Some of the best opportunities on the TSX are dividend-growth stocks. Not only do they pay you a dividend, but it’s consistently increasing.

This is attractive for a few reasons. Firstly, a growing dividend means that the passive income your portfolio is consistently growing. That can be amplified when you own multiple stocks and you’re reinvesting your proceeds.

Furthermore, because the stocks can consistently increase their payouts, they have to be strong businesses capable of that impressive growth in the first place.

So, in addition to the increase in dividends, your capital is likely seeing significant appreciation as well.

This is why dividend-growth stocks are almost always a better bet than high-yield dividend stocks that provide very little capital appreciation.

That’s why any time you’re looking for your next high-quality TSX stock to buy, you should start with the Canadian Dividend Aristocrats list first.

Highly reliable dividend stock

The Canadian Dividend Aristocrats list is made up of established TSX stocks that consistently increase their dividends. That’s why Fortis (TSX:FTS)(NYSE:FTS), a company that’s increased its dividend for 47 consecutive years, is one of the top stocks on the list.

Fortis is one of the best-known utility stocks on the TSX, largely because it’s such a reliable investment. There are several factors that make the stock a low-risk investment.

First and foremost, utility stocks are some of the safest companies you can invest in due to the regulated nature of their revenue. In addition, the services utilities provide, mainly electricity and gas in Fortis’s case, see little change in demand regardless of the health of the economy.

Furthermore, Fortis has assets in several different jurisdictions, which helps lower risk even further. All these qualities are what make it such an attractive dividend stock.

Fortis provides investors great defence. However, its 3.75% yield can be a bit low for some investors. If you’re looking for a bit less safety and a bit more upside, consider this consumer staples stock.

Consumer staples dividend stock

North West Company (TSX:NWC) is another great option for investors, and its yield is closer to 4%, which may be more attractive for some investors.

Comparing the companies are apples and organs; however, as North West operates a completely different business model. The company does its business in mostly remote communities, providing residents with their essential goods at its supermarkets.

Because North West has very little competition in many areas and has integrated its company to improve its margins over the last few years, there is a tonne of growth potential for the business.

That was evident when the company reported earnings just a few weeks ago; it reported profit numbers that were more than triple the year earlier. That’s extremely impressive, especially during a pandemic.

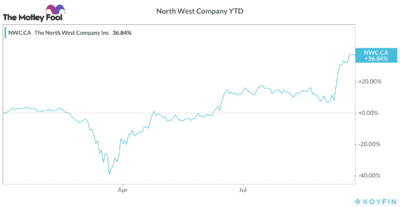

It also announced a 9% increase to its monthly dividend, which is why the stock has rallied as of late. In total, it’s up 37% since the start of the year, as investors continue to see its value in this new economic environment.

Resilient retail REIT

Lastly, investors could consider a highly resilient real estate stock such as CT REIT (TSX:CRT.UN).

CT REIT is a retail REIT, one of the worst impacted sub-sectors in real estate. Luckily for CRT, the company gets 92% of its rent from Canadian Tire.

This is crucial, because Canadian Tire has actually been one of the few retailers that’s made it through the pandemic relatively unscathed.

So, there was always no doubt that CT REIT would continue to see the majority of its rents, while many of its peers saw massive deferrals.

This resiliency has allowed the company to increase the dividend once again. While the 2% increase is not much, it’s still impressive during a pandemic. There have now been seven distribution increases since 2013 for a total of 21% compounded growth.

Plus, over time, the payout ratio has come down and is now right in the middle of the REIT’s target range of 75% to 80%.

That dividend growth should continue with the REIT’s significant long-term potential. Currently, 25% of Canadian Tire locations are still owned by third parties, creating some major opportunities.

Bottom line

Finding dividend stocks that are consistently increasing their payouts, such as these three, is one of the best long-term investing strategies.