When it comes to great investments, it doesn’t get much better in the last decade than Amazon.com (NASDAQ:AMZN). The company went from sending out books to people around the United States to becoming an e-commerce powerhouse. It couldn’t be more relevant today, when the company became the go-to for the work-from-home economy during the pandemic.

The numbers speak for themselves. The company has grown almost 1,700% in the last decade, with a compound annual growth rate (CAGR) of about 35% during that same time. In the last year alone, shares have grown 79% as of writing. And the company continues to grow in every way manageable.

During the last quarter alone, revenue increased 31.1% year over year. Earnings value over sales (EV/S) were 4.6 times in the last 12 months, and estimated to move to 3.7 times in the next year. So, economists still believe the company will continue to not only hold value, but become even more valuable over the years to come.

So, why not Amazon?

Amazon isn’t cheap. The company trades at around $3,100 per share as of writing, and could reach $4,000 in the next year. If you have the money, that’s great! But remember, if you’re about to use it in your Tax-Free Savings Account (TFSA), you should be investing Canadian. That’s because for all your non-Canadian returns you will be subject to taxes. It goes against the spirit of the TFSA, which is to invest in Canadian businesses.

But the other reason is there could be companies set to soar that are much cheaper. You could one day see share prices similar to Amazon, but get in a lot earlier. In fact, there’s one company I would consider, because it’s directly linked to the success of Amazon — a success that should continue for years and decades to come.

Fly high with Cargojet

Cargojet (TSX:CJT) is a company now directly linked to the success of Amazon. As e-commerce use rose this year, Cargojet rose, too. That’s because Amazon signed onto a stake in the company of 9.9%, and if business booms to $600 million in the next few years, that stake becomes 14.9%.

This was before the pandemic. When COVID-19 hit, the work-from-home economy needed e-commerce. The growth predicted years from now suddenly appeared overnight. Now, analysts are predicting e-commerce to grow even more than before, surpassing retail in sales by 2030.

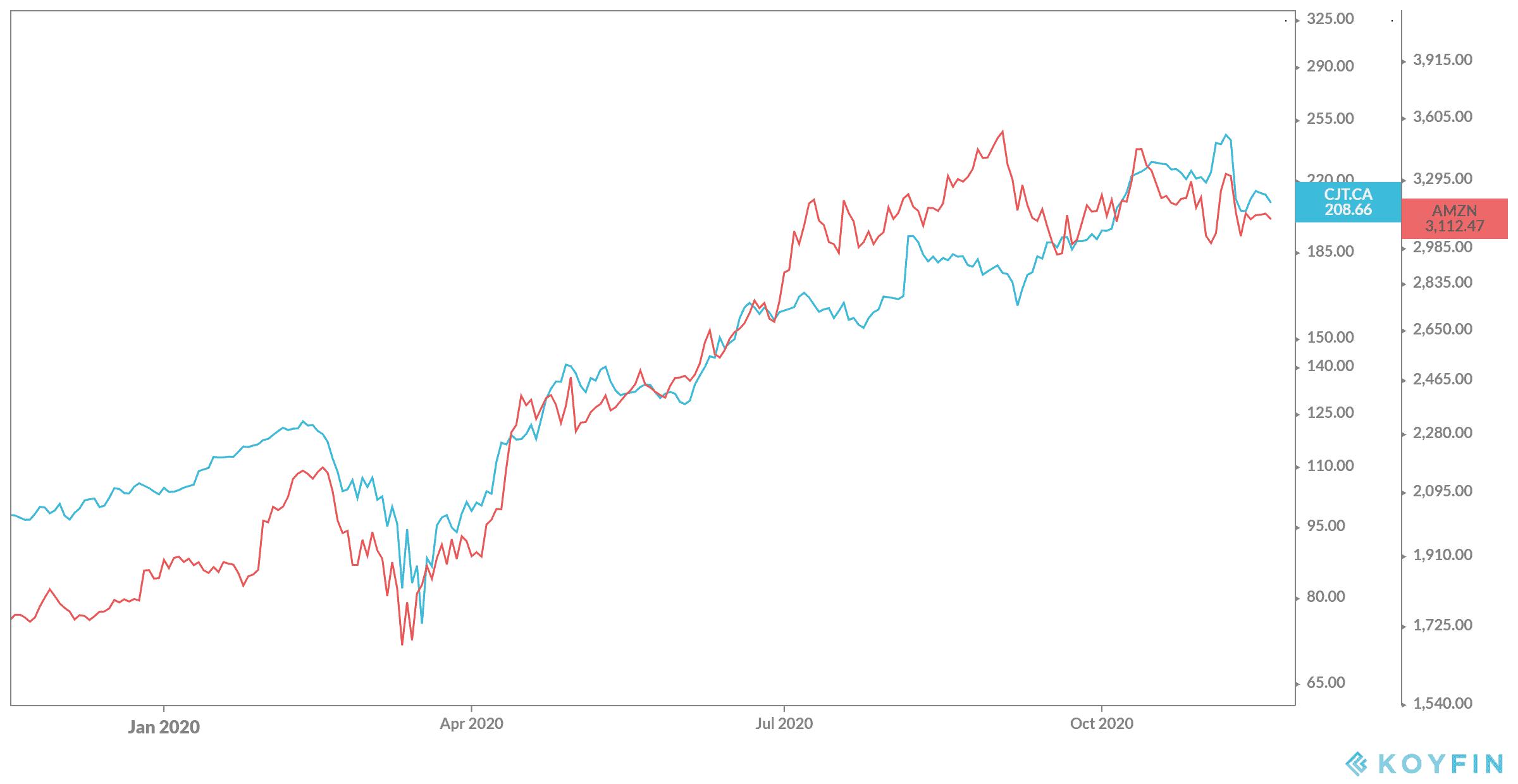

This is ideal for a company like Cargojet, which continues to see revenue rise as use grows. The company’s revenue recently increased by 29.5% year over year during the last quarter. Meanwhile, shares have risen by a whopping 818% in the last five years, and 113% in the last year alone, with a CAGR of 55% during the last five years. Analysts believe shares will rise right alongside Amazon, reaching almost $300 per share in the next year alone based on how it’s been performing.

Bottom line

Amazon is a great company and should continue to grow for a long time. But you don’t have to spend top dollar to see huge returns. Cargojet should continue to soar as its partnerships with Amazon grows. It could be very soon that the 14.9% stake occurs, and when it does, you could see shares skyrocket overnight.