There is a common mistake many Canadians make when it comes to their Tax-Free Savings Account (TFSA). Unfortunately, many investors believe that no matter what, it is completely tax free. That is simply not the case.

There are a few mistakes Canadians can make that could turn your TFSA into one the Canada Revenue Agency (CRA) has its eye on. But the most common mistake? Investing outside of Canada.

Keep it Canadian

If the CRA finds out you have been investing in companies that are not Canadian companies, it’s guaranteed that you’ll hear about it. The TFSA is meant to support Canadian businesses. So, if you’re investing in companies that are from Canada, great! But if you decide to invest in a stock that’s on another composite outside of Canada, that’s not so great.

This mistake means any returns you receive are subject to taxation from the government. It immediately turns your TFSA into a regular investment portfolio. It’s not terrible, but definitely not what you had in mind. This goes against why the account was created in the first place.

What to do instead

It should be pretty obvious, but invest in Canada! Of course, that’s not the most ideal of situations at the moment. Some of Canada’s largest industries are in a huge market downturn at the moment. Even with a rebound underway, a new market crash is very likely happening, even as we speak.

But there is one sector that hasn’t crashed yet, and that’s the tech industry. Canada has become a tech darling in the last few years. These companies have kept the markets afloat, while other industries, such as oil and gas, continue to fall. So, if you’re going to invest in Canada, the tech industry is where to look. In particular, today I would be looking hard at Lightspeed POS (TSX:LSPD)(NYSE:LSPD).

Lightspeed stock

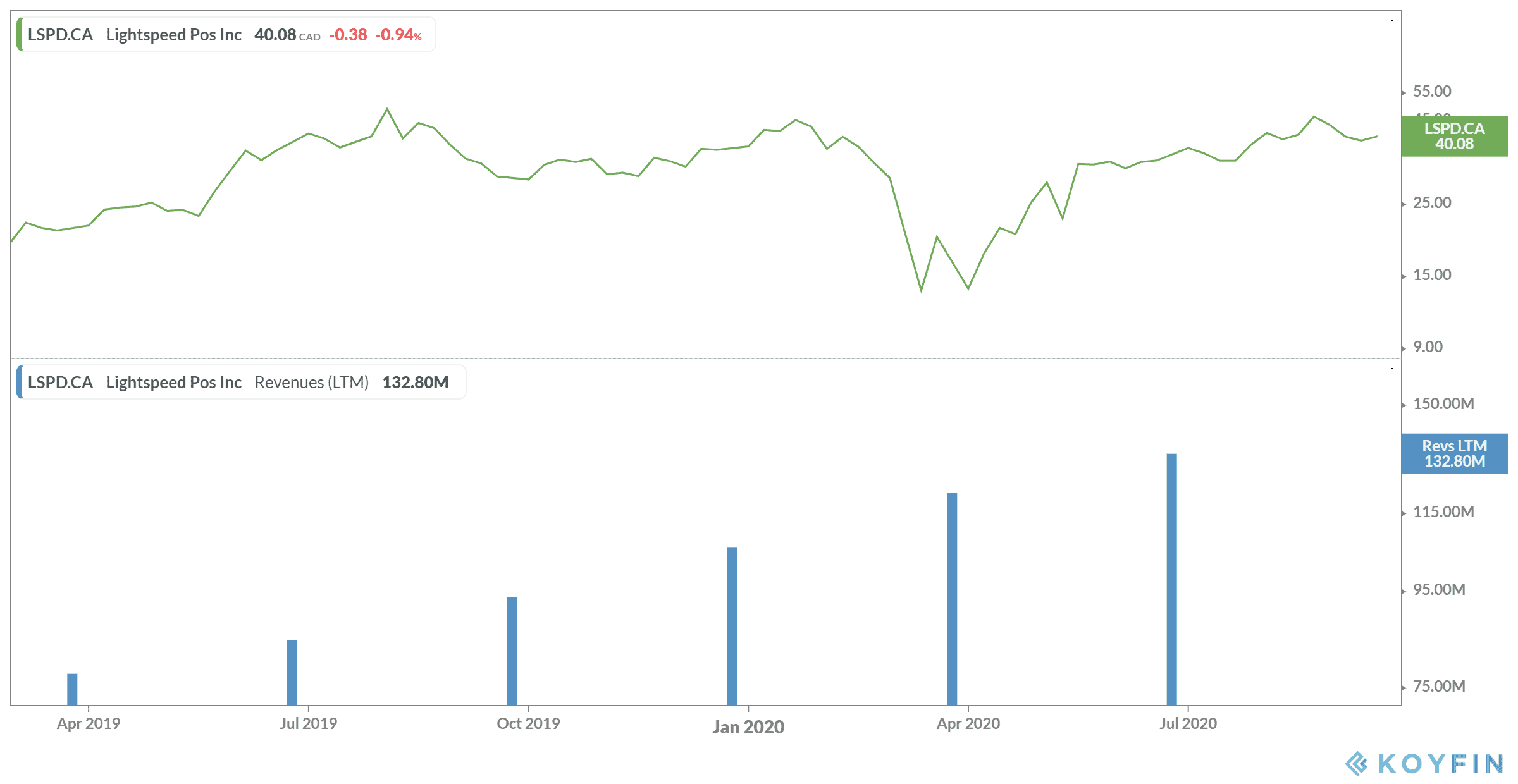

Since its creation, Lightspeed stock has been breaking records. It had the largest initial public offering (IPO) on the TSX for 2019, and the largest in the last nine years within the tech sector. As of writing, the stock has a one-year return of 21% for investors who got in at the ground floor.

The company provides point-of-sale services to retail and restaurants around the world. As it becomes necessary to have brands operate online, Lightspeed provides an essential service for these companies. Then, on Sept.9, 2020, the company started trading on the New York Stock Exchange, a necessary move considering most of its clients operate in the United States.

While the company will have a few years before it makes a profit, sales should continue to soar. The company focuses mainly on small- and medium-sized businesses for now, but with enterprise companies coming on, those sales could skyrocket. Economists already predict growth of 41.1% in sales by 2022. As of the most recent earnings report, Lightspeed saw year-over-year revenue growth of 58%.

Foolish takeaway

The TFSA is the perfect tool for investors that should never be overlooked. As long as you play by the rules, you could see your shares grow by leaps and bounds for years to come — all completely tax-free from the CRA.