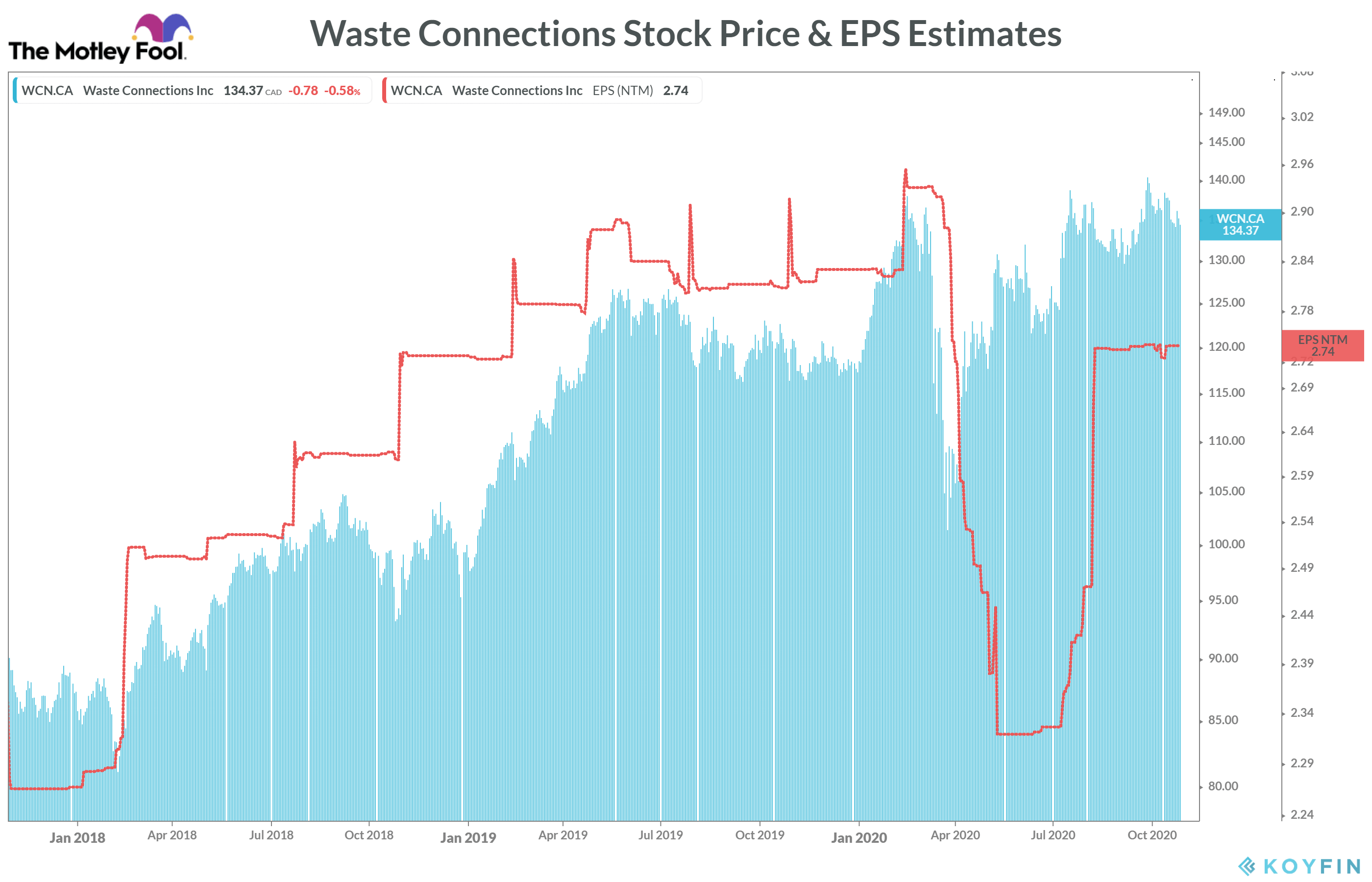

Waste Connections (TSX:WCN)(NYSE:WCN) — the Canadian integrated based services company — will release its third-quarter earnings later this week on October 28. While its stock has remained largely range bound for the last three months, it is still trading in the positive territory on a year-to-date basis. As of October 26, Waste Connections stock has risen by 15.4% compared to a 4.5% drop in the S&P/TSX Composite Index in 2020 so far.

COVID-19 headwinds have badly damaged many companies’ future growth prospects — triggering a sell-off in their stocks. However, these costs might not have a very long-lasting impact on Waste Connections’s financials and long-term growth. That’s why it could be a great stock to buy right now.

Let’s take a closer look at its recent financials and Bay Street analysts’ consensus estimates for Waste Connections’s upcoming earnings.

The trend in Waste Connections’s recent financials

In the second quarter, Waste Connections posted EPS of US$0.60 — down 7.7% from US$0.65 in the previous quarter. It was also 13% worse from the earnings of US$0.69 per share in the same quarter of 2019. Nonetheless, the company’s Q2 EPS figure was better as compared to analysts’ EPS estimate of US$0.55. The company’s earnings went up by 4.8% on a year-over-year (YoY) basis in the previous quarter.

During the quarter, its revenue fell by 3.4% sequentially and 4.7% on a YoY basis to US$1.31 billion. But it was slightly better as compared to analysts’ consensus revenue expectation of US$1.30 billion. In Q2, Waste Connections had to bear significant over $20 million COVID-19-related costs, hurting its overall financial performance.

No major change in 2020 outlook

Despite the pandemic-related headwinds, Waste Connections’s management largely maintained its full-year outlook. The company expects its 2020 revenue to be around US$5.33 billion — slightly lower from US$5.39 billion in 2019.

On the positive side, the management expects Waste Communications to report 50% to 52% adjusted EBIDTA margin in 2020 — significantly higher from about 31.1% in 2019.

Analysts’ estimates and ratings

Analysts expect Waste Connections to report $0.60 earnings per share in the third quarter — down 12.4% YoY. They estimate its revenue to be 3.1% lower on a YoY basis but improve on a sequential basis.

Currently, about 75% of analysts covering Waste Connections stock suggest a “buy.” About 25% of these analysts recommend “hold” on the stock, and no analyst is recommending a “sell.” Bay Street analysts’ consensus target price for the stock is $124.47, which is already about 8.5% lower from its Friday closing price of $136.90.

Why the stock could rally after its Q3 earnings

I expect Waste Connections to report better-than-expected earnings in Q3, as the pandemic-related restriction significantly eased off in the last few months. Despite continued incremental costs related to COVID-19 measures, the company may report good improvement in its total revenue and profitability in the next few quarters.

Interestingly, Waste Connections stock has yielded handsome positive returns in eight out of the last 10 years. Its stable business model that remains nearly unaffected by an economic downturn should keep its stock positive in the medium to long term.