There are a number of ways to receive income when you retire. Historically, Canadians have used the Canada Pension Plan (CPP), Old Age Security (OAS) and Registered Retirement Savings Plan (RRSP) when starting to retire. Each offers a way to take out cash and bundle it together to get through retirement.

But you’ll notice, each of these options is subject to tax from the Canada Revenue Agency (CRA). But don’t worry! There are options you can take to put aside money for retirement, tax free. Of course, I’m talking about the Tax-Free Savings Account (TFSA).

Since its inception in 2009, the TFSA has added on thousands of dollars in contribution room each year. As of writing, the total contribution room available to Canadians is $69,500. While I wouldn’t suggest putting everything you have in one stock, if you and a partner have contribution room, you could certainly partner up and put aside $60,000 in one company.

Suddenly, you have $60,000 set aside for retirement, tax free. Now, all you need is the right company. What you need to look for are blue-chip companies. These companies usually offer strong dividends, a solid business plan, stable growth, and a strong future outlook.

Fortis

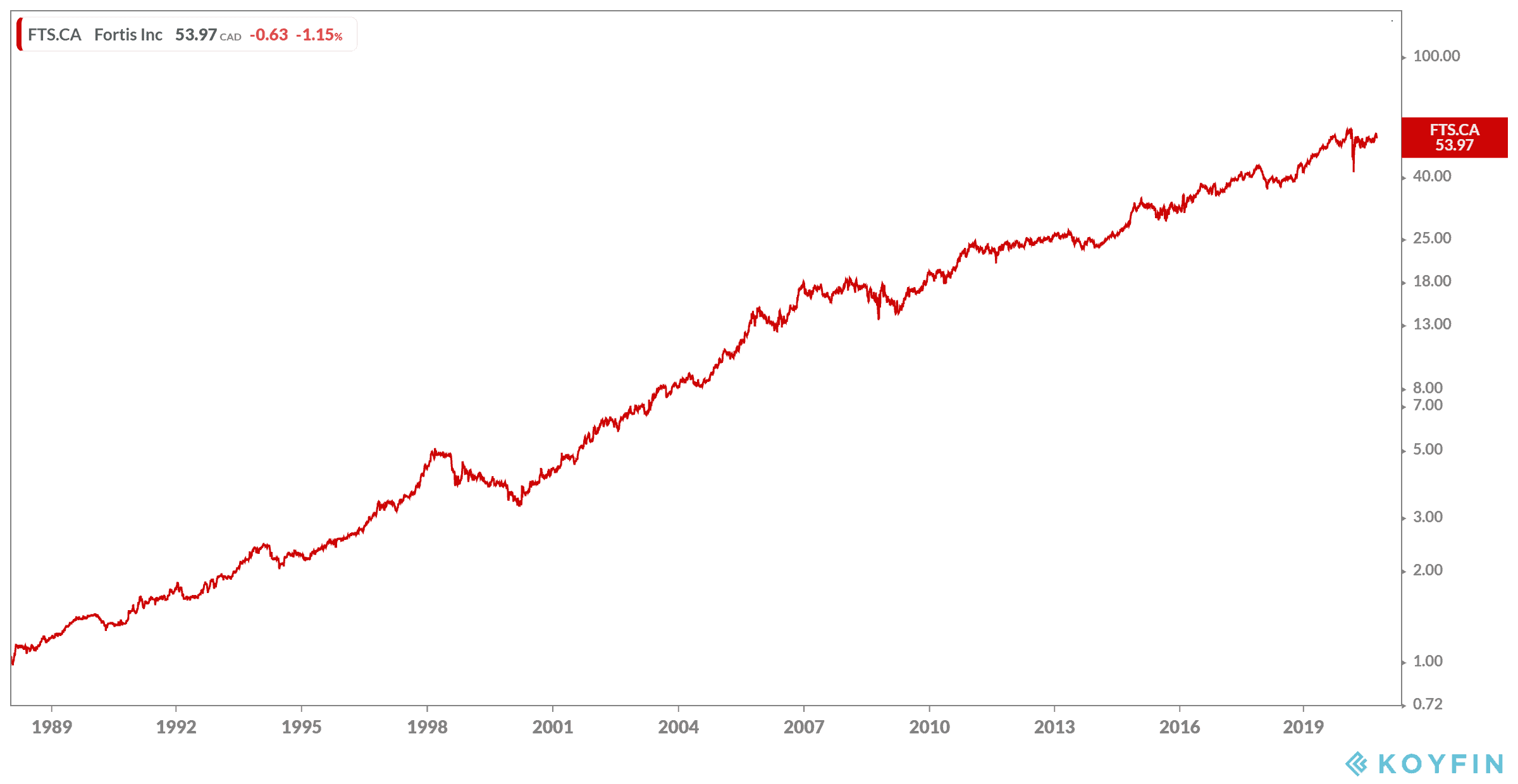

Fortis Inc. (TSX:FTS)(NYSE:FTS) is an ideal choice in this regard. The company is an electric and gas utility company that operates throughout North America, distributing energy to millions of customers. And that’s the thing with utilities, we need them. No matter what, you need to keep the lights on, which is what makes Fortis so strong.

Even during the economic downturn, Fortis continues to grow through acquisition. But the company has plans far beyond that. It’s now looking to start reducing its carbon footprint, and that means getting out of gas. This would make sense, as the world over is getting away from fossil fuels. Governments continue to pour money into renewable energy programs, so Fortis would of course follow suit.

Bottom line

If you want a strong stock that’ll see you through thick and thin in retirement, you want a stock like Fortis. Stable, strong future potential, and with solid dividends. The best part? Putting this in a TFSA means all of these returns can be taken out tax free — Take that, CRA!