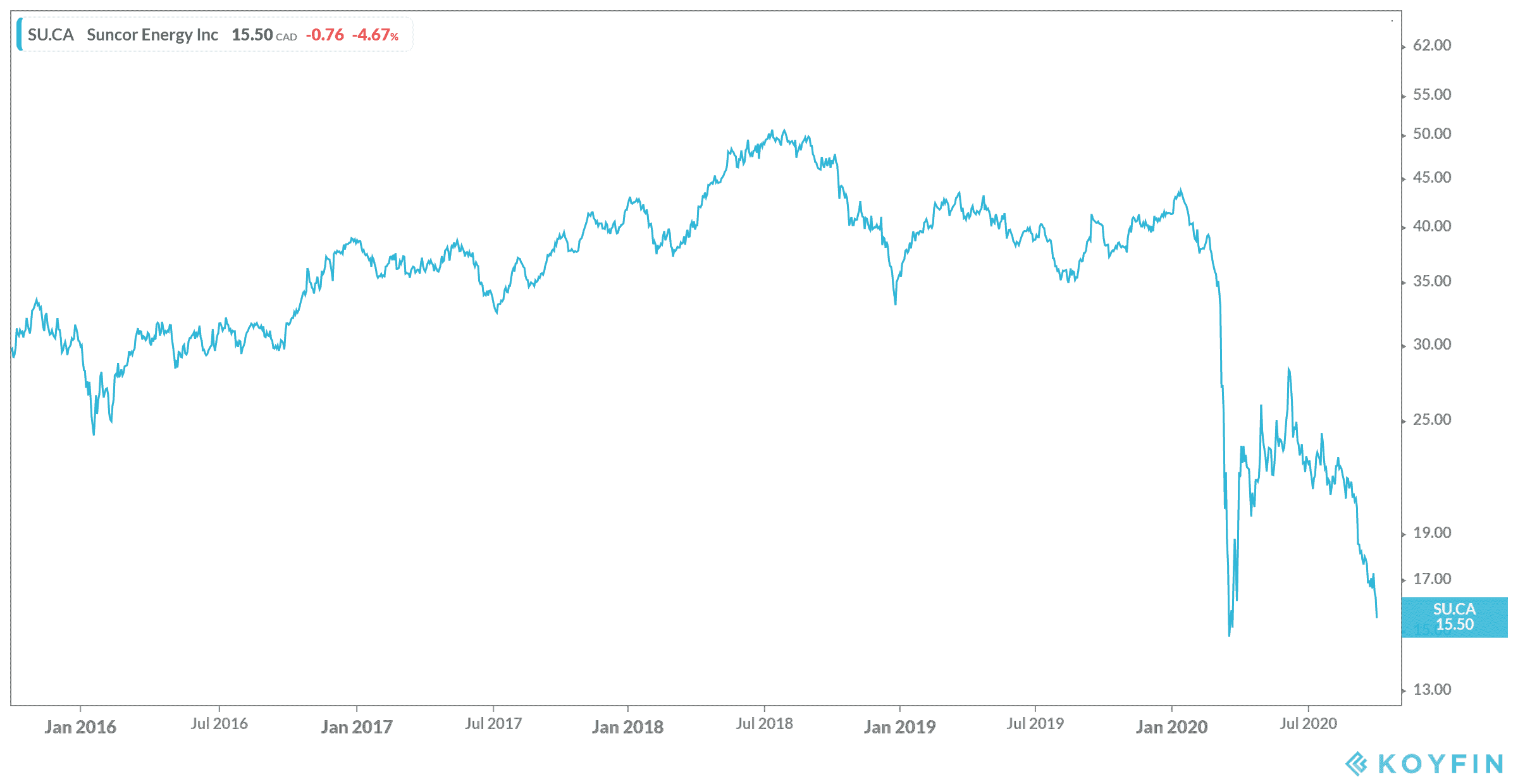

Suncor Energy Inc. (TSX:SU)(NYSE:SU) is often praised as being one of the few companies owned by billionaire investor Warren Buffett. But there’s a huge problem. The company has been trading at incredible lows as of late, with the oil and gas crisis taking on a pandemic.

There are now many economists questioning whether Warren Buffett should get out of Suncor altogether, or even the oil and gas sector. Let’s look at a few reasons why economists believe this is the case — and whether getting out of Suncor would be a good move.

Times are changing

The main reason that many believe Suncor and other oil and gas companies have seen its day is due to the current crisis. Oil and gas prices have slumped as production came to a screaming halt across North America. There is simply not sufficient power to ship the amount of oil and gas we can pump out, resulting in a glut in the markets. Other countries that can produce oil and gas have even tried to ramp up production, hurting North America further.

While pipelines are being built, this will take a few years — and that’s if these pipelines get built. While there are a few approved, social and environmental activists have put a major stop to this. Pipelines have been suggested across indigenous lands, and hurt the environment. There are now endless restrictions for pipeline projects, and it soon may not be worth it.

That’s especially because there are new types of energy production being created. Different renewable energy methods are receiving a lot of investment, both from the private sector and the government. It looks like energy companies may soon have to either change gears or get out of the way.

What about Suncor?

Suncor is the largest fully integrated energy company in Canada. It’s able to collect cash from its downstream assets even during this downturn, and is also able to continue making money from its marketing and retail products. While the company is mainly involved in production in Canada, it also has production in Libya and Syria.

The company is evolving and now owns four wind farms in Ontario and Western Canada. Clearly, it already realizes the change in the winds. However, it’s going to take a lot of investment and time to move completely toward renewable energy if it chooses to do so. Yet it will also take a long time for the world to move away from oil and gas and toward renewable resources.

So should you sell Suncor? I would say no. The oil and gas crisis will eventually come to an end, but may not be what it once was. Suncor, it seems, recognizes these changes and is already taking steps to correct it. For an investor like Warren Buffett, who may be looking to cash out soon, Suncor will likely rebound in the next few years to its former glory. Then, he could get out scot-free.

For those looking to hold long term, Suncor provides a solid opportunity for growth, especially if it’s able to move to renewable energy. Meanwhile, you can still enjoy its dividend yield payouts while you wait for this stock to rebound.