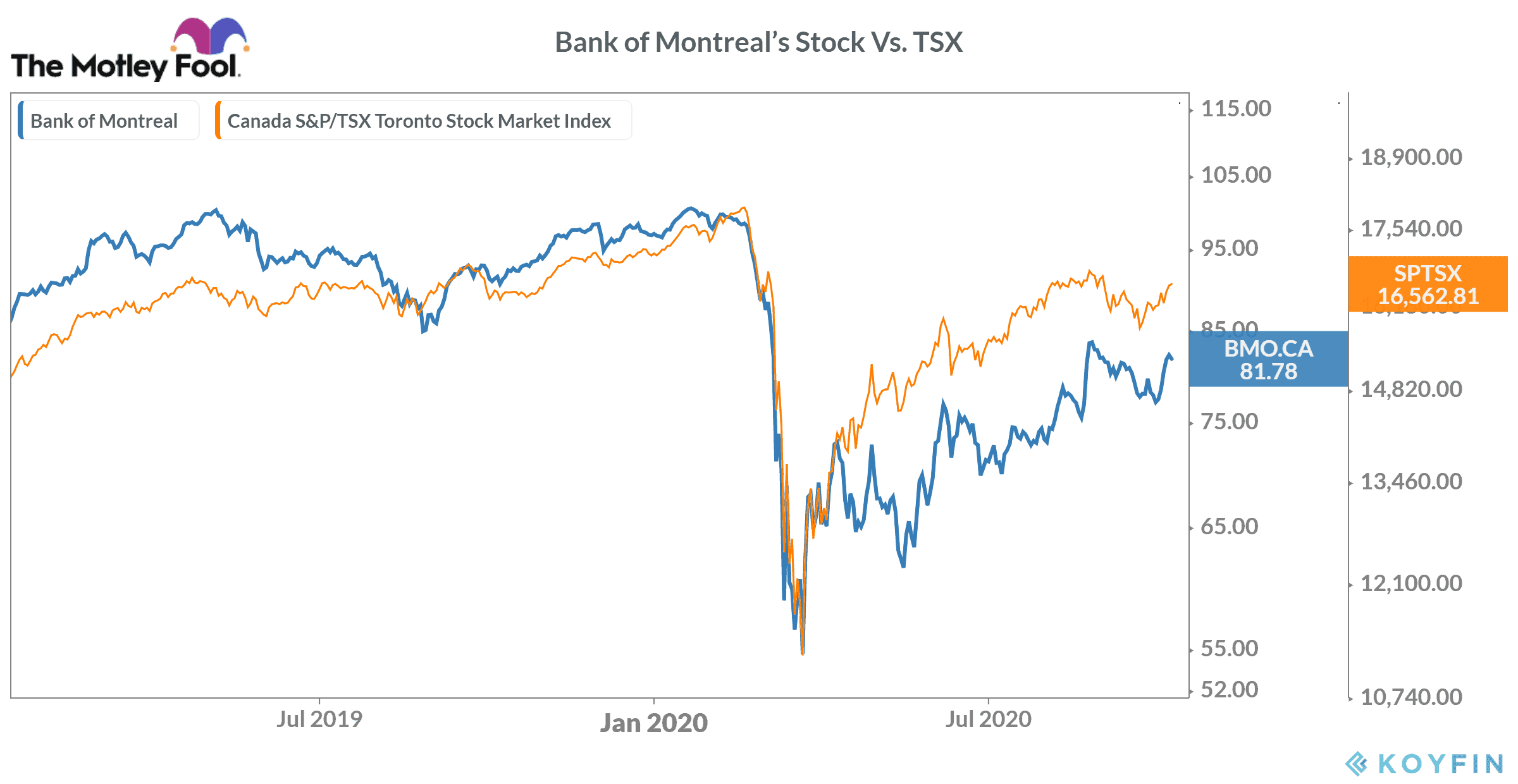

All Canadian banks are currently trading in the negative territory on a year-to-date basis. In 2020, some of the largest Canadian banks such as Royal Bank of Canada, Toronto-Dominion Bank, and Bank of Montreal (TSX:BMO)(NYSE:BMO) have lost 5.3%, 15.5%, 18.7%, respectively.

Last week, most bank stocks traded on a mixed note on TSX. However, the shares of Bank of Montreal turned positive last week after falling for the previous five weeks in a row. The stock recovered by 5.7% in the week ended October 9. Before we discuss whether or not BMO stock is worth buying right now, let’s take a closer look at what drove its last week’s gain.

Why Bank of Montreal stock rose by 5.7%

Earlier this month, Bank of Montreal announced a 1-for-20 reverse split of MicroSectors U.S. Big Oil Index 3X Leveraged Exchange Traded Note (ETN). The MO Financial Group’s ETN that trades on the New York Stock Exchange with the symbol “NRGU.” The reverse split is effective as of writing.

Last week, analysts at BofA Global Research — Bank of America’s securities research arm — upgraded their ratings on Bank of Montreal stock to “neutral” from “underperform.” This upgrade could be one of the reasons why BMO stock rallied last week.

Also, the bank announced its partnership with The Clearing House Payments Company in the U.S. on October 9. The partnership would allow BMO’s U.S. customers to benefit from The Clearing House Payments Company’s real-time payments service. This deal is likely to make Bank of Montreal’s banking products more attractive for U.S. customers.

The ongoing trend in financials

The ongoing trend in Bank of Montreal’s financials remains mixed. Its interest income fell to $5.5 billion in fiscal Q3 2020 ended in July 2020 — much lower than $6.2 billion in the previous quarter and $6.7 billion a year ago. Its interest expense also fell to $2 billion in Q3 from $2.6 billion in the previous quarter. With this, its net interest income stood at $3.5 billion in the third quarter of fiscal 2020 — nearly flat on a sequential basis.

In Q3 2020, the bank’s adjusted net profit margin stood at 20.4%, with significant improvement from 12% in the previous quarter. But it was slightly lower as compared to the 22.9% adjusted net profit margin in Q3 2019.

In the first three quarters of fiscal 2020, BMO’s bottom line has dropped to $3.5 billion from $4.6 billion during the same period of fiscal 2019 – mainly due to COVID-19’s negative impact.

Is BMO stock worth buying right now?

Like most other Canadian banks like RBC and TD Bank, COVID-19 has badly affected Bank of Montreal’s core banking operations in recent quarters. In contrast, its net income from the capital markets segment has increased sharply. In the latest quarter, its net income from the segment rose by 36% year-over-year.

We shouldn’t forget that the prolonged pandemic is continuing to take a big toll on consumer sentiments and the jobs market. These factors point towards an upcoming economic slowdown, and a good recovery from this downturn may take many quarters — if not years. This is the reason why I’ve been arguing against buying any bank stock right now.

However, long-term investors who already own Bank of Montreal stock may continue to hold it as the economic crisis isn’t likely to affect the overall long-term return on investment for them.