The Tax-Free Savings Account (TFSA) is the easiest way Canadians can save and make a lot of money. And when I say a lot, I mean a lot. Yet still, only about half of Canadians have a TFSA. And even fewer are using it properly. While you should always try to max out on contributions, even just $5,000 could get you far.

How it works

Since 2009, the Canadian government has added on thousands in contribution room for the TFSA. As of writing, Canadians have $69,500 worth of contribution room to invest in. That’s quite a lot of room to invest in; however, you may not have that much available.

A great way to change this is by making automated contributions. A goal I like to use is 10% of each paycheque. If you’re able to take that and put it straight into a TFSA, invest in a company on your watchlist, and hold it for the long term, you could see your investments skyrocket! It adds up quickly. If you make the average $45,000 per year, that’s $4,500 per year in investments, which is just $1,500 shy of the usual $6,000 of contribution room added each year.

Then, as long as you aren’t trading too often, investing in Canadian companies and staying within the limit, the Canada Revenue Agency (CRA) can’t tax you a penny. All your dividends and returns can come out when you need them, tax free. And you could be making a lot of money that the CRA can’t claim.

Top TFSA stocks

The top stocks you’re going to want to consider for your TFSA should be blue-chip companies. These are household names of industries that have been around for decades. Each also has a strong future ahead, with solid share and revenue growth.

It also means that you’re looking at companies that provide dividends. Dividends provide investors with cash every quarter (or more often) per share. These companies also have stable payouts, with steady increases in the dividend yield over the last several years.

TD Bank

TD Bank

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) falls directly into this category. The company has been around for over a century, with share and revenue increasing steadily during that time. The bank is one of Canada’s largest by market capitalization, currently at $116 billion.

Yet the company has a lot more room to grow. TD Bank expanded into the United States and continues to be one of the top 10 banks in the country. Yet it’s only in the northeastern part of the U.S., leaving plenty of room for expansion. It’s also moved into the wealth and commercial management sector, a highly lucrative area where it will see revenue soar.

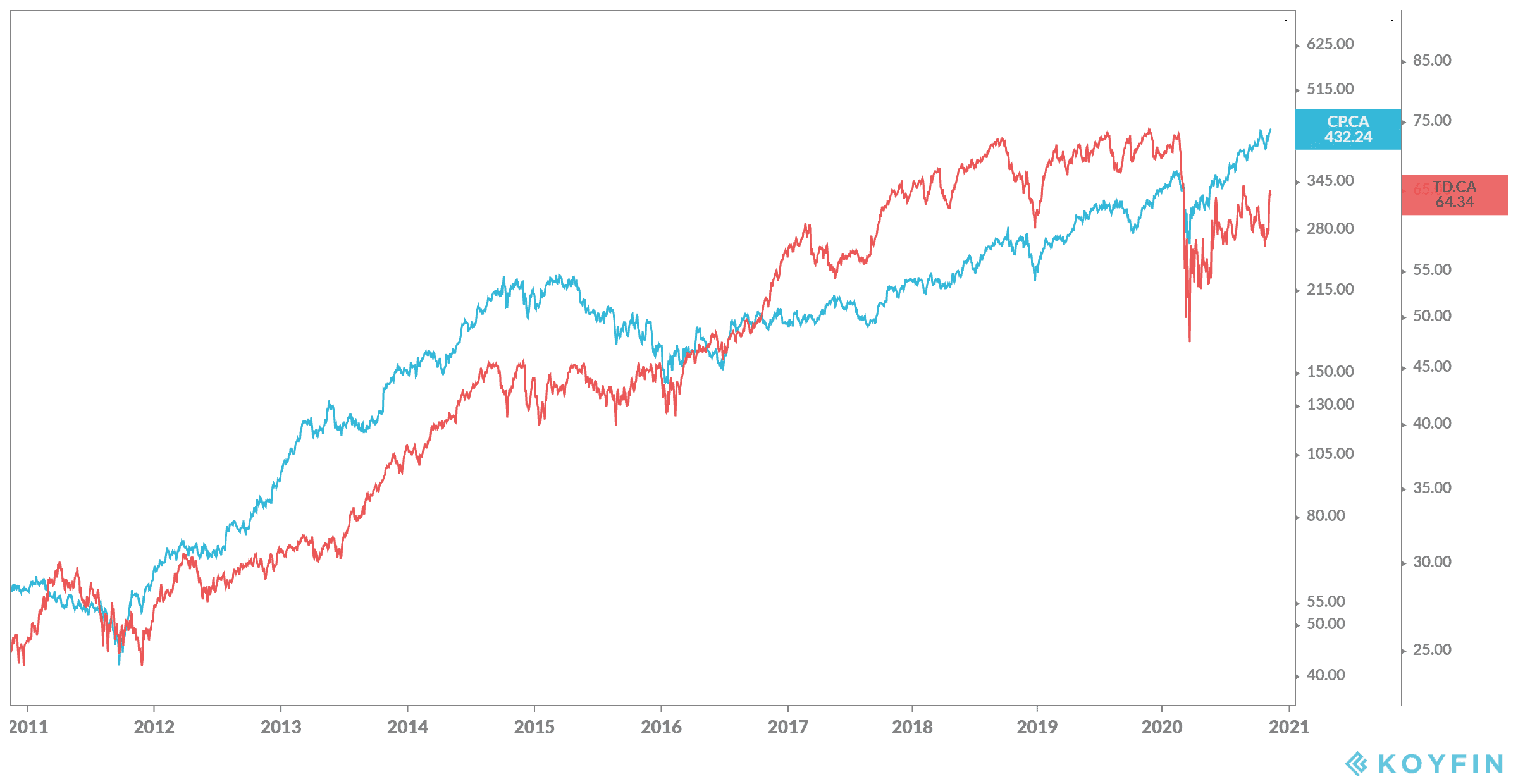

The company has seen shares rise by 43% in the last five years, with a compound annual growth rate (CAGR) of 9.83% during that time. Meanwhile, it offers a solid dividend yield of 4.95%, which has grown at a CAGR of 9.6% during the last 10 years.

CP Rail

Canadian Pacific Railway (TSX:CP)(NYSE:CP) is also a household name, and that’s because it’s one of only two railways in the country. CP Rail is the better of the two, because it’s already done the heavy lifting, reinvesting in infrastructure and making huge cuts. Meanwhile, with the oil and gas glut still going strong, it’s increased its shipping during the last few years.

CP Rail is as steady as it comes, as railway provides a cheap method of shipping anything and everything, and it’s nearly impossible to create a new railway company from nothing. The company has had a whopping 148% increase in shareholder returns in the last five years, with a CAGR of 22% and a dividend CAGR of 12.8% over the last decade.

Foolish takeaway

Canadians can use even a little bit of contribution room to make huge returns. By investing just $5,000 in each stock, and looking at similar growth over the next two decades, you could turn that $10,000 investment into a $357,951.21 portfolio!