Over the last couple of weeks, there has been a slight selloff in TSX stocks, as volatility continues to increase. This is to be expected, as there are many factors weighing on the market at the moment.

First and foremost, there’s concern and worry over the second wave of coronavirus. Major questions linger; will there be shutdowns again, and what will they look like?

Investors have even more questions. Will more stimulus be needed? How will this affect unemployment and an economy that’s already reeling?

These concerns are extremely important, especially since we’re still waiting to see the full effects of the first wave.

Furthermore, there’s a tonne of uncertainty in U.S politics right now. This is weighing on the U.S markets, which have a big impact on Canadian markets.

At this point, I don’t think anybody is surprised to see more volatility. But after the year we’ve had, it’s difficult to predict what may come next. It even seems the market doesn’t know, trading down significantly one day, then bouncing back the next.

So, should you prepare for more carnage, or is this the perfect time to buy the dip?

September selloff: How to prepare

These days, you have to be ready for everything, because there are so many unknowns. You can’t just solely prepare for a selloff in case the market takes off and rallies again. Conversely, you can’t write off another market crash, or your portfolio could be decimated.

Being ready for anything can sound complicated. However, it’s easy to do if you have a long-term investment plan that you have been implementing.

So long as your portfolio is made up of only the highest-quality stocks, and you have a decent cash position, there isn’t much more you can do in the short term.

This way, if the market does selloff, the stocks you own should be able to stay resilient, and you can put that cash you have on the sidelines to work.

However, if the market continues to rally, you won’t miss out, and your top stocks should continue to provide excellent capital appreciation.

TSX stock to buy in a selloff

One other thing you can do to prepare for a selloff is to identify stocks you may want to buy as they get cheap.

This means knowing the business inside and out, aware of what makes the company grow, and what risks lie ahead. You should also have a target price in your head that you know, if the price gets below it, makes it a definite buy.

One of the top TSX stocks you may want to consider is Northwest Healthcare Properties REIT (TSX:NWH.UN).

The company owns a portfolio of medical office buildings and hospitals. These assets are located in several different countries, which helps to reduce risk for investors.

One of the main reasons why it’s so attractive is because 85% of the revenue it receives is either directly or indirectly funded by governments.

The company did see some small impacts on its rent from the pandemic. However, these mostly came from some of its ground floor vendors in its buildings. For the most part, though, the REIT has been relatively unscathed.

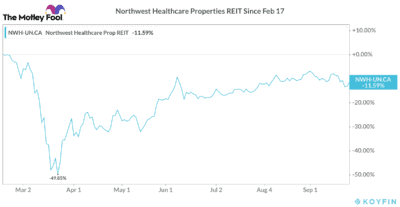

During the last selloff, the stock was sold off significantly and is still undervalued today.

As you can see, at the bottom, the stock was down just shy of 50% from its pre-pandemic trading range. Savvy investors who knew the resiliency and quality of the REIT would have been buying, and those investors got a great deal.

Even at today’s prices, the stock is still undervalued, and its dividend yields a whopping 7.1%. Plus, that dividend pays you monthly income, which allows investors to compound it faster.

Bottom line

It’s impossible to tell ahead of time whether the selloff we saw in September will continue to worsen, or if the market will soon recover.

That’s why it’s crucial investors are always prepared for the worst and their portfolios are ready for anything.