Just a year ago, airlines were flying high, including Air Canada (TSX:AC) stock, which was putting the finishing touches on a successful multi-year comeback. Then the COVID-19 pandemic hit the world and the scene is now quite different.

The global airline industry has been severely beaten in the wake of the COVID-19 outbreak. The declining demand for air travel caused massive losses. Airlines had to cut jobs and salaries to survive.

Despite financial losses and operational setbacks associated with the pandemic, Air Canada stock continue to record strong market activity.

The impact of the pandemic on the airline has been huge

Air Canada has been in the news on things like furloughs, pay cuts and flight cancellations for quite some time. But at the same time, it is trying to improve its game in the face of the pandemic, which has rained particular unrest on airlines around the world.

Last week, Air Canada reportedly ordered 25,000 COVID-19 test kits that can produce results in minutes, with the reported goal not only to allay passenger fears about exposure on flights, but also to help convince the health authorities that flying can be conducted safely.

In recent months, Air Canada has made a number of calls on the federal government to ease restrictions on travel within and outside of Canada, saying travel and border restrictions are causing extreme damage to the industry.

When we look at its latest quarterly results, the impact of the pandemic is pretty clear. Air Canada reported total revenues of $527 million in the second quarter ending June 30, 2020, an 89% year over year decline. It incurred an operating loss of $1.5 billion in the second quarter of 2020, a massive drop from an operating profit of $422 million in the second quarter of 2019. With all foreclosure restrictions and of travel, Canada’s largest airline saw the total number of passengers carried drop by a whopping 96% in the second quarter.

Air Canada stock is still popular

Amid all the setbacks inflicted by COVID-19, Air Canada stock continues to garner a lot of attention among investors. Air Canada is one of the highest traded stocks on the TSX. Trading in Air Canada stock has averaged 3.8 million trades over the past 10 days.

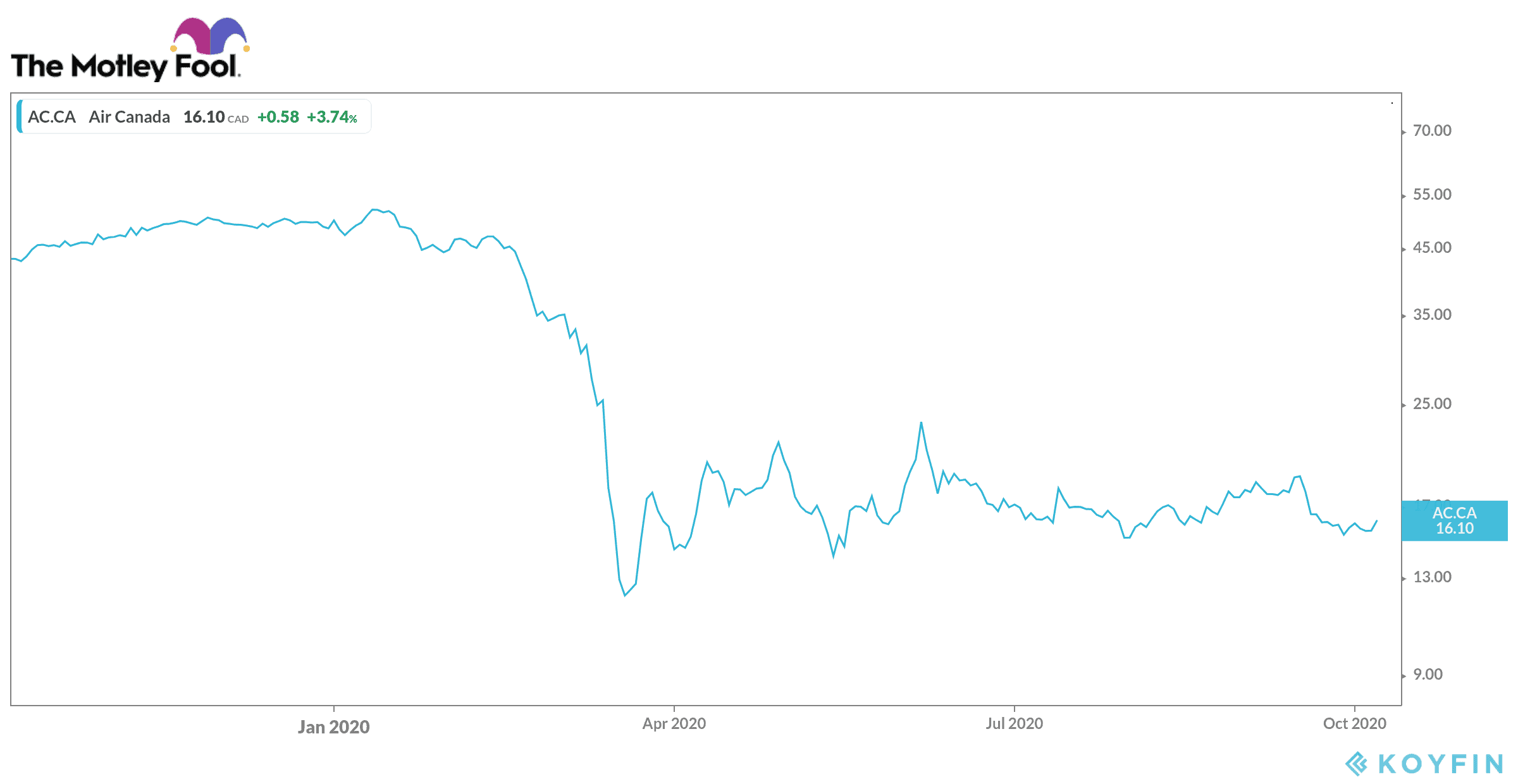

From a high of $52.09 (Jan 14), Air Canada stock price fell to $12.15 in the pandemic-triggered stock market crash (March 20) – a drop of nearly 77%. Shares have lost two-thirds of their value year-to-date.

Air Canada’s recent stock market movements, poor financial report, and persistent operational problems aside, its popularity with investors remains strong. The airline has a market cap close of $4.8 billion and a price to book (P/B) ratio of 2.3.

The airline has a five-year P/E-to-growth (PEG) ratio of 0.02, so it’s very cheap relative to its future expected growth. Air Canada stock is undervalued but still has a long way to go before returning to its pre-pandemic levels, so investors must be patient. If a vaccine becomes available next year, more people will travel, which will give a boost to the stock. Air Canada stock will eventually recover from the pandemic.