Enbridge (TSX:ENB)(NYSE:ENB) stock is yielding 8.2% today. It is also trading at dirt-cheap valuations today. If you’re thinking that sounds like a good opportunity, you’re not alone. Many of us here at the Motley Fool agree.

The next step is to assess the risk in Enbridge stock. Because we know there is always risk. The trick is to buy only those stocks that have an attractive risk/reward profile. This limits downside while maximizing upside.

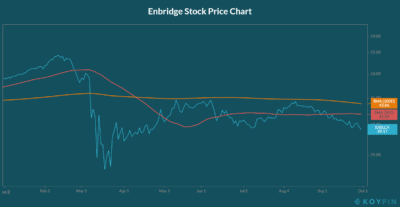

Enbridge stock is approaching March lows

After attempting a recovery after the hit it took in March, Enbridge stock is falling again. In fact, it is down 15% from May highs. As we can see in the following chart, this downward momentum is gathering steam. The 50-day moving average crossed the 200-day moving average back in April, and Enbridge stock has continued to struggle.

Let’s compare this stock price action with fundamentals. So far in 2020, Enbridge has maintained its dividend. These are difficult times. The fact that Enbridge has maintained its dividend through 2020 is testament to its strength.

Also, Enbridge has maintained its guidance. This is another testament to its strength and predictability. At a time when many companies are not only reducing estimates but even completely withdrawing guidance, Enbridge stands out. Not only does Enbridge have enough visibility to issue guidance, but it is actually maintaining it. Guidance will remain consistent to pre-crisis guidance. As it stands today, Enbridge is expecting distributable cash flow per share of $4.50 to $4.80 in 2020. In the first six months of 2020, Enbridge has surpassed expectations.

Also, Enbridge is reporting strong cash flow growth. The company posted a 5.5% increase in distributable cash flow in its latest quarter. This adds to Enbridge’s value proposition. So, as you can see, Enbridge’s stock price action is really in stark contrast to its actual fundamentals.

Enbridge: What is the risk?

So, what is the downside for Enbridge stock? This is a difficult question to answer. But based on fundamentals, it appears that the downside in limited. Because despite the clear difficulties in the oil and gas market, Enbridge is a defensive business. Enbridge owns and operates critical energy infrastructure. It powers our everyday lives. It keeps businesses running, and it keeps people warm.

The risk to Enbridge lies in oil prices. On a long-term basis, low oil prices would hit Enbridge. But on a short-term basis, Enbridge is protected by its low-risk contracts. For example, “take-or-pay” contracts obligate the buyer to either buy a minimum quantity or pay the seller for any shortfall. Therefore, Enbridge has minimal direct commodity exposure.

Also, Enbridge’s customers are predominantly investment grade and/or huge refiners and integrated producers. This also goes a long way in limiting volume exposure.

Motley Fool: The bottom line

Enbridge stock is yielding above 8% today. It represents one of the best dividend stock ideas. As the sentiment surrounding Enbridge catches up to its fundamentals, the stock will outperform big time. In the meantime, shareholders have an 8.2% yield to keep them satisfied. It is a win-win situation.