The share price of Air Canada (TSX:AC) continues to make volatile moves. Contrarian investors hoping to catch Air Canada stock near a low are trying to decide when and where the airline will finally bottom out and begin a steady recovery.

Air Canada stock crash

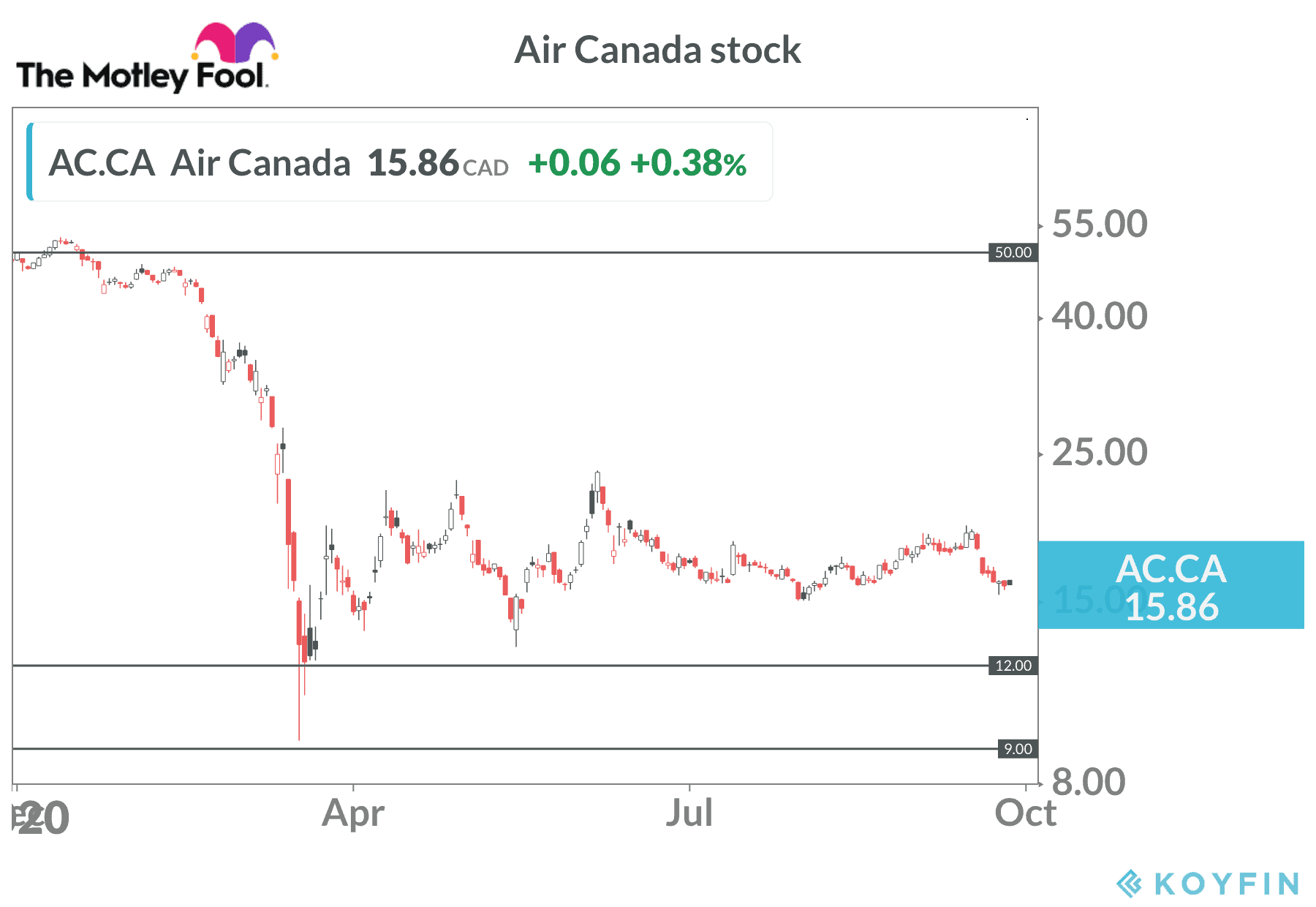

Air Canada stock started 2020 at $50 per share. The year looked promising for the airline industry amid strong demand for vacation and business travel. Investors who historically avoided the shares finally started to believe in the long-term potential for the airline to generate growing profits.

Why?

Air Canada figured out how to boost revenue through add-ons in economy-class seats in recent years. For example, it turns out people are willing to pay more for the ability to choose their seats. Air Canada also makes decent money on the extra luggage fees as well as insurance and flexibility options on travel.

Supported by the new revenue streams and low oil prices, Air Canada’s share price rallied from below $1 after the Great Recession to the $50 milestone, making Air Canada stock one of the best performers in the TSX Index in the past decade.

Unfortunately, the arrival of the pandemic killed the party, and it is uncertain if the airline sector will ever fully recover.

Air Canada stock fell to a closing low around $12 in March. Since then, the share price traded as high as $23 and currently sits near $16.

Pandemic hit to Air Canada stock

Air Canada cut capacity by 92% in Q2 2020 compared to the same period last year. Passenger numbers dropped 96%. Lockdowns and travel restrictions forced the company to eliminate roughly 20,000 jobs in June and retire nearly 80 planes from its fleet.

Management hoped to slowly ramp up flights through the summer and into September. The Q3 numbers, however, will likely show the ongoing challenges caused by Canada’s travel restrictions and the second wave of COVID-19 cases in the United States, Europe, and other key destinations.

In the near term, the outlook remains bleak for Air Canada and its peers.

Opportunity

The executive team moved quickly to boost cash reserves, giving Air Canada a chance to survive the crisis. Air Canada raised significant capital in the second quarter, boosting liquidity to $9 billion by the end of June. This is a unique position in the global air industry, where a number of carriers already went into bankruptcy or have been forced to take major bailouts from governments.

Air Canada reported net cash burn of $19 million per day in Q2. At the time of the report, the company anticipated net cash burn to be $15-17 million per day for the third quarter. Investors should brace for the actual tally to be at the high end of the range, given the continued restrictions and ongoing weak travel demand.

That said, Air Canada should be able to ride out the storm. This assumes COVID-19 vaccines become widely available in the first half of next year. The easing of travel restrictions would follow and boost demand from both leisure and business travelers.

Ongoing risks

We don’t yet know if a vaccine will work and when it might actually become widely distributed. In addition, the business world changed dramatically in the past six months. Executives and sales people realized they can effectively connect with remote teams and negotiate deals using online video platforms.

That could put a permanent dent in demand for expensive and high-margin business-class seats.

Vacation travelers will eventually return to their old ways, but it might take a few years to get back to previous levels.

When will Air Canada stock be a buy?

So far, the March bottom appears to be the floor. Contrarian investors with a positive long-term view of the airline sector might be tempted to start nibbling on a dip back toward that price point.

However, there is a risk we could see another major correction in the broader stock market in the next few months. In that scenario, Air Canada stock could test new 2020 lows. Worse-than-anticipated Q3 2020 results might also send the stock into a new tailspin.

Given the uncertainties, I would probably wait for travel restrictions to ease before buying Air Canada stock.