Registered Retirement Savings Plan (RRSP) investors constantly search for the best stocks to help build substantial retirement portfolios.

RRSP contribution rules

Canada created the RRSP in the 1950s to give people without pensions another option to save money for the future. RRSPs started out less flexible than the current version but improved over the years.

For example, original RRSP rules allowed contributions up to 10% of the previous year’s income to a $2,500 maximum. In addition, unused contribution space couldn’t be carried forward. Today, Canadians can contribute up to 18% of previous year’s income to a limit of $27,230 for 2020.

People can also accumulate unused contribution space. This makes sense when they expect to be in a higher marginal tax bracket in future years. RRSP contributions are used to reduce taxable income.

Investments grow tax-free while inside the RRSP. This means the full value of dividends and capital gains can be reinvested without setting some aside for the tax authorities. The CRA eventually gets its cut, but the hit is deferred until the funds are withdrawn.

Ideally, we want to be in a lower marginal tax bracket when we take money out of the RRSP than where we were when we made the original contributions.

Investors need to keep a few rules to keep in mind on determining RRSP contribution space.

First, any contributions to a work pension reduce the RRSP deduction limit. This includes amounts paid by the employer into a defined-benefit pension. It also includes money put into defined-contribution plans by both the employee and the employer.

It is important to know these amounts. The CRA implements a 1% per month tax on contributions once they go $2,000 above the RRSP deduction limit.

Top stocks for retirement portfolios

Companies that are industry leaders with wide competitive moats tend to fare well over time. Ideally, these stocks have strong track records of dividend growth supported by rising revenue and profits.

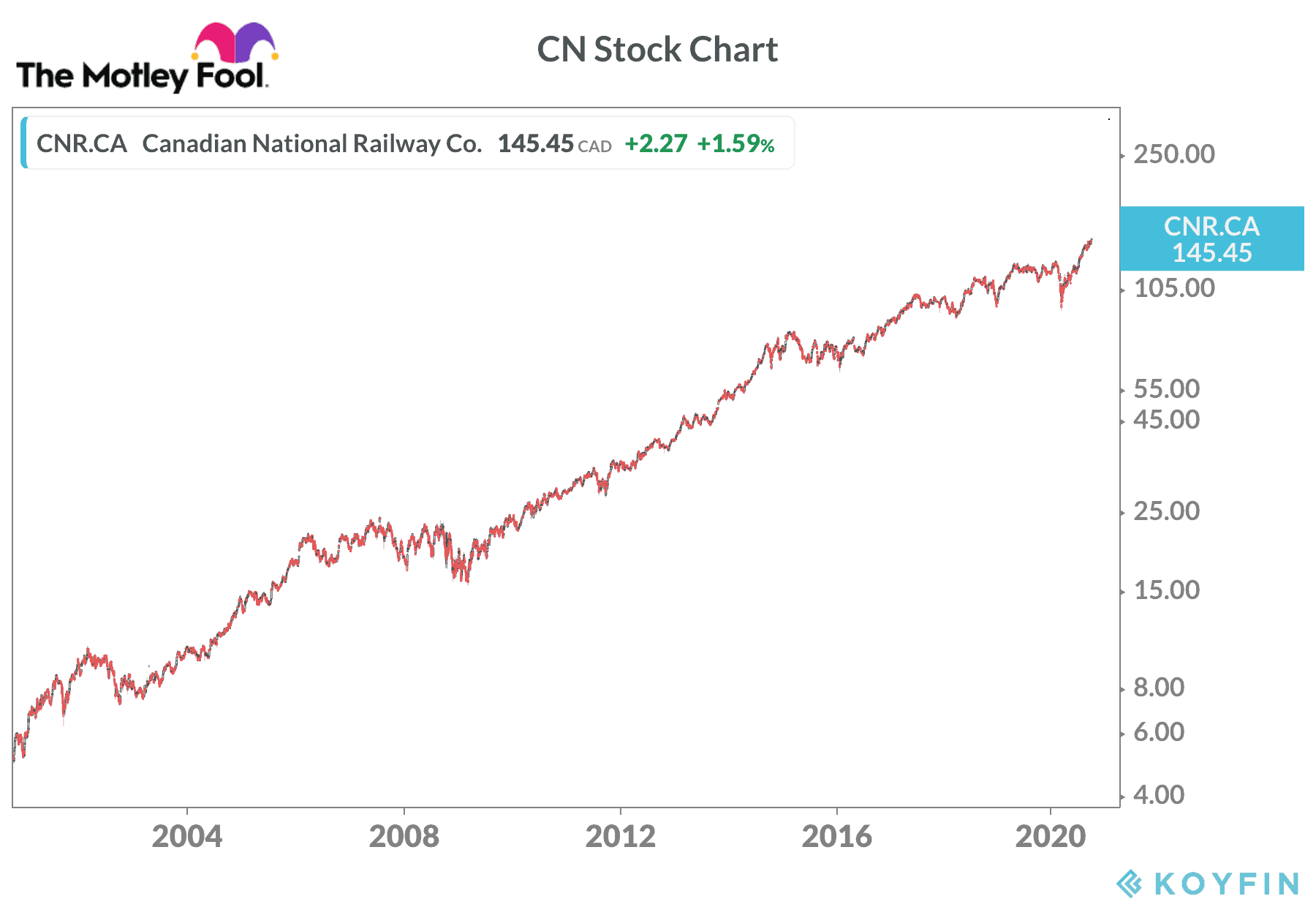

A good example would be Canadian National Railway (TSX:CNR)(NYSE:CNI).

CN is the only rail company in North America with lines connecting ports on three coasts. The odds of new rail lines being built by competitors along existing routes are pretty much zero.

CN generates income in both Canadian and U.S. dollars. The bottom line gets a nice boost when the American dollar moves higher against the loonie. CN invests heavily in network upgrades, new locomotives, additional rail cars and technology to make the business more efficient. In 2019, CN spent nearly $4 billion on capital projects.

A wide variety of business segments helps CN balance out the revenue stream. When one group has a rough quarter or a challenging year, the others tend to pick up the slack.

CN generates significant free cash flow and has one of the best dividend-growth records on the TSX Index.

Long-term investors have done very well with the stock. A $15,000 investment in CN inside a self-directed RRSP just 20 years ago would be worth $400,000 today with the dividends reinvested.

The bottom line on RRSP investing

The strategy of buying top-quality dividend stocks and using the distributions to acquire new shares is a proven one for building RRSP wealth.

It takes patience and discipline to stick to the program through challenging times, but market corrections generally prove to be buying opportunities.