Canadians don’t have all that much to work with these days when it comes to their finances. We need to save every penny we have for a rainy day. Unfortunately, it looks like those dark clouds continue to hover over the markets and aren’t going away any time soon.

While I understand wanting to keep some cash available, if you have even $5,000 to spare, you can make it do great things. The benefit is using your Tax-Free Savings Account (TFSA). By using this account, you’ll be able to put money aside safely, take it out whenever you need it, and none of it is subjected to taxes or fees. You can then invest it in Canadian companies set to make a killing.

What to look for

Now, if you’re going to invest in a strong company, there are a few things to look at — especially during a volatile market such as where we are now. First, you’ll want to see how the company has performed in the past. Sure, the stock may have dropped during the last recession, but that’s expected. But did it rebound? How long did it take? And how is it performing during today’s market?

So, take a look at the company’s compound annual growth rate (CAGR) for the last decade. You’ll want to see some positive numbers that can continue in the future. This is the second part you want to look at: the year-over-year revenue. If the company has continued to create strong revenue streams, then that should be a stock that demands your attention.

There are a few stocks that have continued with positive growth in these areas, even during the downturn. Many even outpace the markets. What you want to look for are companies in industries that are a proven necessity. Even better, necessities that are on the emerging end of the spectrum.

Ticking all the boxes

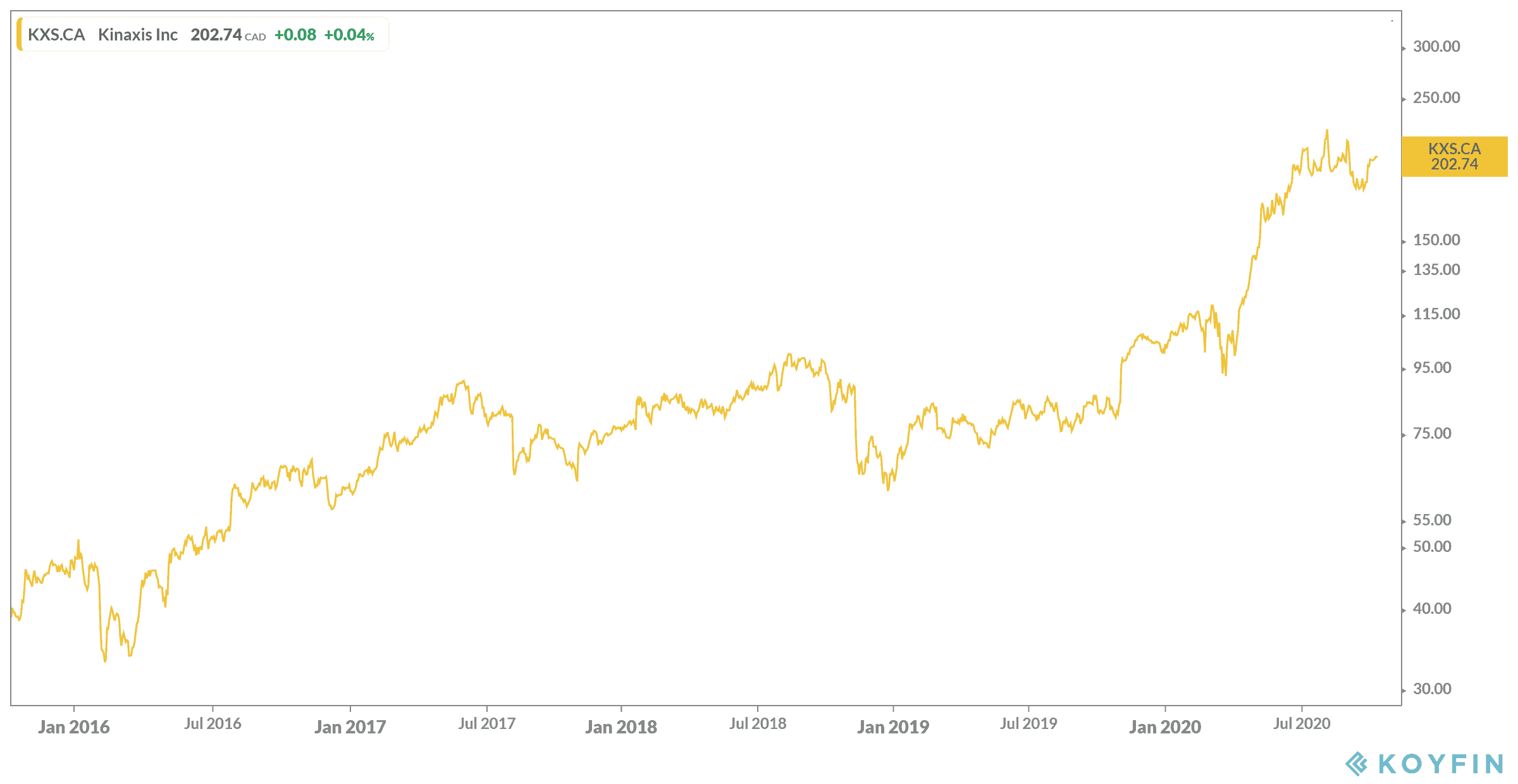

The ideal stock I would recommend right now has to be Kinaxis (TSX:KXS). The company is definitely on the emerging side of necessities. It provides software as a service (SaaS) supply chain management for large enterprise companies around the world. It has an enormous, diverse portfolio, not allowing any one company to take up too much of its revenue. This means its recurring revenue comes from a variety of sources to keep the company strong and growing.

As for those numbers I mentioned? Kinaxis has a CAGR of 37.4% in the last five years, with a five-year return of 397% as of writing. Kinaxis has also had strong year-over-year revenue growth, with the latest quarter at 33.5%, but the last consecutive quarters hovering around 30%.

Bottom line

If Kinaxis continues on its trajectory, which is likely given the necessity of its business, it would be easy to turn $5,000 into $30,000. Today, you could buy shares at about $203 per share — definitely on the high end but likely to continue upwards for long-term investors. After purchasing 25 shares, you could turn that into $24,852.48 in just five years if shares continue at the current pace.