Bitcoin hit an all-time high price of US$19,783 in December 2017. Chances are high that the cryptocurrency could touch and surpass that historical level before year-end 2020. Momentum remains strong. Bitcoin’s price hit a day high of US$18,823 at CoinDesk on Friday in a strong 160% rally so far this year.

Unlike in 2017, the recent Bitcoin climb has been without much fanfare. The media has been preoccupied with the coverage of the presidential election in the U.S. and focused on the COVID-19 pandemic. However, the momentum gain since October this year mirrors what happened in 2017. And things didn’t end well in 2017, as the digital currency tumbled to close the year at US$13,850 and traded below US$4,000 the following year. Investors are right to be worried about the same thing happening again.

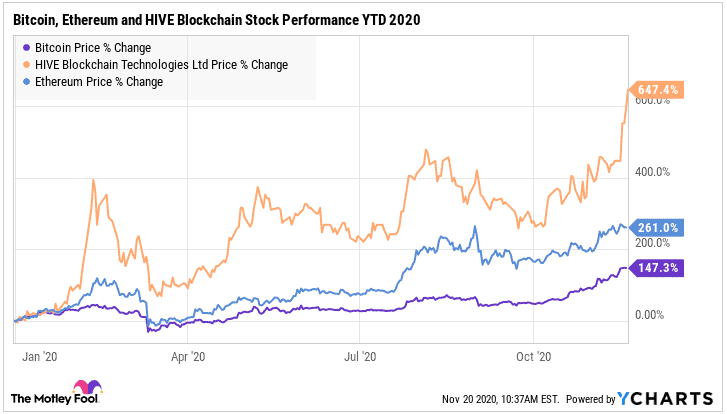

Bitcoin soars but underperforms related cryptocurrency assets

Bitcoin has soared so far this year, but returns underperformed some of its peer assets by a considerable margin. More impressively, one Canadian cryptocurrency stock, Hive Blockchain Technologies (TSXV:HIVE), has risen by 647% on a year-to-date basis.

Ethereum’s 261% price increase so far this year compounded HIVE’s recovery in 2020, as the crypto miner has a significant proportion of its computing power allocated to Ether transactions. Hive holds a lot more of the coin units in inventory. Management recently revealed that an explosion of activity on the Ethereum network drove a significant increase in fees paid to miners. The company will report a record amount of Ethereum mined during the quarter ending September 2020.

However, we can’t overlook Bitcoin’s influence on Hive stock performance during the past few months. The crypto mining firm is heavily invested in Bitcoin mining infrastructure. It is also scaling up its operations with the latest mining equipment after the halving of Bitcoin rewards in May this year.

The periodic halving in the currency’s rewards plays a significant role in its pricing. It awakens investors to the scarcity of the coin, as it nears its supply limit of 21 million.

Is there further upside on Bitcoin?

Wild predictions are already being released for the coin’s value in the next few years. Predictions that Bitcoin price is headed to US$1 million by 2030 and those that project the coin at US$100,000 in the next five years have since started doing the rounds. Such speculation feeds into the hype, as greed takes over rational thinking.

The truth is that it’s hard to place a fundamental value on the coin. Not only because of its lack of cash flows, but also because of its limited applications and limited transaction history. Technical analysts have a difficult job predicting the value of the hyped and greed-fueled crypto-asset due to limited trading history data.

That said, PayPal opened up trading in, transactions with, and the holding of Bitcoin for U.S. customers recently. Add to that the increasing acceptance of the coin at other large global corporations and increasing investments by savvy investors, and the coin’s mass adoption gathers a good pace.

Mass adoption leads to better valuation for cryptocurrencies. And so does the increase in volumes of transactions done with the coin.

Most noteworthy, the U.S. president-elect Joe Biden appointed crypto-friendly Gary Gensler to oversee Wall Street regulations. This is a positive for the currency on the regulatory side. Flexible regulation could allow for further mass adoption and acceptance as a value hedge during crises.

Moreover, millennials have more reason to buy Bitcoin to hedge against future anticipated inflation. This trade is gaining pace, as economists predict a devaluation of world-leading currencies including the U.S. dollar and the euro due to massive printing to support populations during the COVID-19 pandemic.

Thus, we could still see an increase in Bitcoin’s price over time. However, I can’t rule out a near-term correction after the recent surge.