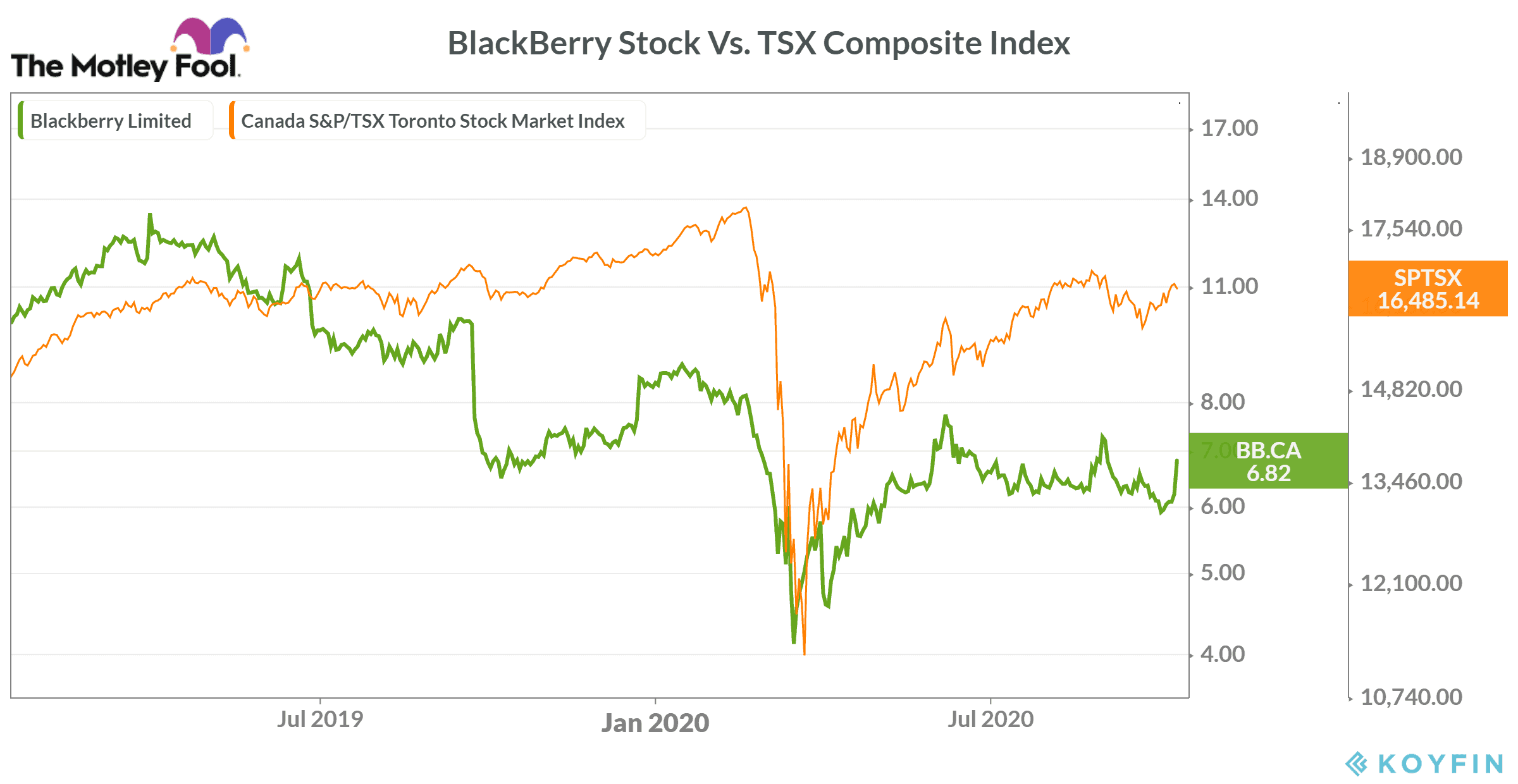

On Tuesday afternoon, the shares of Canadian tech giant BlackBerry (TSX:BB)(NYSE:BB) surged by over 10% compared to a 0.5% drop in the S&P/TSX Composite Index. This is the second week in a row that BlackBerry stock is witnessing solid gains after losing 7% in the week ended October 2. BlackBerry stock ended the last week with a 5% rise. However, the stock was still down by over 25% as of Monday.

Let’s explore what could be driving BB stock’s sharp rally today and whether the stock can sustain these gains.

Why BlackBerry stock rose today

At times you find the broader market or a particular stock rising or falling because of technical factors — without any strong fundamental reasons. It seems to be the case with BlackBerry stock today. The company neither released any noticeable update after October 8, nor would you find a piece of major news today that could fuel over 10% stock gains in a single day.

On the technical side, this morning, the stock violated a major resistance level near $6.30 per share. It is important to note that most big investors watch major technical levels closely. Violation of technical support and resistance levels reflect underlying weakness and strength in a particular stock’s trend, respectively. That’s why many hedge funds use these technical levels to refine their entry and exit from stocks.

BlackBerry stock is currently trading at $6.80 per share. This prior resistance level at $6.30 level is now likely to act as a major support area for the stock. It means that the stock could bounce back if it drops near this support level again.

The recent trend in BlackBerry’s financials

BlackBerry reported its mixed second quarter of fiscal 2021 results on September 24. These results didn’t impress investors as its stock remained slightly negative in the week ended September 25. Its second-quarter earnings showed minor improvements in its QNX segment due to the reopening of auto factories across North America after months of shutdowns — reflecting optimism.

In Q2, the company registered a 2% year over year rise in its sales to $266 million. It was also significantly higher as compared to $214 million in sales in the previous quarter.

Should you buy BB stock right now?

Despite gradual recovery in its overall sales, I don’t find BlackBerry stock very attractive due to its high reliability on the QNX segment. It may take many quarters or even over a year for its QNX segment sales to come back to pre-COVID levels as the global automakers are going through a tough phase at the moment. This view runs counter to BlackBerry’s management expectations. Its management expects the QNX run rate to return to normal by early next year.

While technically I find BlackBerry stock moderately positive, I still wouldn’t ignore its QNX segment-related risks. I expect these risks and challenges to hurt its Q3 earnings. I may keep the stock in my watch list and wait for a confirmation based on its real fundamentals. But I definitely wouldn’t buy it stocks here just because it’s rallying without any major fundamental support.