The Canada Revenue Agency (CRA) never disappoints Canadians. When they were waiting for it to extend the Canada Emergency Response Benefit (CERB) by another month or two, it extended the benefit by another six and a half months. Yes, you read that right! The CRA’s new CERB extension is in the form of a $2,000 Canada Recovery Benefit (CRB), and it is only for those who do not have Employment Insurance (EI). You can get $500 a week in CRB for 26 weeks.

Why is CRB called the CERB extension?

The CRB is very similar to CERB, and it improves on the shortcomings of the CERB. First, I will focus on the similarities. Both are unemployment benefits for Canadians who lost their job because of COVID-19. Both pay $500 a week, or $2,000 a month of taxable benefit to eligible applicants. They also have similar eligibility criteria:

- You should be a Canadian above 15 years of age who lost his/her job because of COVID-19 related reasons.

- If you quit voluntarily, then you won’t qualify for the benefit. Also, you should actively be searching for work.

- You should have earned at least $5,000 in working income last year or within 12 months from the date of the application.

The CRA added a few more eligibility criteria for the CRB:

- You should have a valid Social Insurance Number (SIN).

- You should not be covered under EI or be receiving any other benefits for workers’ compensation, sickness, caregiving, or short-term disability.

The CRB is an extension of CERB in terms of eligibility, tenure, and more.

You can claim CRB even when you are working

For the CERB extension, the CRA scraped the requirement where the claimant should have earned not more than $1,000 in working income during the period he/she is claiming the benefit. This eligibility came under fire because it disincentivized people from returning to work, which paid less than $2,000 a month.

Hence, the CRA tweaked the requirement where the claimants’ working income should have halved because of COVID-19 related reasons. Under this requirement, you can claim CRB even when you are working. If your annual income in the year you got the CRB exceeds $38,000 (excluding CRB), then the CRA will take away the benefit amount at a 50% run rate.

For instance, Jack earned $40,000 in 2020 and claimed a CRB of $4,000. The CRA will take away 50% of the income in excess of $38,000, which equates to $1,000 (50% of $2,000). It will take it back when Jack files his 2020 income tax returns.

How to apply for the CERB extension?

Now that you know you are eligible for the CRB, you must be wondering how and when to apply for the CERB extension.

As far as the question of when you can apply for CRB after the end of a two-week period during which you met all the above eligibility criteria. Remember, you can’t apply for four weeks in one application. The maximum is two weeks. Moreover, you have to apply before 60 days from the end of the two weeks or your benefit will lapse.

If you want CRB for the period September 27 to October 11 (two weeks), you can apply on October 12 and before December 11.

Now comes the question of how you can apply from My CRA account. Like the CERB, you have to attest that you meet the eligibility requirements. The CRA will review your application, seek more information if needed, and then process the payment. The CRB is in place till September 25, 2021.

Make your CRB grow

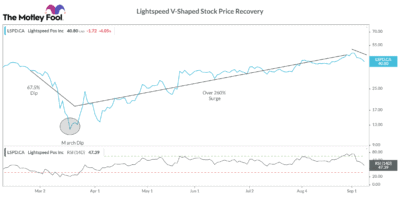

You can grow your CRB by investing it in growth stocks through the Tax-Free Savings Account (TFSA). One good stock is Lightspeed POS (TSX:LSPD) that provides omni-channel solutions to retailers and restaurants. The stock saw a V-shaped recovery from the pandemic. The company is well positioned to tap the post-pandemic market, offering retailers and restaurant features like e-commerce, curbside pick-up, shipments, and online order/appointment booking.

Lightspeed has raised US$397 million from its U.S. initial public offering to invest in future growth opportunities. The stock is set to surge double-digit in the coming 12 months.