There’s no question that small-cap TSX stocks can be some of the best investments. When companies first start out and are relatively small, there is huge potential for major growth. However, sometimes these smaller companies tend to fly under the radar for a few reasons.

Firstly, they are not as big as blue-chip stocks, for example, so they’re naturally not as popular. Small-cap stocks are also generally seen as higher risk. That’s just a general assumption, though, so if you do your homework, you’ll find many of these businesses are worth an investment.

When you can find these high-quality stocks while they are still lesser-known names, you have a great opportunity to gain exposure before the stock inevitably takes off.

That’s why in addition to high-quality blue-chip stocks acting as the core of your portfolio, you should also have some exposure to some of the highest potential small-cap stocks on the TSX.

Here are two such stocks to consider today.

TSX gold stock

During 2020 as volatility and uncertainty have been heating up, gold has been a top-performing asset. This has led gold stocks to be some of the top performers on the TSX.

One company, though, that’s been flying under the radar is GoldMoney Inc (TSX:XAU).

GoldMoney is not your typical gold stock. Almost every gold stock is usually either a gold miner or a royalty company that owns interests in several mines.

GoldMoney is a very different business. The company is a custodian for investors who want to own gold bullion. However, despite not producing and selling gold, the company still sees an increase in sales as the yellow metal becomes more popular.

When more investors want a safe haven in which to invest, GoldMoney provides the infrastructure allowing investors to buy large sums of physical gold while saving on massive premiums and significant storage charges.

This business continues to see the demand for its services grow, especially in these uncertain times, where governments and central banks continue to pump huge sums of money into financial systems.

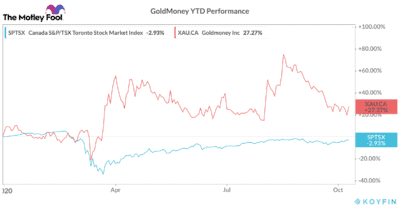

As you can see from the chart, GoldMoney’s stock has significantly outperformed the TSX so far year to date. Plus, as we enter the second wave and more economic carnage lingers, GoldMoney could continue to see new business as more and more investors look to safe havens like precious metals.

Winery stock

Another stock to consider is a small-cap wine producer with a huge share of the Canadian domestic market. Andrew Peller Ltd (TSX:ADW.A) is one of the stop small-cap TSX stocks flying under the radar, especially in this uncertain environment.

The company has had an interesting impact from the coronavirus pandemic. It’s lost a tonne of sales to restaurants; however, the retail side of the business has seen a major uptick since the pandemic began.

So while the stock initially sold off by 40% in the pandemic, and took a while to recover, it’s now back near its pre-pandemic levels.

Long term, Andrew Peller also has a lot going for it. The TSX stock has proven time and time again that it can grow the business. Whether it’s through numerous acquisitions, which have helped grow different brands, or through its organic growth efforts, introducing new items such as ciders and liqueurs.

Plus, the wine and beverage industry is a great industry for investment. It continues to grow and has shown through this pandemic just how resilient sales are.

So with all of Andrew Peller’s qualities and long-term growth potential, getting it today at a trailing price to earnings ratio of 18 times is a steal, especially when you consider the pandemic has impacted some of those earnings.

Bottom line

You always want to find high-quality TSX stocks before the rest of the market. However, when those under the radar stocks are small caps with huge growth potential, the upside possibilities could be massive.