The COVID-19 pandemic unleashed a $100 billion market capitalization for Shopify (TSX:SHOP)(NYSE:SHOP). The stock’s valuation boosted from less than $50 billion in March to $157 billion in October. While the overall market expectations and fundamentals are positive for Shopify, its steep stock price rally has divided investors on the magnitude of growth. A stock’s price reflects investors’ expectations of the company’s earnings potential.

Investors are divided over Shopify stock

Bulls believe that Shopify stock, trading at 80 times its sales per share, has the potential to grow further. Their expectations are fueled by its more than 95% year over year (YoY) revenue growth for two straight quarters. Bears believe that Shopify does have strong growth potential, but the 95% revenue growth is not sustainable for over a year. Moreover, the company refused to provide guidance amid the pandemic uncertainty, which makes bears uncomfortable.

Should you buy Shopify at its current dip below $1,300? Consider these bulls and bears before making a decision.

The bullish case of Shopify

Shopify platform is sticky because of its flywheel concept where the company prospers when its merchants and partners prosper. In 2019, 44% more merchants achieved over $1 million in gross merchandise volume on the Shopify platform than the previous year. The pandemic accelerated its flywheel, and Shopify introduced various payments, marketing, operational features to help merchants of all sizes boost their revenue.

The first step is to get discovered online, for which the company added various themes to its Shopify Plus platform. The next step is to make those customers keep coming. For that, it’s using email marketing and social commerce. Consumers can shop and look at suggestions while socializing through Facebook, Instagram, and TikTok. It is also beta testing social commerce on Google’s YouTube.

The third step is fast and easy checkout. For that, Shopify is offering flexible payment options like Shop Pay, a buy-now-pay-later option, and Shop App. It is also planning to venture into retail POS (point of sales). Instead of just sticking to online, it wants to tap the checkout at merchants’ physical stores as well.

The final step in the flywheel is fast and affordable order fulfillment. Shopify gives merchants various options to either ship the order or offers curbside or in-store pickup. It is also investing in its fulfillment network that will cater to merchants of all sizes and reduce the cost of shipping the order.

Shopify is looking to go international by making its platform available in 20 languages and Shopify Payments available in 17 countries. It now has to work out the order fulfillment by expanding its sales channel. The plan looks like the next Amazon is in the making. For this level of growth, $1,300 may seem like a good deal.

The bearish case of Shopify

Shopify’s growth will normalize in the long term. The bulls rule out competition risk. Shopify is the second-largest e-commerce platform after Amazon. But its 95% revenue growth has encouraged retail and tech giants to jump into e-commerce. There is also a risk that the pandemic-driven growth could ease next year. This could pull down the stock in the short term.

Shopify has raised its cash reserve to $6.1 billion, which gives it the financial flexibility to handle a significant surge or drop in revenue. With this money, it can continue on its long-term average annual growth rate of 50%.

What should you do?

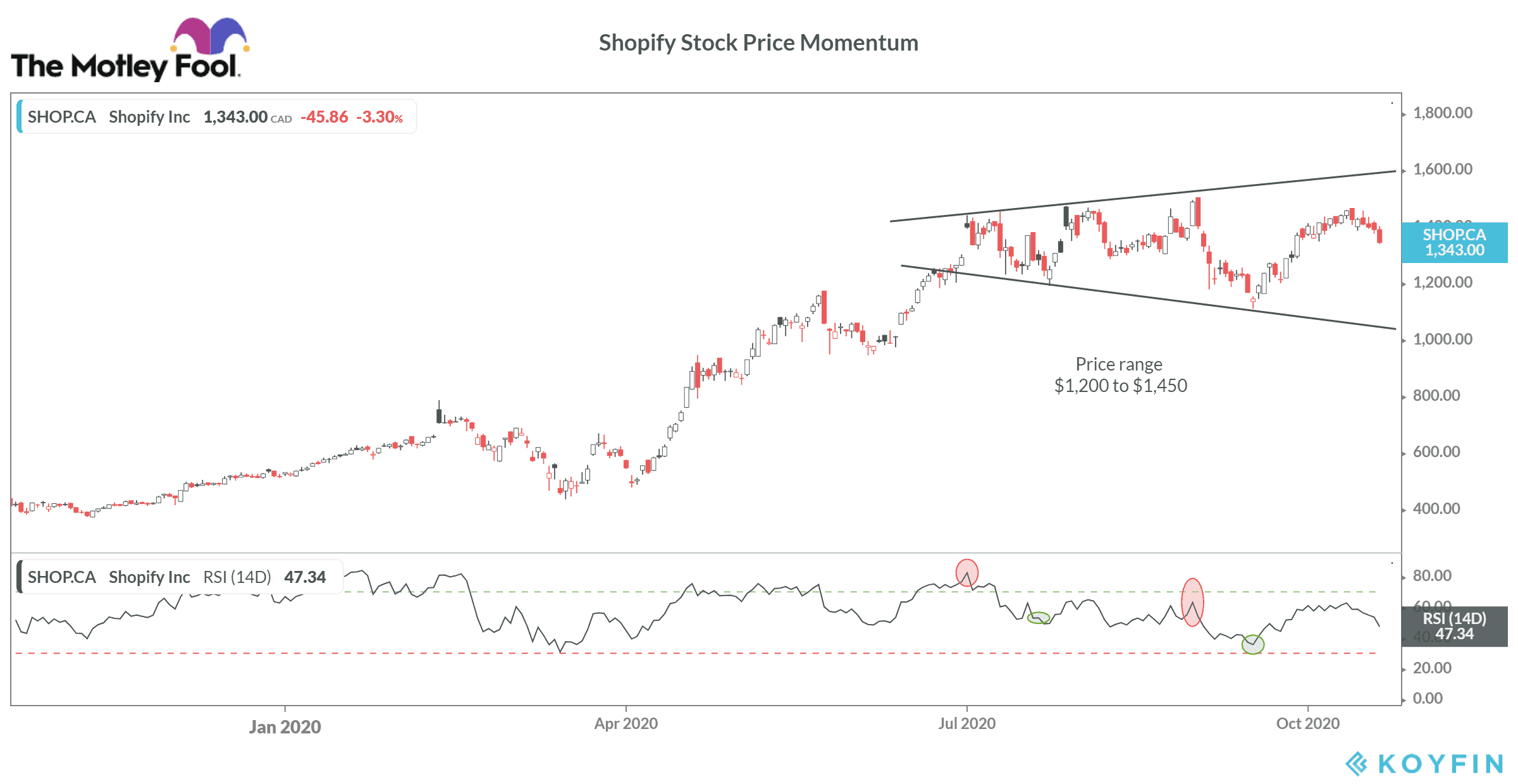

The high valuation of Shopify has made the stock risky. The tug of war between the bulls and bears will keep the stock in the $1,200-$1,450 price range. The stock will find support at $1,000 when bears are strong. In the short term, you can benefit from this volatility by buying at $1,200 and selling at $1,450. This represents a 21% upside.

If you have purchased Shopify stock at or below $1,000, hold it for the long term, as it has the potential to grow. If you are planning to buy the stock now for the long term, any price above $1,300 might not be attractive. Once the pandemic-driven growth fades and the stock corrects, buy it at that time, as it will return to its normal momentum.