I want to start out by being clear. Right now, it’s a volatile market. There are a number of stocks out there with shares well below where they should be, but that doesn’t mean you should snatch them up in bulk. However, if you follow most Motley Fool advice, you’ll know by now that a long-term strategy is the way to go for stocks that are backed by a strong company.

That’s the same when considering high dividend yields. High dividend yields do not necessarily mean a strong company. A strong company doesn’t necessarily have a high dividend. So, you need to find those that fit right into the mould.

That’s why today, for those looking to buy a strong company and hold onto it for years, even decades, you can absolutely take advantage of a Enbridge (TSX:ENB)(NYSE:ENB) and its high dividend yield.

The business

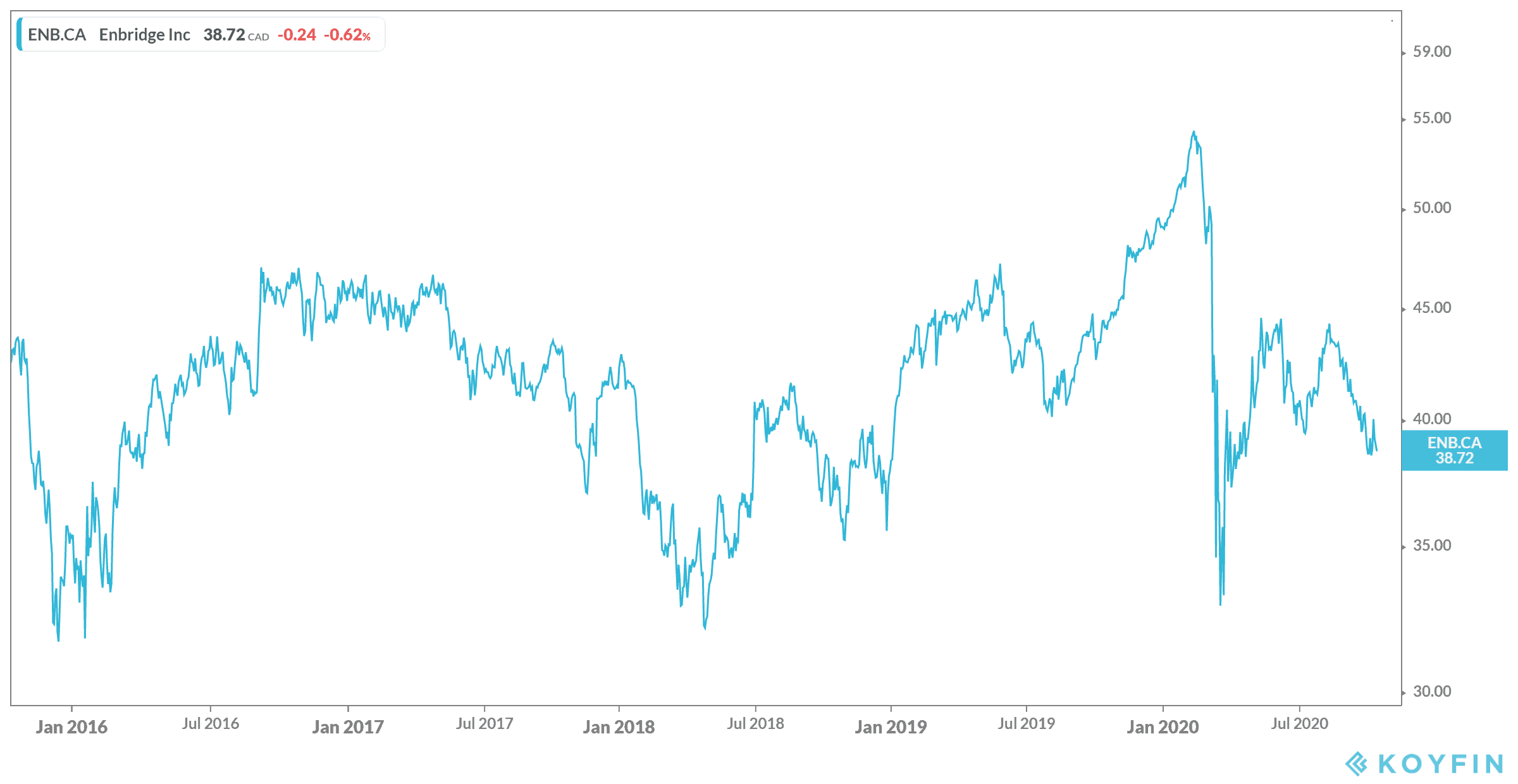

When you first look at Enbridge stock, I’ll be frank: its shares do not look all that impressive. In fact, if you had bought Enbridge stock five years ago, your shares will actually be down by 9.3% as of writing. But that doesn’t necessarily mean you should give up on this stock.

Enbridge focuses on creating and running pipelines across North America. Its business is solid, with long-term contracts that will continue to support the company’s bottom line for several decades. That part of the business means it can also secure its dividend, which is a whopping 8.3% as of writing. Before the crash, it hovered in the 5% range.

Beyond its current business, the company has a number of growth projects in the works. In fact, it’s one of the few pipeline companies that’s gotten the green light for building. It’s had to jump over societal barriers, environmental barriers, and come out the other end strong. Other pipelines will have to follow the lead of Enbridge if they hope to create those pipelines. When all of those pipelines are up and running, Enbridge stock should soar back to normal, and beyond.

The future

The company is going to provide the solution to the oil and gas glut in the west. Once crude is running through pipelines again, Enbridge stock is going to soar to heights not seen in years. However, there is one problem for long-term investors, and that’s renewable energy.

On the one hand, it’s going to take decades for the world to be completely free of oil and gas. Look at coal as an example. One hundred years ago, coal was still a primary source of energy. Today, it’s rarely used, especially in the Western world. But it’s still used in a number of countries, showing just how long it can take to move away from energy resources.

But on the other hand, companies that are mainly oil and gas based simply won’t get the investment they once did. Investors will be looking for renewable energy companies to provide new money. Governments will want to support renewable energy more and more, as it becomes the way of the future. That means Enbridge may have a few decades, but perhaps not beyond that.

That being said, pipelines will likely be the last ones out, given that you don’t need trains, planes, or trucks to ship oil and gas, and the infrastructure will be there for a long time.

The dividend

As I mentioned, Enbridge stock has a dividend yield of 8.3%. It hasn’t made any cuts to that dividend yield, despite the fluctuation in its share price. And again, that’s because of its solid business plan. If you’re looking for a company that can provide you with a solid dividend now and years from now, you definitely should go with Enbridge.

That’s especially during this downturn. Enbridge will make a comeback. Its dividend will continue to grow. You can be sure of that for at least another decade. So, if you need some extra cash, Enbridge stock is definitely the way to go.