The CERB benefits will end tomorrow — leaving millions of Canadians with limited options to avail financial support from the government. The Service Canada and Canada Revenue Agency (CRA) have paid a whopping $78 billion to eligible Canadians so far under the CERB scheme. The government has processed nearly 26.7 million applications under the scheme.

On Wednesday, the Trudeau administration showed a willingness to extend financial support for needy Canadians during the 2020 throne speech event. As Parliament resumed full operations on Thursday, opposition parties started debating the 2020 throne speech. But these debates aren’t likely to change the administration’s decision to end CERB later this week. So, you shouldn’t expect an extension of the CERB scheme beyond September 26.

Stocks that can pay you more than CERB’s $2,000 a month

For nearly seven months, the CERB scheme provided $2,000 a month as financial assistance to millions of Canadians who lost their jobs due to the COVID-19 crisis. It might sound unbelievable, but some Canadian stocks can continue to give you more income than CERB benefits. Let’s look at two such great TSX stocks:

Shopify stock

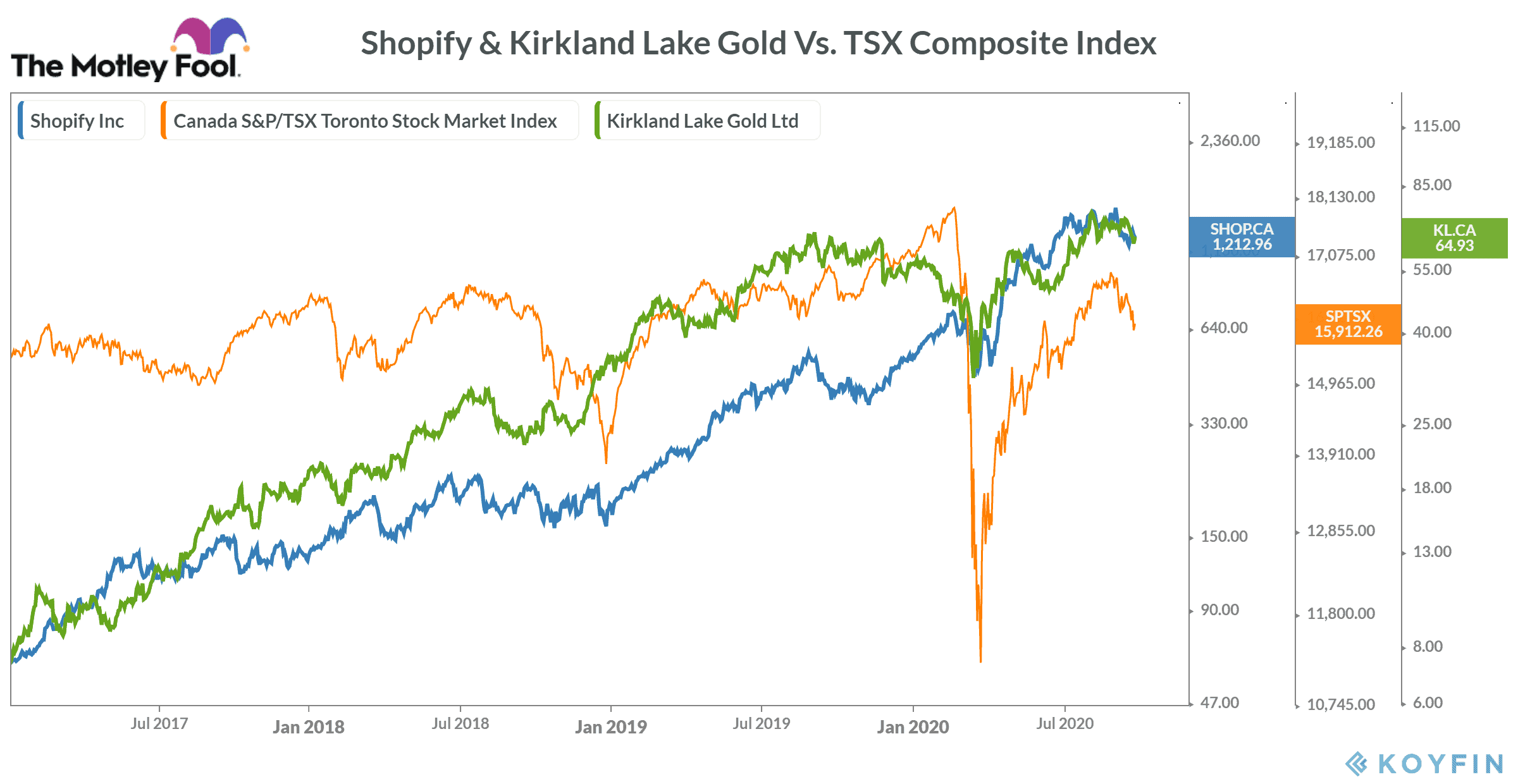

Shopify (TSX:SHOP)(NYSE:SHOP) has changed the way people look at the Canadian tech industry in the last few years. After going public in May 2015, the Ottawa-based e-commerce services provider has now become the largest Canadian company by market value.

Currently, Shopify has a market cap of $148 billion — much higher as compared to any other Canadian public company. Royal Bank of Canada and Toronto-Dominion Bank are the second and third largest companies on TSX with a market cap of $133 billion and $109 billion, respectively.

Shopify stock has yielded an outstanding 2,649% return in the last five years. It implies that if you invested $5000 in its stock five years ago, you would have earned total money equivalent to $2,208 a month — much higher than CERB’s $2000 a month.

Kirkland Lake Gold stock

Kirkland Lake Gold (TSX:KL)(NYSE:KL) is a Toronto-based gold mining company with a market cap of nearly $18 billion. While its market cap is much lower than Shopify, Kirkland Lake Gold stock has given amazing returns to its investors in the last five years.

During this period, the Canadian gold mining company has yielded 2,045% returns. It means if you invested $6,000 in Kirkland Lake Gold stock five years ago, it might have returned you money equivalent to $2,045 per month — also higher than what you get from CERB on a monthly basis.

Stocks to get a higher return than CERB benefits

The shares of Shopify and Kirkland Lake Gold have clearly yielded outstanding returns in the last five years. But it doesn’t necessarily mean that these stocks would continue to do so in the next five years as well. In 2020 so far, Shopify stock has risen by 140% while Kirkland Lake’s stock has gone up by only 10%.

Nonetheless, there are many other growth stocks on TSX that could yield similar returns in the future. While choosing stocks to invest, you must always pay attention to the timing of your entry and potential risks.