CGI Group Inc. (TSX:GIB.A)(NYSE:GIB) stock is one of Canada’s leading technology stocks. Since 1976, it has grown into one of the largest IT and business consulting services firms in the world. But lately, CGI stock has been weak.

Here are the reasons I believe this weakness is a strong buying opportunity.

Riding the technology secular trend higher

A secular trend is a trend that remains consistent over time. It is usually a trend that lasts five or more years. A cyclical trend, on the other hand, is a trend that follows a short term cycle. Commodity sectors are good examples of cyclical trends. They are much more volatile, as they have booming periods followed by down periods.

CGI Group is helping its clients enter the new digital world. Its services are helping its clients reduce costs and increase revenue. The digitization movement has been accelerated. The initial response to the pandemic was business preservation. Companies were looking to advance their digital strategies to ensure continuity of business and ultimately survival. Long-term, the focus is shifting to using digital strategies to further increase efficiencies and reduce costs.

The digitization of all industries was already under way before the coronavirus hit. Now, it is in full swing. But this movement is still in relatively early stages — a secular trend will drive CGI Group stock higher for years to come. The goal of industries everywhere is to use technology to thrive in the new post-coronavirus world.

CGI Group stock has fallen in 2020, giving way to a strong buying opportunity today

In 2020, CGI Group stock has fallen 18%. It is kind of a surprising move, as CGI is helping businesses survive and thrive in this new world where digitization is key. But to understand this better, let’s dig deeper. CGI Group is a $19.7 billion behemoth who services a diversified list of clients. From governments to companies from a variety of different sectors, CGI is extensively involved in the technology movement.

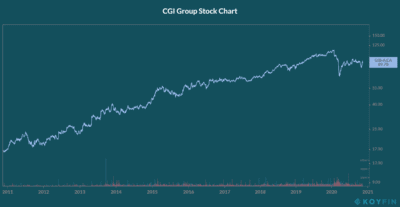

Here is a price graph of CGI Group stock over the last decade. This price graph is the perfect illustration of what being in a secular growth market will do to your stock price.

Other than the downward blip in March 2020, CGI Group stock has been on a consistent upward rise.

CGI Group: the future looks bright for this tech stock

Moving on to the outlook for CGI, the company still expects to double the size of the company in the next five to seven years. The path there will be, as usual for CGI, through organic growth and acquisitions.

CGI has maintained a stellar balance sheet throughout its history. And strong quarterly cash from operations continues to build on that. Management articulated on the call that the time for them to make an acquisition is fast approaching. CGI Group has $1.7 billion of cash on hand and a $1.5 billion revolver. Cash from operations was $492 million in the quarter and $1.9 billion for the full fiscal year 2020.

Motley Fool: the bottom line

CGI Group stock presents us with a positive opportunity today. Recent share price weakness has given us a good entry point to participate in the secular trend with this technology giant. CGI Group stock is a tech stock to buy today for its record of consistent shareholder value creation.