Bausch Health Companies Inc. (TSX:BHC)(NYSE:BHC) stock had a very big day yesterday. In fact, it was the best-performing stock on the TSX. So why did Bausch Health Companies stock soar more than 12% yesterday? And what does this mean for Motley Fool investors?

Bausch Health stock surges on bullish guidance

Bausch Health Companies has struggled with investor confidence since its final days as Valeant Pharmaceuticals. Given its history, one can’t blame investors for being weary. Valeant had a sorted history of unethical practices of price gouging and accounting issues. Many past Motley Fool articles discussed these issues at length.

But yesterday, management added another success to its recent effort at regaining confidence and trust. Essentially, management re-affirmed its guidance for the business’ recovery — guidance that has gone a long way. Management expects third-quarter revenue to be greater than $2.1 billion. This represents a sequential growth rate of 28%. Year over year, this represents a decline of 3% compared to a decline of 23% in the second quarter. A recovery is indeed underway.

For the full year, management expects revenue of approximately $7.9 billion, the mid-point of the company’s prior guidance and 8% lower than 2019 revenue. Also, 2020 EBITDA is expected to be approximately $3.25 billion, 9% lower than 2019. Bausch Health Companies generated $200 million in cash in the second quarter. And in 2020, the company continues to expect $1 billion in cash from operations.

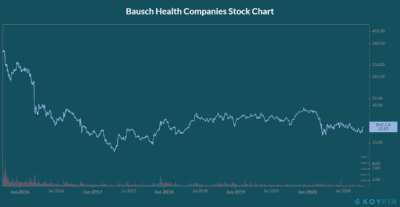

Low expectations are priced into Bausch Health stock, which is why it reacted with such strength yesterday. The stock trades at a price to sales multiple of a mere 0.7 times. And it is trading 39% lower year to date. The following chart shows Bausch Health Companies stock’s five-year price performance.

It is not pretty, but the stock is slowly recovering. Before the pandemic hit, Bausch Health was consistently surpassing the market’s expectations. In my view, this will continue.

Bausch Health Companies stock is the top healthcare stock on the TSX

While Bausch Health is not out of the woods yet, it certainly has gained a lot of ground. It’s been four years since Bausch’s transformation began. The plan was to first stabilize the company, then transform it. Today, the stabilization effort appears well under way if not mostly achieved. Bausch has resolved nearly all litigation. It has also divested of $4 billion of non-core assets and has paid down nearly $8 billion of debt.

As the coronavirus disruptions ease, Bausch Health can return to business. The company focuses on its consumer and eye-care, gastrointestinal, and dermatology franchises. Bausch Health has a fully integrated specialty pharmaceutical and branded generics business that will lead the company into a strong future.

Motley Fool: the bottom line

Bausch Health Companies stock appears on the cusp of big returns. Yesterday’s 12% rise is just a glimpse of what’s to come. This has been a long time coming for Bausch Health Companies. In my last article on the company, I argued that its future looks bright. Although the pandemic has brought some short-term problems, the progress that has been made is encouraging.

Here at Motley Fool Canada, we recognize that the healthcare industry is a lucrative one that is steadily growing. It is also one that is innovating at a faster pace than ever before. The problem is that most of the healthcare stocks are American. With a goal of saving and improving lives as the population ages, investors can feel good about investing in Bausch Health stock for the long term.