There’s a lot of noise in the markets these days. The markets crash, then rebound and are currently crashing yet again, leaving many wondering whether there’s a quick, “easy” way to bring in some extra cash. One of those ways? Short-selling stocks.

But even if you’re not new to investing, it’s likely you don’t know much about short-selling stocks. So, how do you short-sell stocks? Is it something you should consider for your own portfolio? And what is the risk involved with the process?

Let’s dig in and take a look.

What is short-selling stocks?

Short-selling is based on a belief that goes against much of what happens in the markets. While most of your portfolio should consist of stocks you’ll think will continue to rise, short-selling is quite the opposite strategy. You want to try to identify a stock that you believe will actually go down in the future.

An investor will first borrow shares of a stock that they believe will go down by a set future date. This is based on tons of research and strategies by the investor. Timing is critical when it comes to short-selling, so there are a few methods short-sellers look for, such as entering during an entrenched bear market, where the investor believes stocks will continue to drop.

As well, there’s the belief that the stock will continue to deteriorate based on performance or fundamentals, such as revenue growth or a challenging industry, watching valuation soar with buyer optimism and recognizing the potential for a huge correction.

So, when expiration date hits, the investor then sells those borrowed shares to buyers who are willing to pay the current market price. The trader bets that the price in those stocks will continue to drop when they can buy for a better price. The investor then buys shares at the lower price and returns the borrowed shares to the lender. They’ve therefore returned all the borrowed shares, but for a much cheaper price, pocketing the difference.

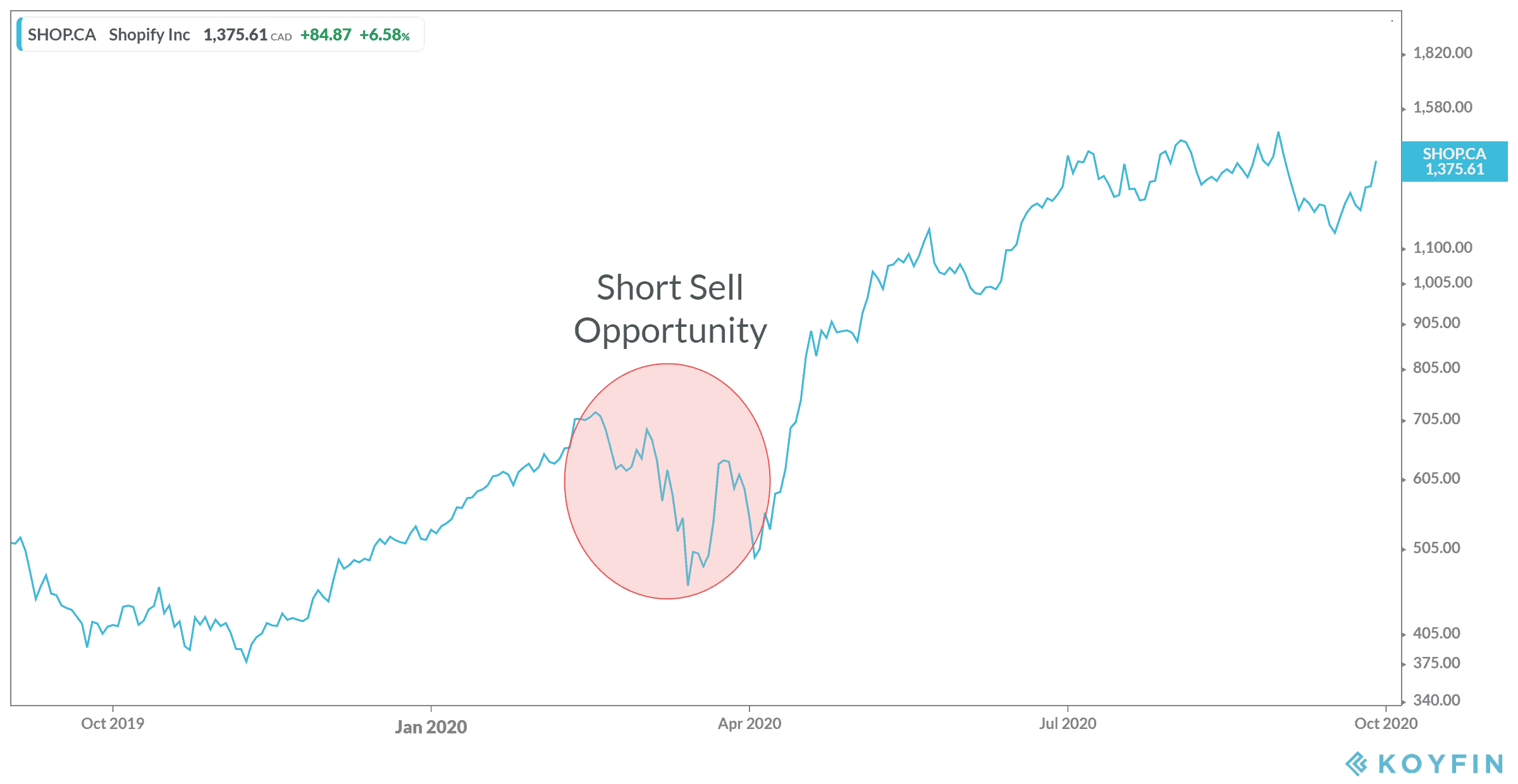

There are certainly those that have made a living short-selling stocks. Let’s take Shopify Inc. (TSX:SHOP)(NYSE:SHOP) as an example. While the company soared upwards, many economists believed the stock due for a big drop. The last crash therefore created an opportunity for short- sellers to get out and take their profits.

As an example only, short sellers may have borrowed 100 shares at $1,300 per share. They then bought back those 100 shares at $1,000 per share when the price dropped. Those short-sellers could have walked away with a profit of $30,000.

Is it worth the risk?

Now this is for educational purposes only. It’s always a good idea to learn more about investing, as it’s your money. However, when it comes to shorting stocks, there’s clearly a huge risk. Stocks can theoretically climb an infinite amount! So, Shopify could drop, but it just as easily could keep soaring upwards (which it’s mostly been doing over the last two years).

In fact, in the example I used, you could still make $30,000 without the risk. In the past year, Shopify has delivered a return of 240%! In the last five years, it’s been 2,906% as of writing! So if things remain on the rise, there are far safer way of getting $30,000 from this stock – and staying away from the risk of the stock soaring even higher.

So overall, I would recommend staying far away from the short-sell method of trading. And it’s certainly not something you could do in your Tax-Free Savings Account (TFSA), as it would be declared a business portfolio immediately and render the portfolio subject to tax.

Instead, if you want to invest in a company like Shopify, invest long term. Such an investment will increase your likelihood of walking away with solid cash — even as much as $30,000!