Editor’s Note: A previous version of this article stated that Canada’s debt was at a total of $272 trillion. This has been updated to reflect that there is $272 trillion in global debt.

It now seems official. A second market crash is pretty much inevitable — not just around the world in general, but definitely here at home in Canada. Our country now leads the way in terms of debt, even ahead of the United States and United Kingdom. Between January and September of this year, global debt racked up a further $15 trillion, mainly thanks to COVID-19. That brings the total global debt to a whopping $272 trillion!

What does this mean? Be prepared for another market crash, and soon. With COVID-19 cases surging across Canada, another lockdown will happen in at least one or two provinces. This means business closures and lay offs — all what we saw back in March. So, start preparing now.

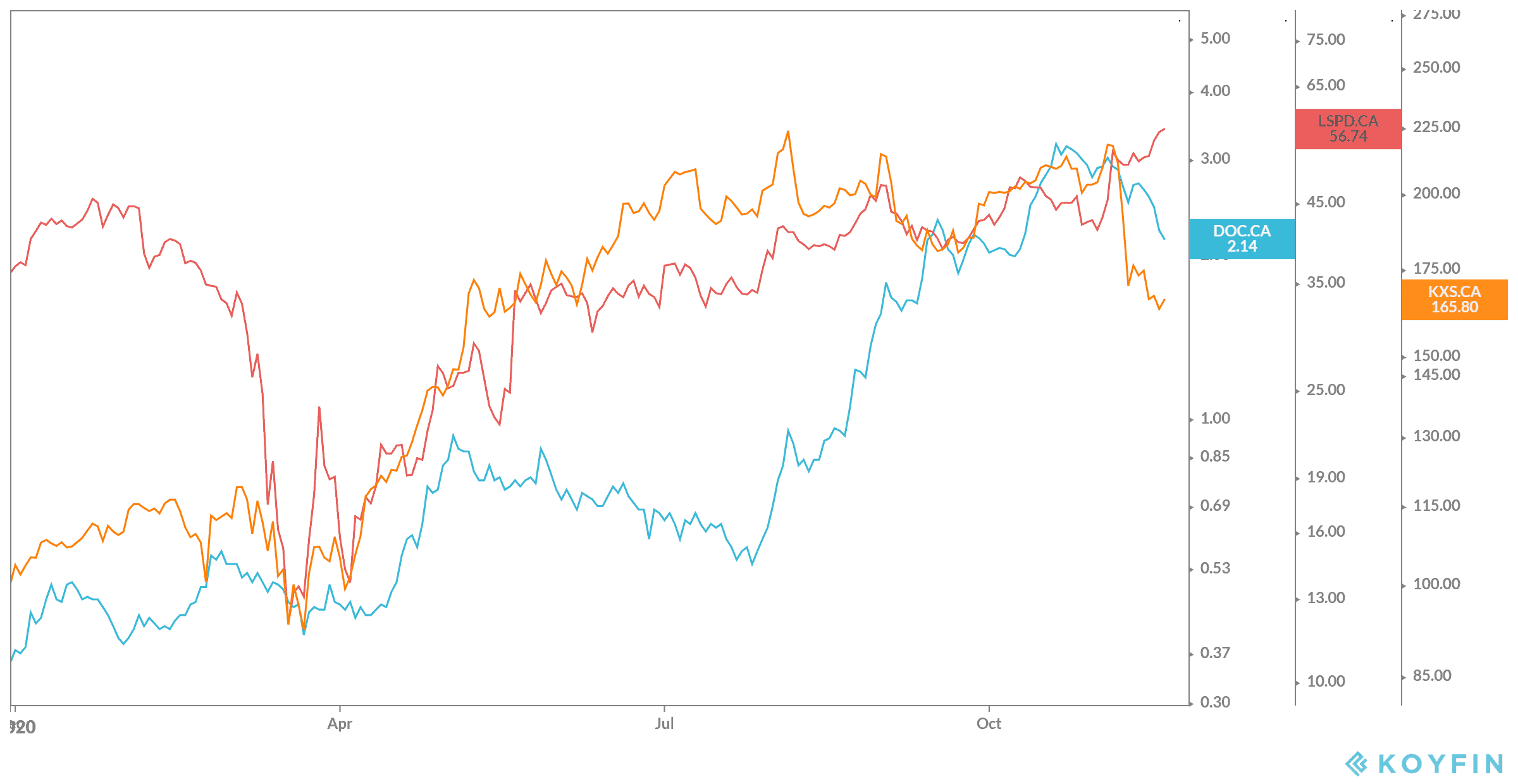

How can you prepare? Invest in companies that will do well no matter what happens in the markets. Even better, invest in companies that can actually benefit! For those, I would consider Kinaxis (TSX:KXS), Lightspeed POS (TSX:LSPD)(NYSE:LSPD) and CloudMD Software & Services (TSXV:DOC).

Kinaxis

Tech stocks in general have become a defensive necessity against another market crash, but Kinaxis beats them all. That’s because the company has a stable means of earning recurring revenue for years and decades to come. The company provides supply chain management software powered by artificial intelligence. It can make sure companies products ship securely, safely, and even help better a company’s performance.

You wouldn’t know a crash even happened to look at revenue. It recently increased year over year by 18% during the last quarter. Meanwhile, shares have grown 271% in the last five years for a compound annual growth rate (CAGR) of 30% during that same time! Yet the company has an endless ability to grow, making this a great stock to pick up and hold for decades.

Lightspeed

Another tech stock to consider has to be Lightspeed. The company has gotten a lot of headlines since its initial public offering, and that’s continued as revenue increased again and again. Lightspeed offers point-of-sale services to retail and restaurant businesses but has since expanded. Now, companies can sign up online for free — a huge benefit in a time when companies don’t have the cash available during an economic crisis.

With revenue up 60.8% year over year in the last quarter, and shares up 80% in the last year, there is one thing to consider: this stock has a lot more room to grow. E-commerce is huge, and only going to get bigger, likely outpacing retail by 2030 according to analysts. So, buying this stock and holding on tight can only do you good, especially in another market crash.

CloudMD

Finally, if you really want to get defensive against another market crash, then you need to combine a tech company with a healthcare company. That’s what you get from CloudMD. This company provides virtual healthcare across Canada. It’s been acquiring businesses in every healthcare industry from physiotherapy to mental health and of course physicians and nurses. It now has a huge arsenal, growing every day.

And that includes its shares and revenue. During the latest quarter, revenue grew year over year by 163%! With gross profit rising by 42% in the same period. Meanwhile, shares rose an incredible 494% as of writing. Yet shares are only about $2.50 each, making this an entirely affordable stock that has plenty of room to grow, both by share price and market capitalization.