The Canadian marijuana market continues to evolve in 2020. National recreational sales are growing at a rapid pace across the country with August cannabis retail sales reaching the $244.9 million mark, up 94% year over year.

However, most investors in marijuana stocks are sitting on steep capital losses, as the major cannabis market players, including Canopy Growth (TSX:WEED)(NYSE:CGC), Aphria (TSX:APHA)(NASDAQ:APHA), and Aurora Cannabis (TSX:ACB)(NYSE:ACB), struggle to impress a disappointed investor community.

Most of the challenges facing the nascent cannabis industry have to do with its evolving market structure. They include fast-growing rivalry among incumbents, a rapid influx of new entrants, strong bargaining power of a few buyers, and the threat of close substitutes from a resilient illicit market. I will briefly touch on these four items.

An influx of new market entrants

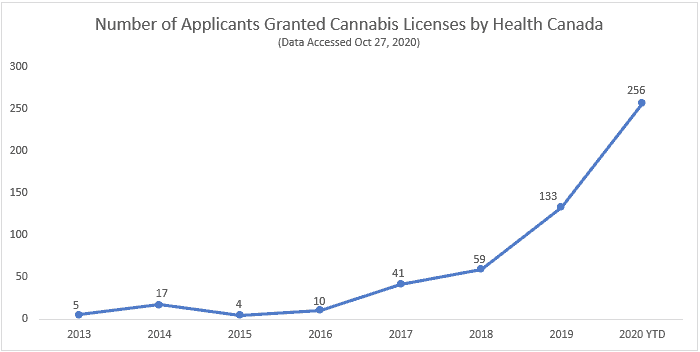

The threat of new competitive entrants significantly impacts industry profitability. There’s an ongoing influx of new players into the Canadian marijuana market.

Health Canada is flooding the marijuana industry with new market entrants right now. The number of applicants that have received licences rose to 525 by October 27, up from 269 at the end of 2019. Nearly half (48.8%) of total cannabis business licence holders since 2013 were granted their licences within the first 10 months of this year. That’s quite a number.

A sudden influx of new entrants into the game exerts pressure on incumbent players. A significant number of new licensees target micro-cultivation and the medical cannabis market. This was a key segment where healthy gross margins remained after price wars eroded margins in the adult-use dry flower market.

Medical marijuana margins will most likely shrink in the coming months, as new players promote new products to gain market share. The vapes and edibles segment could see price wars too, as new players disrupt the game.

Strong bargaining power of cannabis buyers

Due to regulatory design, the Canadian cannabis market is heavily controlled by a few large institutional buyers who control pricing. The provinces hold the clout in this industry. They are at times the sole wholesale buyer of the product.

Although Alberta, Ontario, and the Yukon somehow opened up the retail space to free-market players, (with strict licensing requirements), online stores remain the preserve of provincial bodies in most instances.

A few large buyers aren’t the best recipe for success in any market set-up. They can bargain competitively and chew up manufacturing margins from licensed producers.

Most noteworthy, I don’t like it when over 80 sellers try bargaining with just one buyer at any one time. Such is the case in Ontario. Worse still, the province is on a campaign to outmaneuver the illicit marijuana market in a price war. The Ontario Cannabis Store managed to undercut the illegal market price points for the first time ever recently.

The point is, the government has the pricing power, and producers are price takers. They have little influence on margins besides lowering production costs. Yet they still need to pay licensing costs and incur significant regulatory compliance expenses. Profitability may remain a pipedream for some.

Cheap substitutes from illicit market dealers

As mentioned above, for the first time ever in Ontario, consumers could buy legal cannabis products at a lower price than the illegal market in October 2020. Law enforcement has been vigilant in fighting the illicit pot market after seizing over $143 million worth of inventory recently.

However, the real threat to industry margins still remains. Illegal players have lower operating expenses, and they will remain a threat to industry pricing power and margins for decades. Licensed pot companies will remain mindful of this threat and will keep prices low enough to remain competitive.

Growing industry rivalry

Price competition is a deadly game in any industry. Yet cannabis players enjoy undercutting each other right now. Some will say HEXO started it. Yes, it needed volume growth to survive. Aurora followed, it had the same target. Almost everyone has a value brand now, and average prices keep falling. Margins are being thrown out the window.

Will the intense rivalry ever stop? I wouldn’t know, but the whole industry may continue to feel the pain of low margins for a long time.