Canadians use the Tax-Free Savings Account (TFSA) for a number of reasons. The TFSA serves as a safety net for work disruptions, a retirement plan, and a fund for future purchases.

The overall goal is to limit damage to our financial freedom.

How to use a TFSA

Saving for a rainy day, or a pandemic, is one goal for a TFSA contribution. The 2020 crisis reminds us all that despite our best efforts, life sometimes throws a curveball at our financial situation.

Hopefully, we won’t need to tap the TFSA savings due to lost income, but it is nice to know the money is available in the case of an emergency.

Otherwise, the TFSA fund can be used to supplement retirement income. This is particularly important for people who might not have a company pension. A TFSA also plays a key role when planning retirement tax strategies.

Why?

The CRA does not tax income earned inside the TFSA. In addition, money withdrawn from the TFSA is not added to net world income when the CRA determines clawbacks on Old Age Security (OAS) pensions. Company pensions, CPP, OAS, and RRSP withdrawals and RRIF payments all count as taxable income.

Best way to invest inside a TFSA

Money that is needed in the near term, say within one year, should probably be placed in term deposits. The yield is horrible on fixed-income investments these days, but the money is secure.

Funds invested for retirement should seek better growth opportunities. A popular strategy involves buying top dividend stocks and using the distributions to acquire new shares. The snowball effect is powerful and can turn a relatively small initial portfolio into a large personal pension fund over time.

Some people actually get to the point where they can simply live off the dividends. Imagine getting a steady tax-free income without having to go to work!

Top stocks for a Tax-Free Savings Account

The best stocks to own in a TFSA have long track records of dividend growth supported by rising earnings. Search for companies that tend to perform well in all economic circumstances. In addition, leaders in their respective industries or business segments often outperform.

Fortis and TD Bank are good examples to consider today for a TFSA portfolio.

Fortis

Fortis gets most of its revenue from regulated utility assets. The company has a strong capital program to drive internal revenue expansion. Fortis also uses acquisitions to propel growth. The dividend increases every year and the stock normally holds up well when the broader market takes a hit.

A $10,000 investment in Fortis 25 years ago would be worth $220,000 today, with the dividends reinvested.

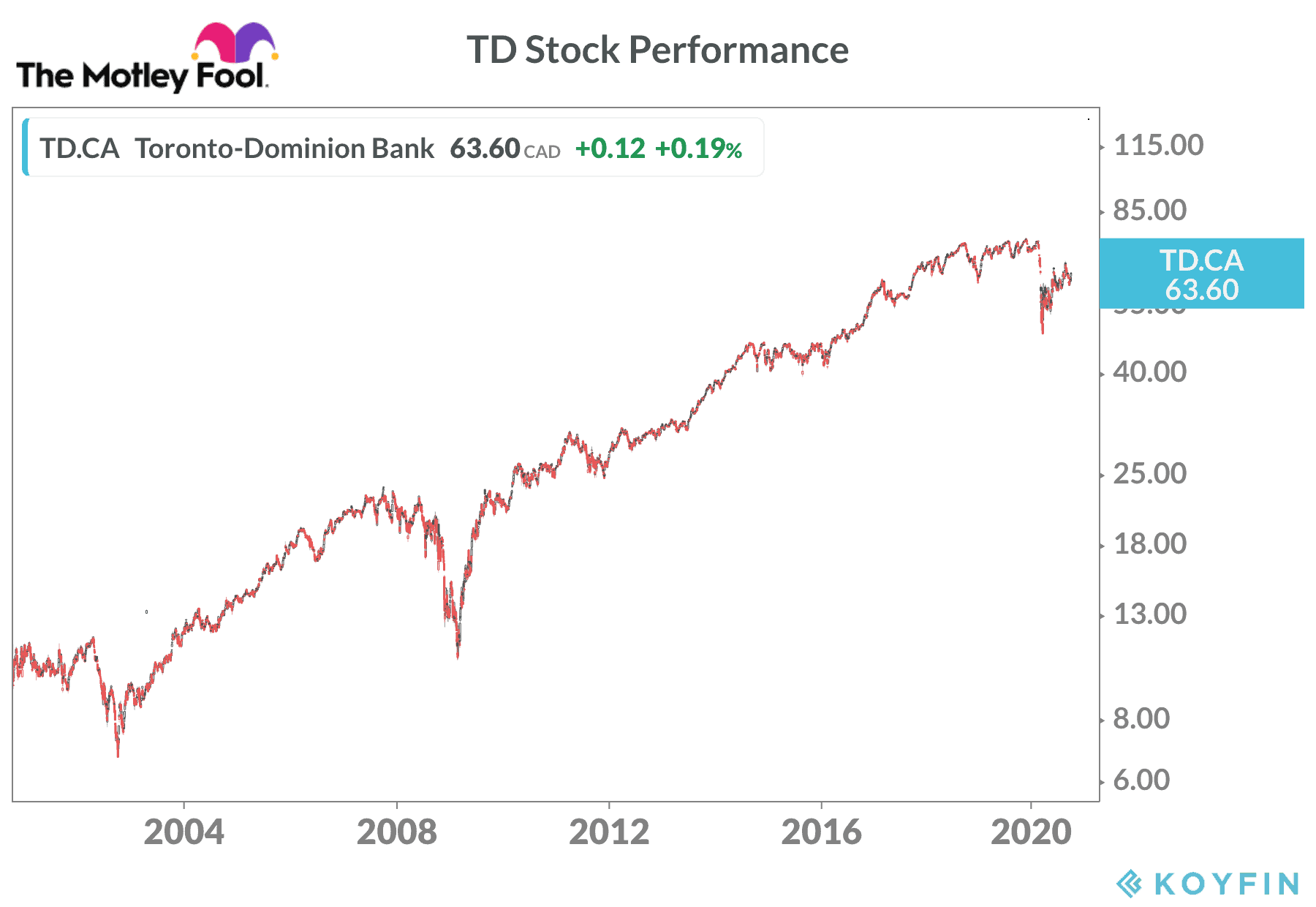

Toronto-Dominion Bank

TD Bank faces challenges in the current environment, as people and businesses struggle to navigate the pandemic. However, the bank remains very profitable and has the capital to ride out the downturn.

TD reported adjusted earnings of $2.3 billion for the three months ended July 31. This is down 30% from the same period last year due to high provisions for credit losses (PCL) but still a strong performance.

TD is one of the best dividend stocks on the TSX Index. The drop in the share price this year makes it very attractive right now for a TFSA portfolio. Investors who buy today can pick up a solid 5% dividend yield.

A $10,000 investment in TD just 25 years ago would be worth $240,000 today with the dividends reinvested.

The bottom line on TFSA investing

Investing in top dividend stocks carries near-term risk, but the long-term returns in a TFSA fund can be significant. We just need to stick to the plan.