There are 246 energy companies listed on the TSX Composite, making up a total of $560 billion in total market capitalization at writing. These companies provide about 16% of the total TSX. Near the top of that list is Suncor Energy (TSX:SU)(NYSE:SU).

Suncor is Canada’s largest fully integrated energy company, and one that billionaire investor Warren Buffett continues to hold a stake in. What fully integrated means is that it does everything. It explores, drills, produces, and even markets its own oil. That also means when the oil and gas market is down, the company has other methods to fall back on. It’s the diversity that keeps the company going.

Then, COVID-19

But no one could have predicted an oil and gas crisis would happen coupled with a pandemic. During the crisis, Suncor saw an opportunity to buy land, rent equipment, and keep drilling all on the cheap. Meanwhile, its downstream services and long-term contracts would keep the lights on.

However, the pandemic meant that all that production came to a screeching halt. Even with production up and running again, social distancing and all that goes with the pandemic means there are still massive limitations.

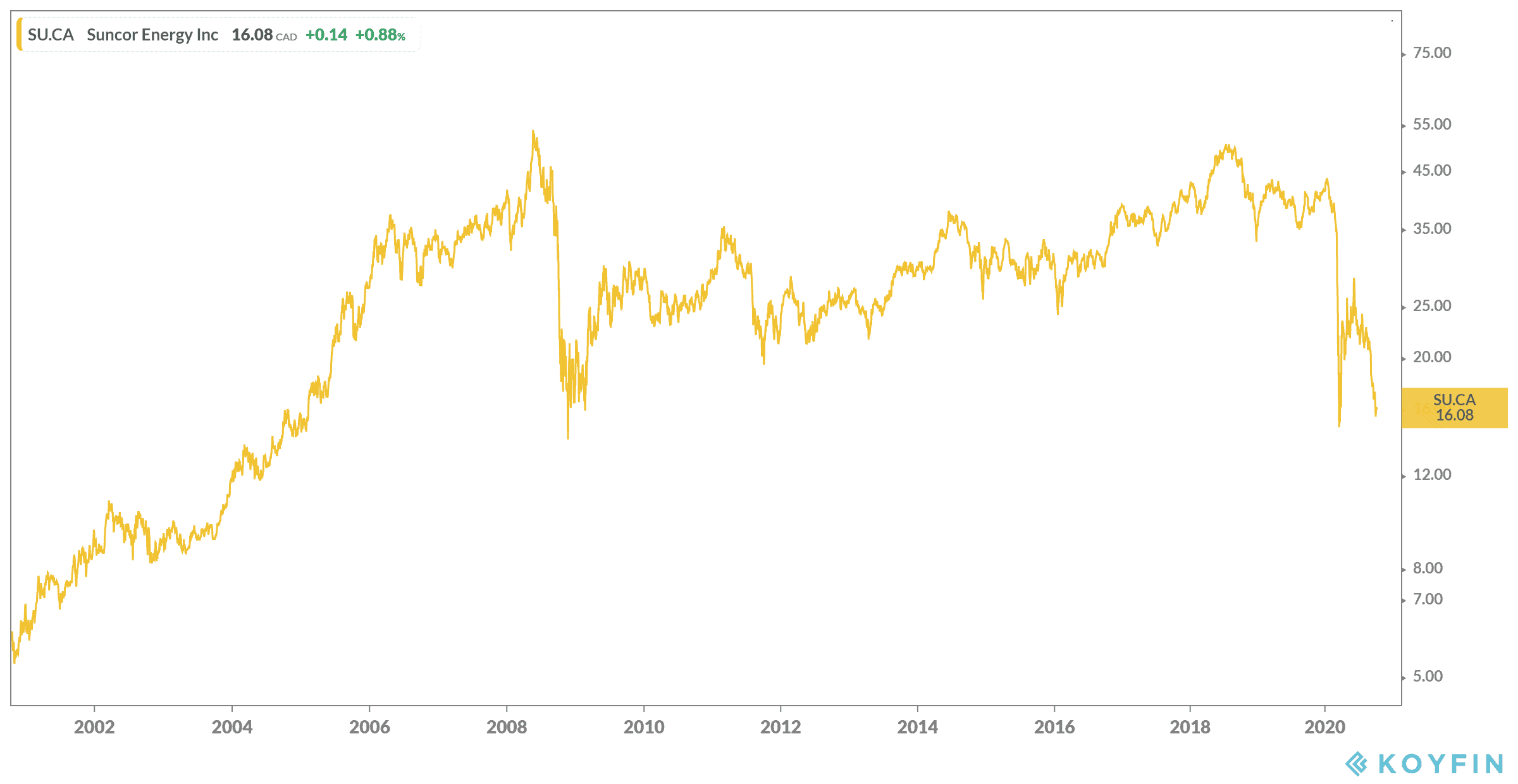

So, what started out with a hiccough turned into a serious ailment. The company slashed its dividend, as share prices hit lows not seen since the last recession in 2008. Even in the last few years the stock has been dropping further and further before the crash. In fact, its 10-year compound annual growth rate (CAGR) is negative 4.86%.

How much is it worth?

If you had invested $10,000 at the start of 2020, today that investment would be worth $3,914.73. Ouch. And if you had received a dividend, as I mentioned, even that has been slashed. So, should you hold on for dear life or get out now?

There are two ways to look at this, and it depends on your overall investment strategy. If you’re looking to get out in the next few years, say you’re retiring, then Suncor is still a solid investment. The oil and gas crisis will end. The pandemic will end. When it does, Suncor should soar back up to pre-crash prices and then some. Its integrated business and growth strategy means the company has decades more ahead of it at least to bring in revenue.

The other strategy is whether you’re looking to hold onto this stock for decades. There, I’m not as sure. Economists believe more and more government funds and investments will go to renewable resources. These energy producers will be the future, and oil and gas will be — albeit slowly — phased out.

Does that mean Suncor could be phased out? It’s not clear. The company already operates some windmills so could manage to go into the renewable sector, but it needs the funds to make that happen. If things don’t change in the next decade, who knows if it’ll be able to afford it?

Bottom line

Suncor is a scary bet I’m personally not willing to take. If you have shares in this stock, I would hold onto them until at least pre-crash levels hit and you’re able to sell. If you have mega patience, then continue to hold until both of these crises come to an end. But if you’re looking for a new stock to buy, I simply cannot recommend Suncor at this point given the last decade of performance and its near and distant future.