The stock market has picked up once again after the September correction. The October stock market rally is being driven by the fresh liquidity the Justin Trudeau government is pumping in the economy with the new recovery benefits. One way of investing in the stock market is jumping on the rally before it is too late. You can benefit from this rally and convert your $6,000 Tax-Free Savings Account (TFSA) contribution into $100,000. Here’s how.

Two stocks that can convert your $6,000 TFSA contribution to $100,000

If you have $6,000 in your TFSA, invest in stocks that have shown steady double-digit growth of more than 20% in the last five or 10 years and hold the potential to continue this growth for another decade. Finding such stocks is difficult as the business environment changes, disrupting several industries over time. But one industry that has only grown with time is logistics.

There will always be trade, and people and businesses will consume goods. The last decade was a remarkable period for logistics as global trade flourished, and more participants from across the globe entered the supply chain. This increased demand for air cargo and software solutions that can optimize supply chain operations.

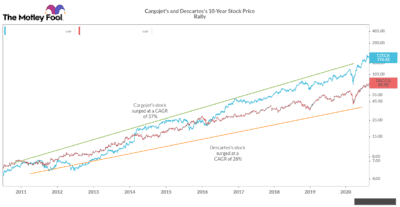

Cargojet (TSX:CJT) and Descartes Systems (TSX:DSG)(NASDAQ:DSGX) benefitted from the global trade boom. Their stocks surged at a CAGR of 37% and 28%, respectively over the last 10 years. If you had invested $3,000 in each of the two stocks in January 2011, by now, you would have over $100,000 in your TFSA. And all this money would not even count towards your taxable income.

Now, you must be wondering if it is too late to invest in these two stocks. Do they still have the potential to replicate the last decade’s growth in the next 10 years? Yes, they do.

Cargojet stock

Cargojet provides premium time-sensitive air cargo services. While global trade drove its revenue in the last 10 years, the e-commerce wave will drive its growth in the next 10 years. The concept of e-commerce is helping local stores reach out to a broader set of audiences across the state or country. The e-commerce trend has also reduced the delivery time, making air cargo services even more relevant.

The COVID-19 pandemic accelerated the e-commerce wave and pushed Cargojet’s second-quarter revenue up 65% year over year, its highest growth in five years. And this growth is not a seasonal volume burst, as seen in the holiday season. Rather, it is here to stay at least for the next three years until passenger planes take the skies.

Cargojet stock has surged more than 85% and could well surge further in the next two years. If the economy returns to normal, the stock’s growth would also normalize. This wave of the high, medium and even low growth would normalize to more than 20% average annual growth in 10 years.

Descartes Systems stock

Descartes Systems’ supply chain management solutions offer end-to-end logistics solutions and cater to all types of challenges. Companies can use Descartes’s platform for a single trade assignment or their day-to-day trades. Its customer base is also vast ranging from airlines to food companies to manufacturers.

Whether it is people, goods, or information, if it needs to be transmitted via road, rail, air, or sea, Descartes gives you the solution. The globalization of trade drove its revenue at a compound annual growth rate (CAGR) of 12% in the last five years.

Now, the U.S.-China trade war is restructuring the global supply chain. The e-commerce wave is driving the need for logistics. The e-commerce order flexibility and low-cost deliveries are driving the need for optimization. Both these factors will drive its revenue in the next 10 years.

Descartes’s stock has surged 30% this year and could continue to surge around 20% CAGR in the next decade.

TFSA investors

Invest $3,000 each in Cargojet and Descartes and let it grow for a decade. Do keep checking the updates on these companies in between to ensure your TFSA portfolio is growing smoothly.