly. So the company has a diverse portfolio, able to take advantage of any new project in any type of infrastructure. It’s also been around since 1959, with plenty of historical data available for those wanting to look ahead for growth outlook.

But if you’re impatient, I can tell you the company has had a five-year return of 113% as of writing, with a one-year return (yes, even during a pandemic) of 10%. In the last decade, it’s seen a compound annual growth rate (CAGR) of 16.34%, practically unheard of for most stocks. Meanwhile, it offers a 1.8% dividend yield at writing.

Then there’s CNR, an energy company that explores for, develops, produces, and markets oil and gas. This also includes pipeline projects, which could be the breaking point for the current gas glut. While Canada might be suffering, the company has support from its pipelines, and its international operations in the United Kingdom and Offshore Africa. Again, it has also been around for decades, since 1973.

Foolish takeaway

If you invest in companies like WSP and CNR today, you can live off the returns worry free as soon as the next decade. By simply pushing your CPP back to 70, you can use that cash to reinvest and live off the returns and dividends for years to come.