It’s amazing how stocks from a seemingly lazy railway transport industry can produce phenomenal long-term investment returns. Canadian National Railway (TSX:CNR)(NYSE:CNI) and Canadian Pacific Railway (TSX:CP)(NYSE:CP) are two reliable and steady growth stocks. Young investors can stash CN Rail stock and its peer in their Tax-Free Savings Accounts (TFSAs) as core holdings and still enjoy respectable and steady equity returns.

Why invest in CN Railway and CP Railway stocks?

Railroad operators like CN rail are natural monopolies with permanent moats and very little competition. A country or region can only accommodate one or two of them. Only a limited number of railroad companies can run the business efficiently in one given jurisdiction. Further, heavy initial start-up costs significantly deter any potential competitors from thinking about entering the industry.

The duopoly of the Canadian National Railway and Canadian Pacific Railway in Canada is there to stay for decades to come. Of course, the closest competition could come from cheaper driverless trucks and new oil pipelines. However, given today’s technology, none of the competing offerings could move bulky industrial goods, heavy mine production, and grains from coast to coast and connect Canada to the Gulf of Mexico at cheaper rates per tonne mile than the railway lines.

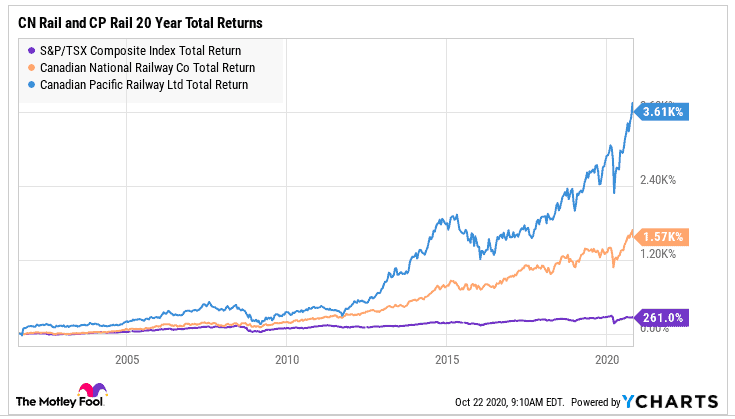

Investment returns on the two rail stocks have been phenomenal over the past two decades.

Investors in CNR stock and CP rail stock have generated enormous returns over the past two decades. A 3,610% total return on CP Rail stock is no joke, and the 1,570% total return on CN rail stock is more than enough capital appreciation in a retirement account.

The two railway stocks could continue to produce steady, market-beating returns in the future. Allow me to briefly discuss the opportunity at Canadian National Railway stock today.

Why buy CN Rail stock after Q3 results?

Canadian National Railway is the largest of the two railway operators. The COVID-19 pandemic had a negative impact on the business, but revenue for the first nine months of 2020 down by just over 10% on a year-over-year basis to $10.16 billion.

The company is experiencing a V-shaped recovery in cargo volumes. It saw a sequential recovery in month-over-month business volumes during the third quarter. Monthly cargo volumes have since exceeded their 2019 levels by October 20. This speaks to a resilient business. Record Canadian grain volumes and above average U.S. grain shipments helped cover the void left by declining oil shipments.

It’s entertaining to see an old railway company utilizing modern robotic process automation of everyday tasks and use machine learning and artificial intelligence (AI) to improve its critical business processes, like track inspections. The old railroad industry is catching up with tech trends and is getting transformed along with the entire economy.

CN Rail is modernizing its operations and the company has seen improving efficiency ratios over recent years. In turn, margins are improving and free cash flow generation capacity is getting better.

Watch CNR’s surging cash flow

Even though Canadian National Railway’s revenue was 10% lower during the first nine months of 2020, the company still saved $35 million in fuel expenses and saw free cash flow generated during the period increased 39% year over year to $2.1 billion. Management expects free cash flow to hit the $2.5 billion mark by end of this year.

What could CNR do with all that liquidity?

There are many progressive things management could do with the increasing free cash flow. The company could reinvest in modernizing its business, pay down debt, repurchase its stock, and keep increasing its dividend to shareholders. All these moves should improve CN Rail stock’s valuation over time.

Foolish bottom line

CNR is an ever-improving business. I would expect a steady share price growth on CNR stock over the next two decades. The company’s president and CEO Jean-Jacques Ruest said during an earnings call on October 20, “CN is about the long term. CN is about sustainable profitable growth.” I am a believer.

TFSA investors could do well to stash CNR stock as a core holding in their portfolios.