Corus Entertainment (TSX:CJR.B) reported its Q4 of the fiscal year 2020 earnings on Thursday last week. The event fueled a massive price rally in its stock, as it rose by 7.6% for the day. The rally extended the coming days, and the stock has seen over 24% in the last five days. Before we take a closer look at some reasons for investors’ optimism in detail, let’s quickly look at some key points from Corus Entertainment’s Q4 earnings report.

Corus Entertainment’s Q4 earnings beat

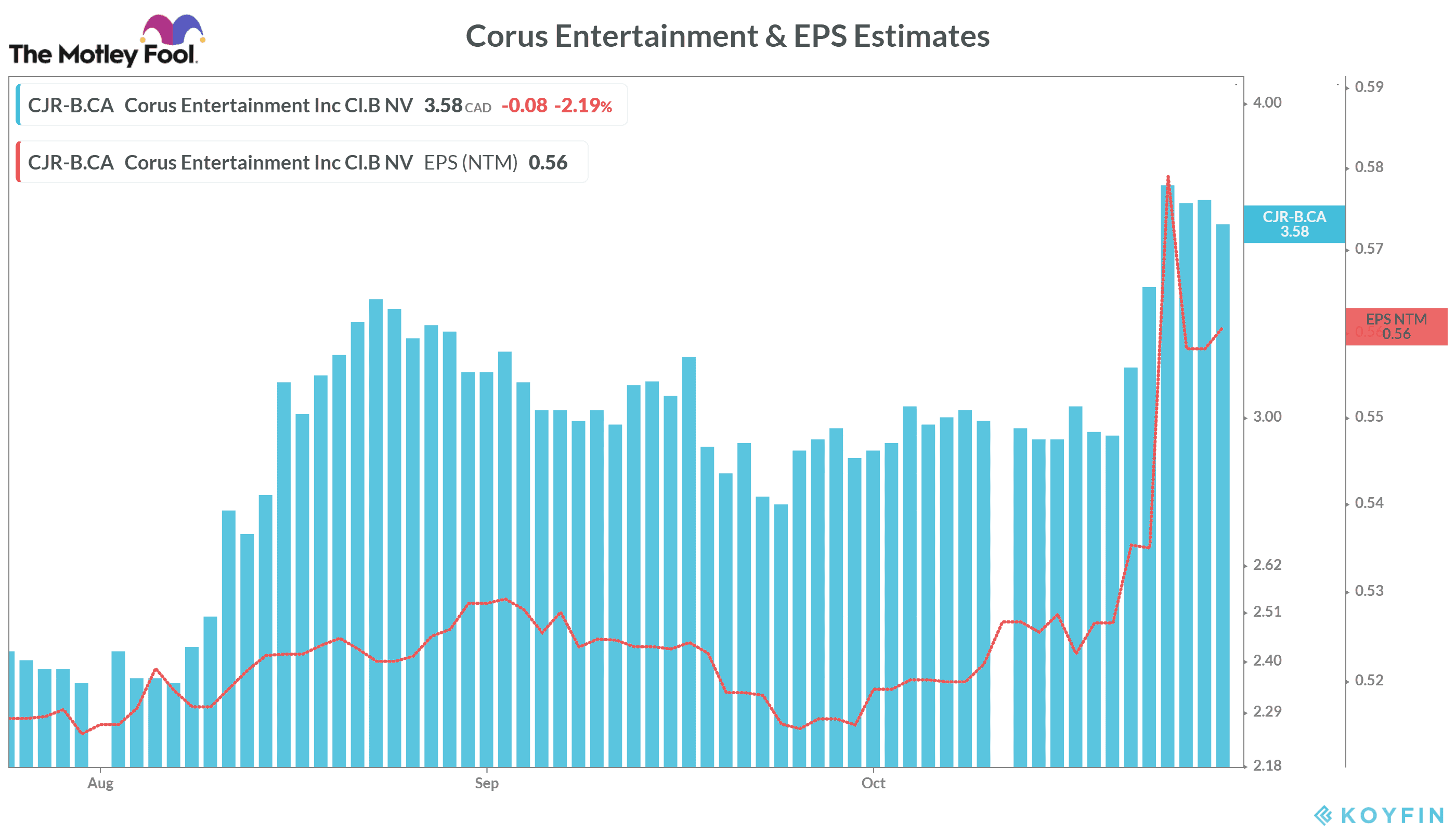

In Q4, Corus Entertainment posted earnings per share of $0.16, up 77.8% from $0.09 in the previous quarter. It was also 23.1% better than the EPS of $0.13 in the same quarter of the last year. Corus Entertainment’s Q4 EPS figure was better than Bay Street analysts’ EPS estimate of $0.06 for Q4 of 2020.

Previously in the quarter ended in May 2020, the company’s earnings per share declined — at a comparatively higher pace – by 71% on a year-over-year (YoY) basis.

Lower revenue and operating expenses

In the fourth quarter, Corus Entertainment reported revenue of $318.4 million — down 8.8% sequentially. It was also 15.7% lower than the revenue of $377.5 in the same period of the last fiscal year. Its revenue was worse than Bay Street analysts’ consensus revenue expectation of $319.3 million for Q4. Previously in the quarter ended in May 2020, the company’s total sales fell — at a comparatively higher pace — by 23.9% on a YoY basis.

On the positive side, Corus also reported a decline in its operating expenses. Its operating expenses of $272 million fell by 1.8% sequentially. It was also 19.2% lower than the operating expenses of $336.7 in the fourth quarter of the previous year.

Significant rise in profitability

In the fourth quarter of 2020, Corus Entertainment posted an adjusted EBITDA of $94.5 million — better than analysts’ consensus EBITDA estimate of $90.82 million for Q4 of 2020. Its adjusted net profit also jumped up by 74.7% sequentially to $33.18 million during the quarter. It was the 10th consecutive quarter when the company’s net profit grew sequentially.

In Q4 2020, Corus Entertainment posted an adjusted net profit margin of 10.42% — up by 4.98 percentage points from 5.44% in the third quarter. It was the seventh quarter in a row when its net profit margin went up on a YoY basis — reflecting strength in its fundamentals, despite the ongoing pandemic.

Improving advertising demand

In the fourth quarter, Corus Entertainment saw an improvement in its TV advertising demand on a sequential basis. The management expects this improvement to continue in the coming quarters. During its latest earnings conference call, the company’s CFO highlighted that the plan to “increase revenue from advanced advertising as a percent of TV advertising revenue as well as advertising revenue from new platforms.”

Foolish takeaway

After facing a massive over 50% losses in the first quarter, Corus Entertainment stock is of a sharp recovery. Given its rising profitability, declining operating expenses, and solid outlook, you may want to include this under-$4 stock in your stock portfolio.