Today’s volatile market is likely to be here for quite some time. In fact, it could be years before there is a consistent rebound. Even if a vaccine is created and distributed, it will take more than just a vaccine to return the economy to normal. But that being said, there are still TSX stocks that provide a defence for investors.

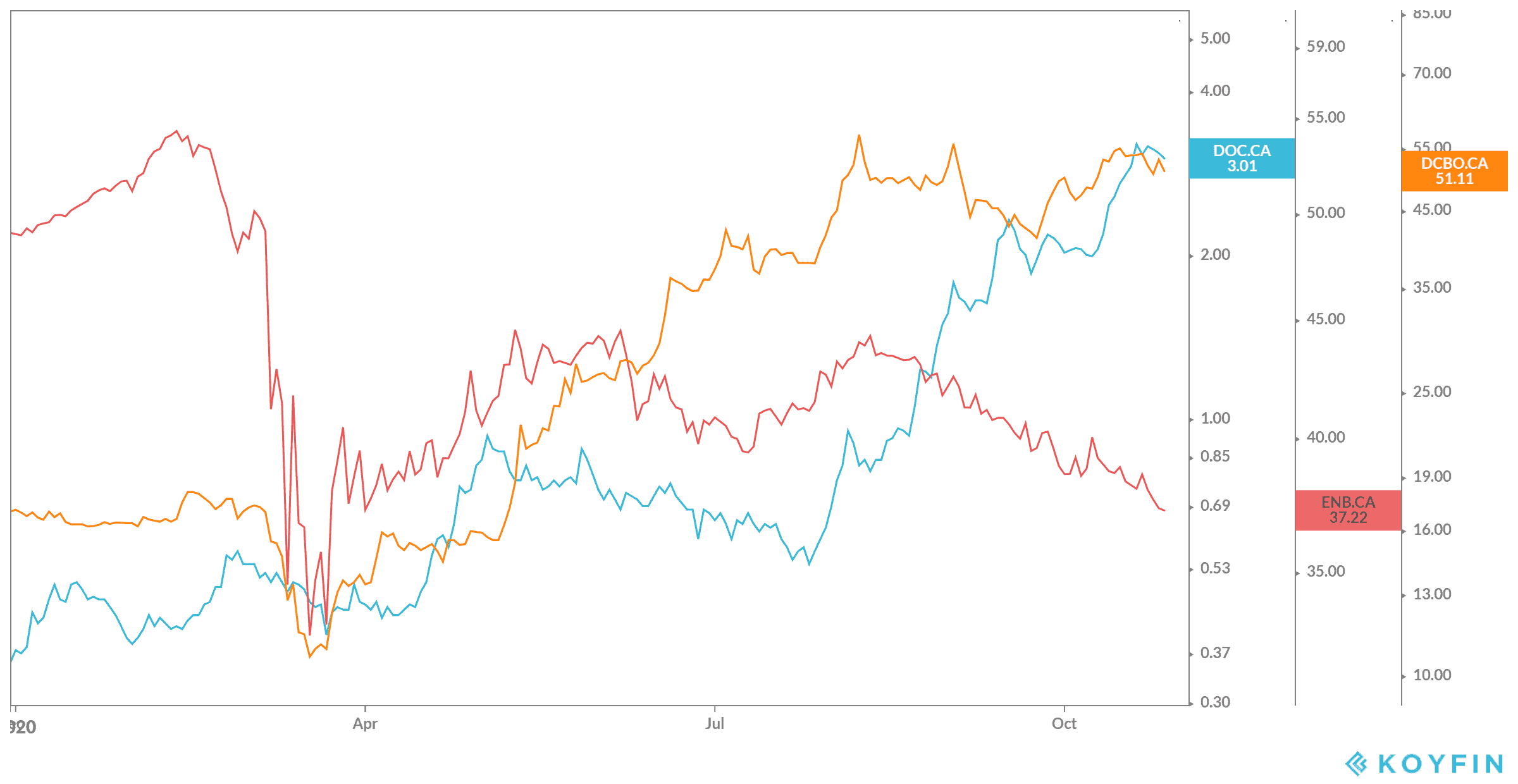

If you have a Tax-Free Savings Account (TFSA), you already have the top choice in your arsenal. All you need now are solid TSX stocks that can see you through this downturn and for years to come. In my opinion, those choices right now have to be Enbridge (TSX:ENB)(NYSE:ENB), Docebo (TSX:DCBO), and CloudMD Software & Services (TSXV:DOC).

Enbridge

Enbridge

The tides are changing when it comes to pipelines, so investors should be wary. If you’re looking to hold onto pipelines for another 30 or 40 years, then Enbridge might not be your best option. That’s because more and more investment is turning towards renewable energy. So, oil and gas and the pipelines that ship them could go the way of coal.

However, if you’re looking to make some cash in the next decade or two, Enbridge is the perfect stock. The company has been beaten down due to the oil and gas crisis, and unfairly so.

Enbridge provides the solution to the gas glut: pipelines. It is in growth mode with several projects about to come online. It could be the saviour the Canadian oil sands needs in this next decade. Meanwhile, it has a solid 8.69% dividend yield supported by decades of long-term contracts! So, you get an undervalued stock with huge dividends as a reward for your patience.

Docebo

Now, if you’re looking for a company to continue rising in share price throughout the downturn, Docebo is your top choice. The company came on the scene at the perfect time, right before the pandemic. Now, the company’s learning management system is exactly what every business around the world desperately needs.

During Docebo’s second quarter, the company saw year-over-year revenue growth of 46.5%, while subscription revenue grew by 55.1%! Meanwhile, investors who got in on the ground floor have seen returns of 272% as of writing. But it’s likely this company is only getting started, as large enterprises continue to sign on.

CloudMD

Finally, CloudMD is another company that came along at the right time. Virtual doctors have become a staple in today’s pandemic world. CloudMD is now in acquisition mode, buying up as many of these virtual doctors as it can to create a powerhouse of online medical advice. The goal is to provide patients with “all points of care” from their phone, tablet, or computer.

The company is up a whopping 622.89% since its initial public offering but is still an incredibly cheap stock. With a market capitalization $406 million, the company has a ton of room to grow into a market leader in virtual medicine. Investors could quickly see their investments double in the next few years, pandemic or no.

Bottom line

All three of these stocks provide the perfect portfolio of TSX stocks for TFSA investors. The main attraction is that each is financially viable with plenty of room to grow, both in revenue and returns, for decades to come. As always, the Motley Fool recommends you hold onto stocks like these for the long term. So, see yourself through this pandemic and well beyond.