As the end of September approached, many Canadians flocked to the Canada Revenue Agency (CRA) website, hoping to see an extension to the Canada Emergency Response Benefit (CERB). But the Justin Trudeau government delivered on its promise and ended the CERB on September 26. Instead, it brought better and more flexible CERB extensions in the form of Canada Recovery Benefit (CRB) and Employment Insurance (EI).

I will leave the EI discussion for another time. Here I will talk about the CRB. Instead of applying for the $2,000 monthly CERB, you can now apply for $1,000 bi-monthly CRB. The outcome of both the benefits is $2,000 a month. But you can get more in CRB than in CERB.

How to apply for CRB

The CRB is for self-employed and contract workers. The nature of their work is volatile. They don’t get a fixed salary at the end of the month. Hence, the CRA made some changes to the CRB eligibility to make the benefit available to more Canadians, even when they return to work. You can apply for the CRB if your weekly income is reduced by 50% because of COVID-19-related reasons.

The major change in the CRB is the application process. In the case of CERB, you applied for the benefit of a period of four weeks. The application window opened at the start of the period. You anticipated that you would be eligible for CERB for that particular month. But if you earned more than $1,000 in that month, you would have to return the entire $2,000 CERB to the CRA. For CERB, it was either $2,000 or $0.

The CRA has worked on this shortcoming and created a more flexible application process. In the case of CRB, you will have to apply every two weeks. You can’t apply for a week or four weeks, because the benefit period in the application is for two weeks. As you apply for the benefit after two weeks are over, you are sure that you are eligible for it, thereby, reducing the scope of CRB repayment. And you have to apply within 60 days from the end of the two-week period, or the benefit will expire.

How can you get more in CRB?

You must be wondering how the CRA is helping you by reducing the benefit period from four weeks to two weeks. I will explain it with an example.

Anna runs a store. On average, she earns around $1,000 a week. She had to close the store for 14 days as there was a COVID-19 outbreak in her area. She didn’t earn a single penny. Later, when she opened the store, the business was back to normal. For the entire month, she earned $2,000.

Anna can claim $1,000 CRB for those 14 days when her store was closed. But she can’t claim the $2,000 CERB as she doesn’t meet the eligibility for the entire month. Because of the four-week eligibility, many Canadians didn’t max out their $14,000 CERB ($2,000*seven months).

You can apply for CRB as and when you become eligible in the next 12 months (till September 25, 2021). This 12-month period will give all Canadians sufficient time to max out their $13,000 CRB.

You can grow your benefit beyond $1,000

Tackle your benefits smartly. With both working income and CRB, you will have more liquidity than what the CERB provided. Set aside $300 from your $1,000 CRB in the Tax-Free Savings Account and buy Enghouse Systems (TSX:ENGH) stock.

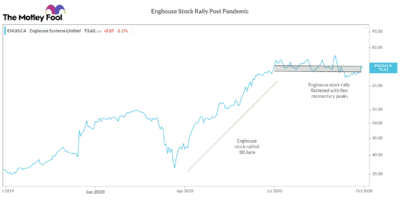

Enghouse acquires small software companies to get more subscription and maintenance revenue, an opportunity to cross-sell, and for cost efficiency. Its model improves its profit margins and makes its cash flows predictable. Hence, its revenue and adjusted EBITDA surged at a CAGR of 7% and 11% in the last five years.

Enghouse stock surged over 45% this year, but its rally has flattened around the $72-$75 price range since July, with some peaks. But it has long-term growth potential. Hence, buy the stock when it is at its price range. It can double your money in three to five years.