Suncor stock might be out of favour right now, but the share price appears heavily oversold, and that could provide contrarian investors with a shot a huge upside.

Suncor stock price

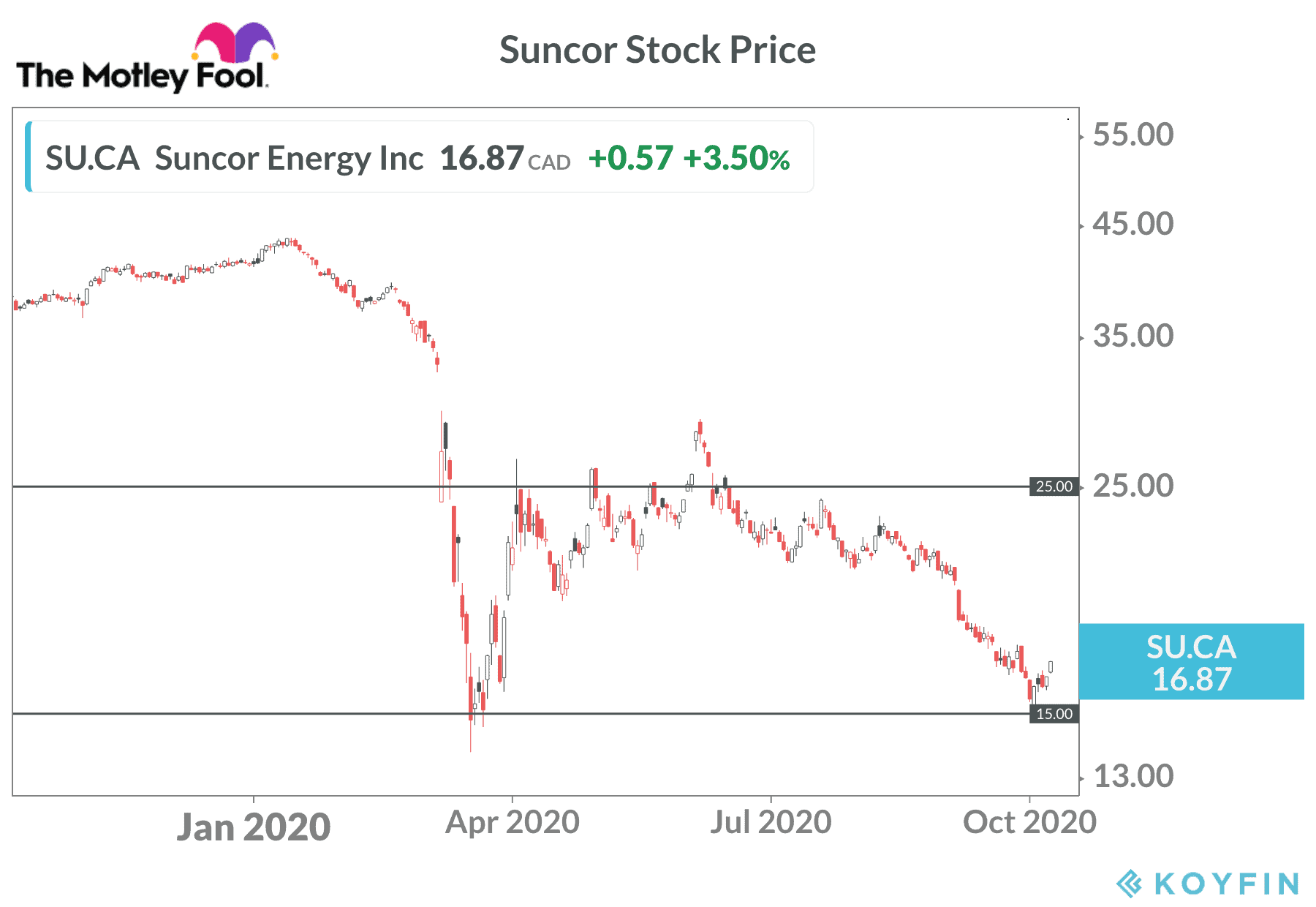

At the time of writing, Suncor stock trades near $16.50 per share. That’s up 10% over the past week. The move is a welcome relief to the massive crash the shares endured so far in 2020.

How bad has it been?

Suncor began the year near $42 and went as high as $45 in January on rising oil prices due to geopolitical conflict in the Middle East.

The arrival of the pandemic shifted the market’s focus to the demand side of the trade. Lockdowns imposed at the beginning of the crisis wiped out oil demand across the globe. This sent WTI oil tumbling from above US$60 per barrel early in the year to a brief stint in negative territory on the futures contract in April.

China then reopened its economy and started buying more oil just as OPEC and global producers reduced supply. This helped WTI oil recover back above US$40 in early June.

Suncor’s share price rallied off the March low of $15 to $28, supported by optimistic hopes of a V-shaped global economic recovery.

The summer then brought new waves of COVID-19 in big fuel-consumption markets, including the United States and Europe. This triggered a drop in oil prices through September. Suncor’s stock price had already pulled back from the June high on rough Q2 results and reduced production guidance for the year due to a fire in August.

The drop picked up steam along with the broader weakness in equity markets over the past month and traded back near $15 per share at one point on October 2.

Will the rally continue?

The rally off this point caught investors by surprise in the past few days. Suncor announced a plan last week to trim its workforce by 10-15% as a result of the ongoing weakness in oil prices and a slow recovery in fuel demand. This should have been negative for the stock.

Suncor is a major oil producer, but it also owns four large refineries and 1,500 Petro-Canada retail stations.

Why is the stock up?

WTI oil is back above US$41 per barrel. The rebound from US$37 last week is part of the reason Suncor is catching a tailwind. The coming six months might not see meaningful oil-price upside, but the spring of 2021 could see fuel demand begin to rebound, as COVID-19 vaccines start to be become widely available.

Travel restrictions should ease next year, and that should lead to better demand for jet fuel. At the same time, a full reopening of economic activity should boost overall oil demand.

In that scenario, oil prices could steadily recover in 2021. Suncor stock should go along for the ride.

Should you buy Suncor stock today?

The recent surge might turn out to be a head fake before another leg to the downside, so I wouldn’t back up the truck. However, the share price appears oversold right now, and it wouldn’t be a surprise to see Suncor stock move back up to $25 in the coming months.

The current dividend looks safe and offers a 5% yield right now, so you get paid well to wait. Downside should be limited at this point, and the upside opportunity is significant.

If you have a contrarian investing style, it might be worthwhile to start a small position.