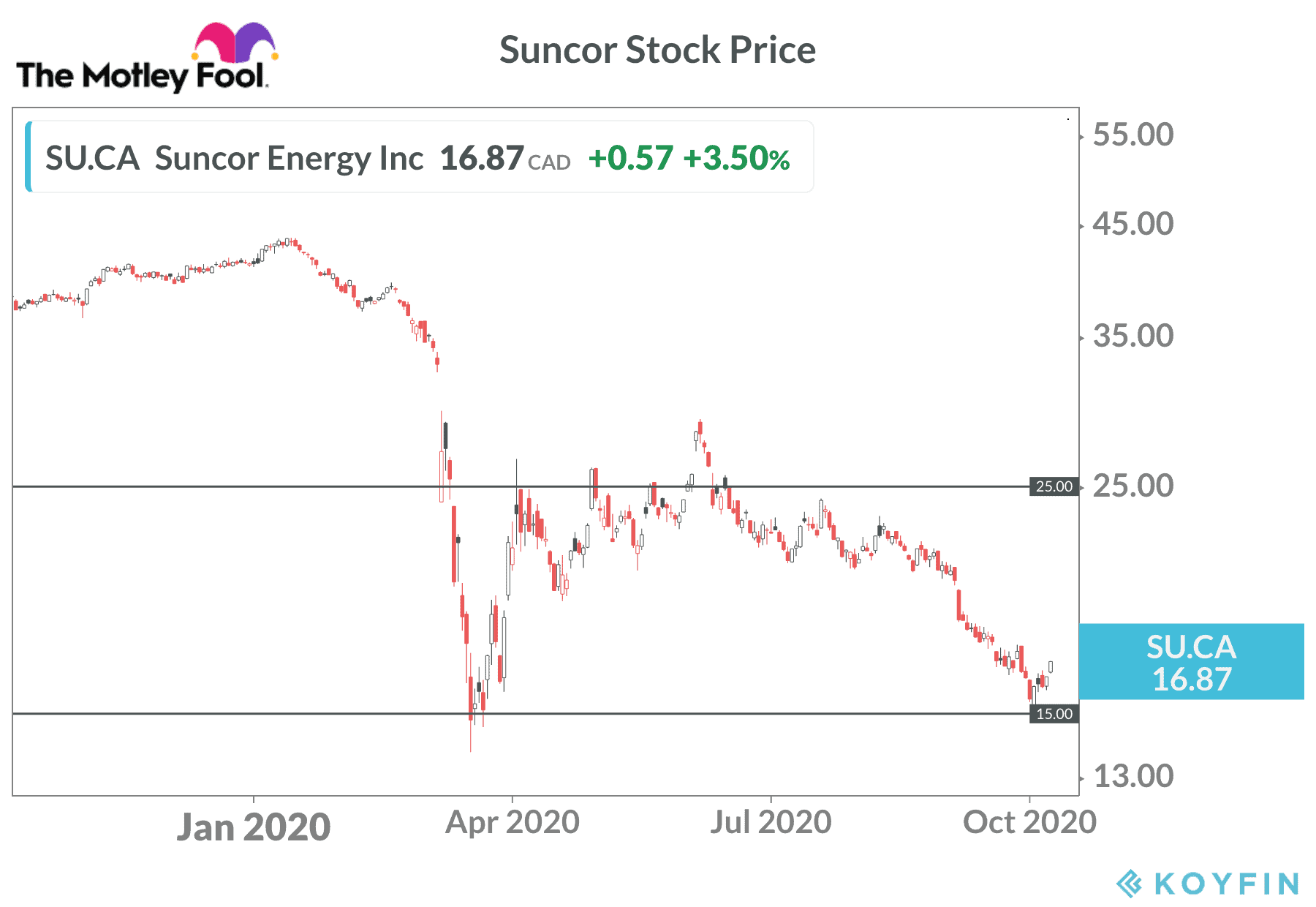

Suncor Energy (TSX:SU)(NYSE:SU) trades close to $17 per share compared to $42 at the beginning of the year. Contrarian investors now wonder if Suncor stock is simply too cheap to ignore.

Oil outlook

Suncor’s oil production business is its largest division. The company operates oil sands and offshore oil facilities that contain decades’ worth of resources. Suncor gets WTI pricing for most of its output due to its advantageous access to existing oil pipelines for the land-based production. Suncor receives Brent pricing for the offshore production.

The International Energy Agency (IEA) just released its 2020 world energy outlook. This annual report looks at anticipated trends in energy demand under various scenarios.

The IEA sees 2020 oil demand dropping 8% compared to last year. COVID-19 hammered the oil market and the impact is expected to continue well into the future.

The timeline and extent of the recovery depend on how quickly the global economy returns to strength. Policies targeting sustainable development also come into play. The IEA predicts oil demand will rebound to pre-crisis levels by the end of 2023, but the agency says demand could plateau in a decade based on existing government policies.

Annual oil consumption will increase by an average of 750 million barrels per day (bbl/d) through 2030. Emerging economies, including India and other developing nations, will lead the growth.

Despite the slow recovery in demand, the IEA expects oil to recover from US$40 today to US$75 per barrel. This should benefit Suncor and its stock price. Heavy investment is required to maintain production levels. The industry cut capital pending in 2020 by hundreds of billions of dollars and that could impact supply in the next few years.

The IEA says US$390 billion in investment per year will be required after 2030 just to offset the decline at existing production sites.

Bullish analysts predict a price spike back to US$100 or higher in the next five years. In that scenario, Suncor’s stock price would surge.

Is Suncor stock a safe bet today?

Suncor’s refining and retail operations took a hit along with the upstream assets in recent months. Fuel demand should bounce back once COVID-19 vaccines become widely available and travel restrictions ease. Plastics demand is expected to grow significantly in developing countries in the coming years. Oil is the feedstock used to make the products.

The board cut the dividend by 55% at the start of the pandemic to preserve cash flow. The new payout should be safe and provides a 5% yield right now.

Suncor’s operational breakeven sits around US$35 per barrel for WTI oil. The company plans to reduce staff by 10-15% in the next 18 months. In addition, Suncor continues to implement automation and other efficiency measures across the asset base to drive down costs.

Investors might want to start nibbling on Suncor stock today. Suncor bottomed out around $14 per share in March and traded as high as $28 in June, so there is decent upside when oil prices start to recover and the market gets bullish on energy.

Volatility is expected in the next few months, but buy-and-hold investors should see the stock price move meaningfully higher in the next five years. In the meantime, you get paid well to wait for the recovery.