Editor’s Note: A previous version of this article stated that Canada’s debt was at a total of $272 trillion. This has been updated to reflect that there is $272 trillion in global debt.

Today’s market is all over the place. It’s basically the definition of volatility. Yet it can still get worse. Global debt tacked on another $15 trillion between January and September. That brings total global debt to a whopping $272 trillion. It’s made some stocks skyrocket, such as those in the e-commerce industry, and others sink to all-time lows, like cannabis.

But there’s one industry that you should definitely keep your eye on no matter what goes on in the markets, and even during another market crash. That’s the healthcare industry. Healthcare stocks have trended up and up, yet are still at affordable prices.

Healthcare is the perfect industry to consider right now. Investments are pouring in, as COVID-19 sweeps the world. Everyone now realizes how underfunded our healthcare industry is, even in Canada. Whether it’s the buildings themselves or finding new ways to bring help to patients, healthcare is the perfect buy-and-hold stock at today’s prices.

Viemed

During the COVID-19 crisis, one thing has become clear: we need more ventilators. And wouldn’t it be great if these could be in home? Viemed Healthcare (TSX:VMD)(NASDAQ:VMD) has been working on this for years. The company provides in-home medical equipment across the United States with respiratory services. So, during this crisis, the company has seen a surge in demand.

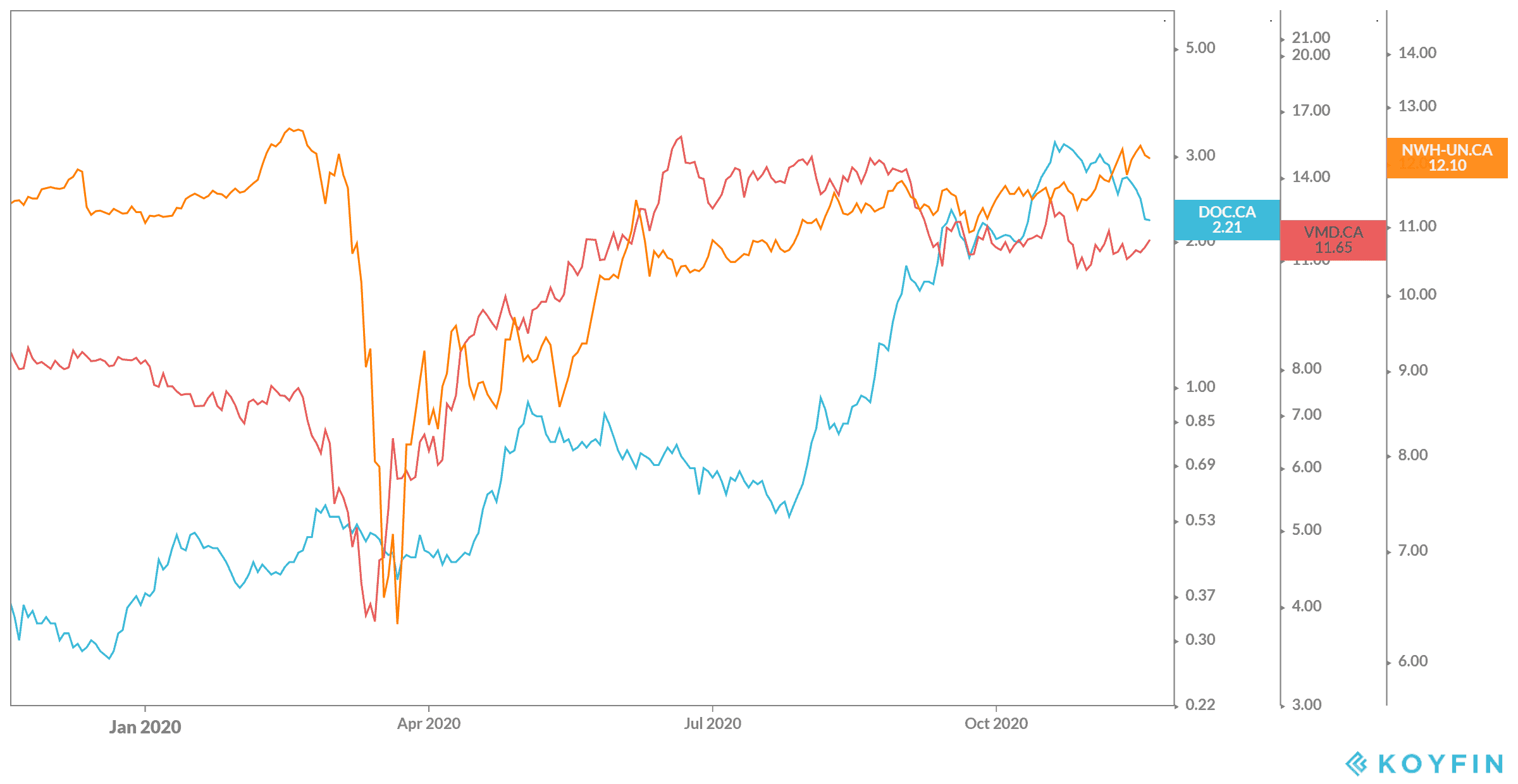

This will likely continue beyond the crisis, with revenue as of writing increasing year over year by 58.9% during the last earnings report. While this is likely to slow down in years to come, it’s still going to be increase for long-term holders at a steady rate. Meanwhile, shares are up 38% in the last year alone and at an affordable $11.66 as of writing.

Northwest Healthcare

Other than products, another area seeing an increase in investment is healthcare properties — not just hospitals, but office space, laboratories, and pharmacies. Everything needs to be at peak production with so many COVID-19 cases, never mind the slew of other health issues that were there before. This is why Northwest Healthcare Properties REIT (TSX:NWH.UN) has seen such a boost in its revenue.

The company owns a diverse portfolio of healthcare properties around the world, with occupancy at a whopping 99%! This has surged revenue to a 10.8% increase year over year and boosted shares by 107% in the last five years. With leases signing on for years, if not a decade, at a time, the company should continue seeing strong revenue well into the future, with a 6.57% dividend yield in the meantime.

CloudMD

For the biggest bang for your buck, CloudMD Software & Services (TSXV:DOC) has to be the one. The company is the future of healthcare, providing virtual healthcare workers across the country. Not just physicians, but nurses, physiotherapists, mental health works, practically everything. And soon it could be everything, with CloudMD constantly acquiring new virtual healthcare companies.

Revenue has skyrocketed 163% year over year, with gross profit increasing 42% in that time. Shares went even higher, growing 511% in the last year! Yet again, shares are incredibly affordable at just $2.20 as of writing. So, bulk up on a stock like this and hold onto it for decades. This could be one you can retire on.