Over the last few weeks, it’s been made clear that the second wave of the coronavirus pandemic is upon us. That’s why last week, I recommended investors avoid TSX stocks like Cineplex (TSX:CGX) for the time being.

After Canada did a great job to flatten the curve in the first half of the year, the dreaded second wave continues to impact Canadian communities. In some cases, the second wave has come on so strong that governments have been forced to scale back some of the reopening policies to once again help curve the spread.

Of course, these days, we know that businesses will be affected whenever there are changes to the pandemic guidelines. Furthermore, it’s likely to affect indoor businesses that attract a lot of people and require them to spend long durations in enclosed spaces. That’s Cineplex’s business in a nutshell.

Cineplex stock

Investors have recognized this risk with Cineplex, and since my warning to investors just one week ago, the stock is already down a whopping 40% in the five trading days that have followed.

The impact on Cineplex’s business shows us a few things about the state of the market these days. First, it’s crucial you know your businesses inside and out and the risks that are impacting them.

Cineplex is a company that worked extremely hard to battle the pandemic guidelines and reopen its business this summer. However, the second it was obvious that the second wave would be devastating, investors should have been avoiding the stock.

However, this sell-off in Cineplex stock also shows that the market is taking no risks. Cineplex stock is incredibly cheap at the moment. As of Monday’s close, the stock is trading at just $4.75.

That’s down over 85% from its 52-week high and more than 90% from just a few years ago. Despite that, the stock is still being sold off heavily as investors rush to get out of the investment.

This goes to show that in the uncertainty of the pandemic, investors want to avoid risk as much as possible. So, while I would continue to advise investors to avoid the stock for now, when we start to turn the corner on the pandemic, Cineplex could offer investors one of the best recovery opportunities.

A TSX stock to avoid

Another stock I would advise investors to avoid for now is MTY Food Group (TSX:MTY). Like Cineplex, MTY is a stock that will likely be influenced again by the second wave of the coronavirus pandemic.

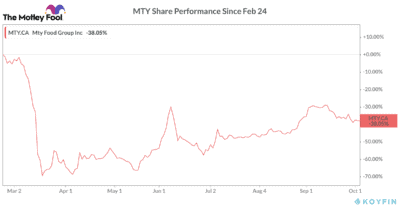

MTY operates a portfolio of quick-service restaurants, a lot of which are located in mall food courts. This could be a significant issue, as we already saw back in the spring. When shutdowns were first announced, understandably, MTY was impacted massively. That’s why the stock fell by roughly 70% initially and today is still down roughly 50% off its 52-week high.

As you can see, the stock was hammered in the early stages of the pandemic. And despite a slight recovery in the stock, it remains well off its high.

Another thing that’s noticeable when looking at the graph is, much like Cineplex stock, MTY has been selling off the last few weeks.

However, the sell-off has been nowhere near to the degree of Cineplex. This could change, though, as the second wave progresses and gets worse, which is why I would avoid the stock. Plus, trading more than 100% off its 52-week low, it still has a tonne of room to fall.

After all, Cineplex stock crashed right through its 52-week low and is nearly 25% below that old bottom. This suggests that MTY has a tonne of room to fall if the impact on its business get worse.

Bottom line

It’s paramount that investors understand each of their businesses’ risks and vulnerabilities and can recognize in advance how developments in the economy and pandemic can impact your investments.

That way, you can avoid these ticking time bombs in your portfolio, which will undo a tonne of the work you’ve done to grow and save your hard-earned capital.