The month of September was full of confusion and anticipation, as the Justin Trudeau government transitioned from emergency benefits to recovery benefits. Most Canadians were hoping that the Canada Revenue Agency (CRA) would extend the Canada Emergency Response Benefit (CERB). The CRA had extended it twice in the past.

But the government had something better planned for Canadians. The new CERB extension took the form of Employment Insurance (EI) and Canada Recovery Benefit (CRB).

EI and CRB are extensions to CERB

The CERB extensions offer the same $2,000 monthly payment for the time Canadians are out of work or have lower income. However, the government has removed the $1,000 maximum income requirement in the EI and CRB. This change means EI and CRB will extend the CERB-like benefits to Canadians even after they return to work.

Moreover, the government has stretched the EI and CRB availability for a year. However, every eligible Canadian can get a maximum of $13,000 in 26 weeks (or 6.5 months). It has also extended the CERB-like benefits for Canadians who are working but fall sick or have to care for dependents because of COVID-19-related reasons.

How are CRB and EI better than CERB?

The government has also improved on the mistakes that happened with the CERB. Instead of making both Service Canada (SC) and the CRA in charge of benefits, SC is now in charge of EI, and the CRA is in charge of CRB.

In CERB, the CRA made advance benefit payment where you assumed you are eligible, which caused a lot of benefit repayments. As the condition has stabilized slightly, SC and the CRA will make the payments after the end of the benefit period when the eligibility is clearly established.

The CRA has also reduced the period for an application to two weeks from four weeks. You need not wait for the month to get over to apply for the benefit. You can get payments twice a month.

For instance, Jane is eligible for unemployment benefits in the first half of the month, as her weekly income has halved to $200. But she gets a new project mid-month, which pays her $3,000. In the case of CERB, she will not get the benefit, as it looks at four-week eligibility. In the case of CRB/EI, she will get the claim of $1,000 for two weeks, as it looks at two-week eligibility. Her monthly liquidity would add up to $4,000.

Jane is a smart investor, and she puts the $1,000 EI/CRB claim in her favourite stock, which she has been studying for a long time.

Smart investor: Extend your benefits

Like Jane, you can grow your benefit amount without adding to your tax burden. Save at least 25% of the $1,000 benefit amount in your Tax-Free Savings Account (TFSA). Invest this money in a trending stock that has strong fundamentals and long-term growth potential.

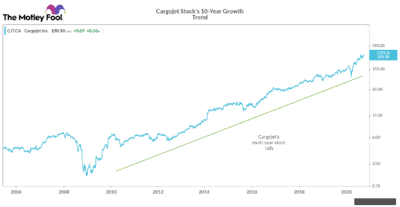

One such share is Cargojet (TSX:CJT). This stock was not affected by the recent market correction, where tech stocks plunged by double digits. Even though it is an air service, it has been riding the bull for over five years. There is an increasing demand for its premium, time-sensitive cargo services.

The government declared Cargojet an essential service during the lockdown. It transmitted large volumes of personal protective equipment and other medical supplies from Asia to Canada. As it comes under essential services, Cargojet stock would continue to grow, even if there is a second wave of the pandemic.

The air cargo service will see a decline in medical supply volumes, but that will be offset by a surge in business-to-business (B2B) volumes that were affected during the lockdown. Moreover, the surge in e-commerce orders would continue. Hence, a 65% growth in second-quarter revenue could replicate in the coming three quarters. Moreover, lower oil prices could keep its adjusted EBITDA margin around 40-45% throughout the year.

Although the stock has surged 80% year to date, its growth factors are still relevant. Remember, it is not about buying a trending stock at the bottom, but jumping on the multi-year rally. The stock has been on a growth trend for the last 10 years, rising at a CAGR of 43%.