Since the start of the pandemic, there has been a tonne of significant opportunities for investors of TSX stocks.

During the initial market selloff, many were panicking, but those savvy investors with the smart money knew exactly what they were doing, taking advantage of bargain-basement prices.

Investors who stepped up and bought when there was panic selling across markets would have been majorly rewarded already. This effect is compounded even further for investors who bought high-quality dividend stocks at low prices.

For example, those investors who bought Pembina Pipeline at or near its low would have locked in a whopping 15% dividend yield from a company that’s highly resilient.

It’s these investments that will set investors up for years, and it’s therefore crucial that you know which top TSX stocks you’ll want to buy in the next selloff. In addition, you’ll want to have predetermined levels of value that you know if the stock price falls below, will make it a no-brainer buy.

Here are two TSX stocks that savvy investors will be waiting to gobble up in the next stock market selloff.

TSX utility and green energy stock

Some of the first stocks investors will consider as the market is crashing are TSX utility stocks. These businesses are top performers in adverse market conditions and can be counted on to stay resilient through a recession.

The problem with traditional utilities is that they can underperform in periods of growth. And given the rapidly changing environment in financial markets, that can be a sophisticated risk.

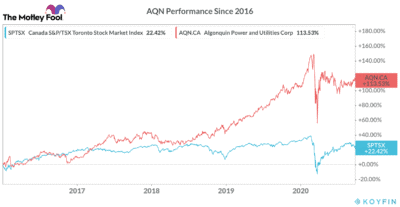

That’s why I think investors will be drawn to a stock like Algonquin Power and Utilities Corp (TSX:AQN)(NYSE:AQN).

In addition to the stability of utility stocks, Algonquin also offers investors the long-term growth potential of the renewable energy industry.

Currently, two-thirds of its business is tied to its water, gas, and electric utilities. So the stock is more weighted to its defensive businesses. However, the other third is its renewable energy business, which has enormous potential over the long term.

Switching to green energy is a top priority for many governments around the world. So I expect high-quality operators like Algonquin to take full advantage.

The company is already in the midst of a massive five-year capital program. Therefore, I would expect more of the same from Algonquin; consistent long-term growth investors can count on.

Plus, in addition to this incredible long-term growth, the stock pays an attractive dividend that currently yields more than 4.3%.

Plus, in addition to this incredible long-term growth, the stock pays an attractive dividend that currently yields more than 4.3%.

TSX gold stock

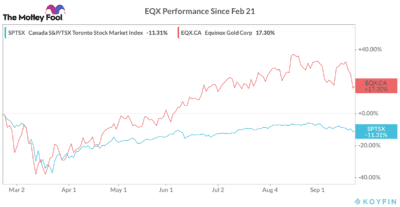

One of the top stocks on the TSX all year long has been Equinox Gold Corp (TSX:EQX). And now, with the recent selloff in gold stocks, there may be no better time to gain exposure.

Already we have seen gold stocks tumble as the market enters another period of increased volatility. Part of the reason for the minor selloff is due to fear in the markets, causing investors to want to raise cash. We saw this back in March, right before most TSX gold stocks went on a major rally.

The other reason TSX gold stalks have stalled recently is due to stimulus talks being on the back burner. While more stimulus is important, the environment is already highly accommodative for gold.

The other reason TSX gold stalks have stalled recently is due to stimulus talks being on the back burner. While more stimulus is important, the environment is already highly accommodative for gold.

Furthermore, the economy won’t be able to last without more stimulus, so it’s inevitable these talks will start up once again, once other more pressing issues have been sorted out.

For now, investors have been blessed with a rare opportunity to buy Equinox stock well undervalue. Currently, the stock trades below $15. That’s nearly 20% below its 52-week high. And if this selloff worsens, the stock could actually get cheaper before it rallies again.

Bottom line

There’s more volatility coming, and this may be the last chance to buy top TSX stocks at bargain prices. So it’s crucial investors are ready for whatever happens next. That way, you won’t miss this rare opportunity.