When the Canada Recovery Benefit (CRB) was announced, many thought it was basically a replacement of the Canada Emergency Response Benefit (CERB). Unfortunately, that’s simply not the case. While the goal of the CERB was to get money to Canadians as quickly as possible, the CRB is different. Here, the goal is to get Canadians back to work as quickly as possible.

So now, you will be asking for CRB payments for a very particular reason. That reason is that you can’t find work due to COVID-19, though you have been trying, and can’t receive EI due to being self-employed or other reasons.

So let’s say you need those CRB payments right now. Here’s how to make that cash last.

The breakdown

When you receive CRB payments, here is how it will work. You will receive $500 each week for two weeks. You can then reapply if you still meet all the previous criteria I described. You can do this up to 13 times, for a total of 26 weeks and a total of $13,000. But that’s before tax. Really, the total would be $11,7000 afterwards.

Then, you get back to work after all those applications. You manage to make $45,000 at the end of the year, including your CRB payments. Great! Except now you need to tell the Canada Revenue Agency (CRA). Since you surpassed the $38,000 for the year, you now have to pay $0.50 of every $1 past the $38,000 on your tax returns back to the CRA. For $45,000, that’s a whopping $3,500 — a third of your CRB payments!

Make it back

So let’s say this describes your situation. What you then want to do is try and make back what you’re going to pay to the CRA. To do that, you need strong stocks with stable returns and dividends that will come in before tax time. That way you can have cash available when tax season comes, and hold onto those CRB payments you really did need at the time.

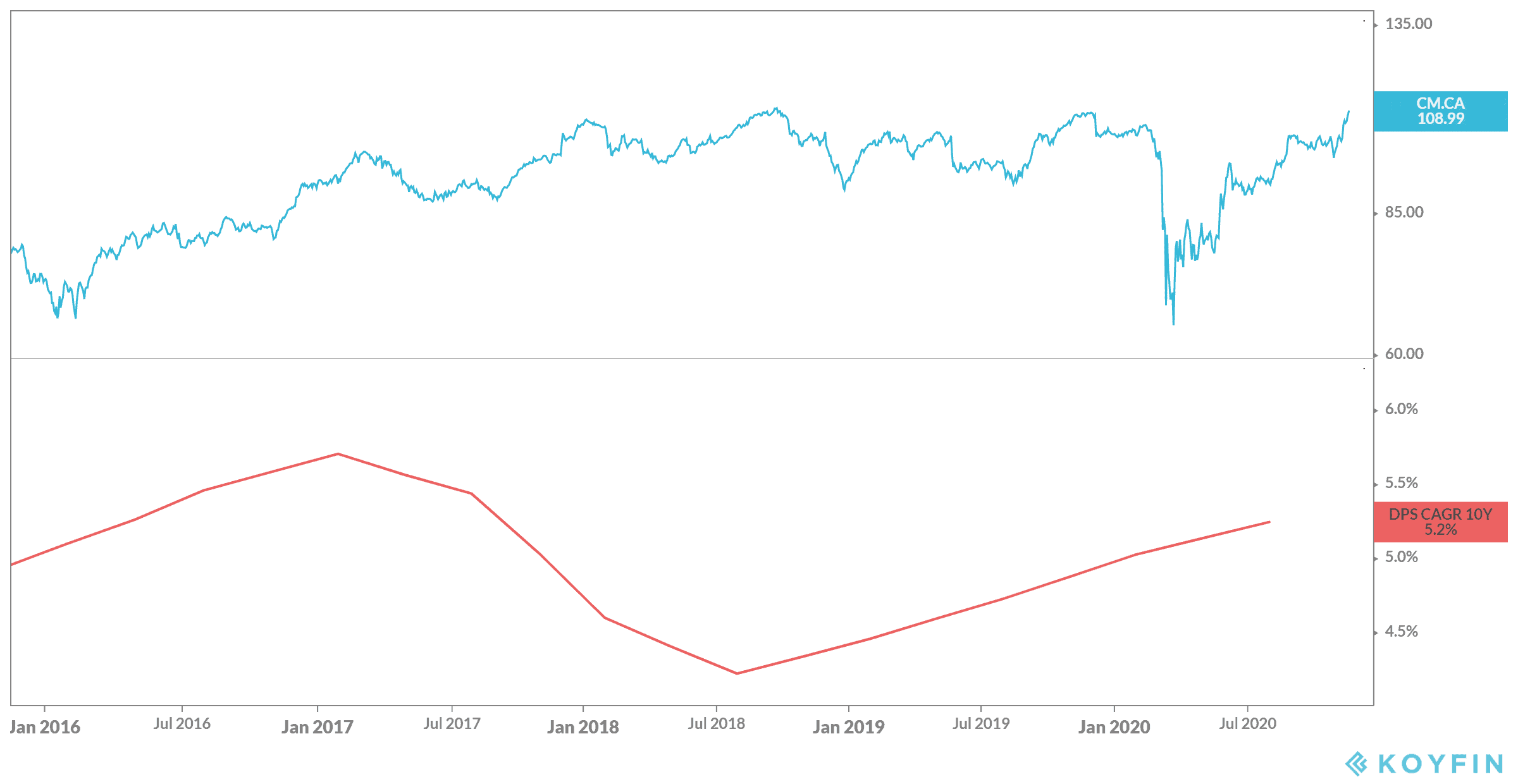

It doesn’t have to be a risky investment, in fact it shouldn’t be. Done right, you can create a lasting income stream to last you the rest of your life! Take a stock like Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM). CIBC is one of the Big Six Banks and bounced back after the last recession. It’s likely to do the same again, and then continue growing for decades as it has in the past.

It also offers the highest dividend yield of the Big Six Banks at 5.43%. So you can then look forward to quarterly income from your investment. Meanwhile, returns have been strong at 42% in the last five years, with a compound annual growth rate (CAGR) of 8.86% in the last decade. So you can then look forward to your investment continuing on that scale for the next decade as well!

Bottom line

S0 let’s say you can do what you should be doing with any pay cheque and put aside 20% each payment. That’s $2,340 that you can invest in CIBC from your CRB payments. Then, you continue to invest as you make the further $33,300 for the rest of the year. That’s $6,660 for a total of $9,000 in investments.

If we use historical data as a projection for the year, in a year you should have turned that $9,000 into $10,391.85 including dividends, bringing your payment down to $1,939! Meanwhile, you’ll have created an income stream of $490 per year, with returns to boot for the rest of your life! All starting with those CRB payments.