Over the last few weeks, given the sharp rise we have seen in stock markets, it looks as though investors are convinced that the economy will soon be on the road to recovery. This has meant that top pandemic stocks, such as tech companies, are being sold off. At the same time, distressed businesses, such as restaurant stocks, that traded extremely cheap throughout the pandemic have begun to rally.

This is the perfect opportunity for savvy value investors to find high-quality TSX stocks that have been trading cheap to make a tonne of money as the share price recovers.

And although it seems like you could buy any business in one of these distressed industries and see a major return on your investment, I would caution against doing that.

There is no doubt that these industries will see a rebound, but if there is something inherently risky about a stock, you may want to avoid it.

The restaurant industry is one of those distressed industries. Here are two TSX stocks to take advantage of the rally and one to avoid altogether.

Defensive restaurant royalty stock

The first stock to consider buying is my personal favourite restaurant stock, Pizza Pizza Royalty (TSX:PZA). Even before the pandemic, Pizza Pizza was considered by many to be the most defensive of all the restaurant royalty stocks.

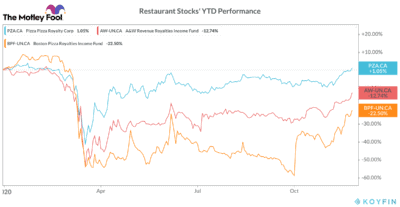

That’s been proven over the last few months, as Pizza Pizza was by far the least impacted of all its peers. At most, the stock has seen a 25% impact on its revenue. This caused Pizza Pizza to trim its dividend by just 30%, compared to many of its peers who suspended the dividend altogether.

It’s also bouncing back a lot quicker. Pizza Pizza doesn’t have to worry about dine-in restrictions. Furthermore, its takeout model and relatively affordable options compared to its peers make it ideal amongst consumers during these economic conditions.

Even though its impact wasn’t very severe, the stock is already making a strong recovery, and management even increased the dividend again over the last few weeks.

So, if you’re looking for a top stock to buy during this market rally, Pizza Pizza has a tonne of momentum. Plus, if you buy it soon, you could lock in its impressive 7.1% dividend.

High-potential restaurant stock

Another high-quality stock to consider buying today is A&W Revenue Royalties Income Fund (TSX:AW.UN). During the early days of the pandemic, A&W was impacted a lot more severely than Pizza Pizza.

The stock initially traded down 50%, and management was forced to suspend the dividend. A&W, though, has always been one of the top growth stocks in the restaurant industry.

The fund has been consistently increasing the number of restaurants across Canada, as Canadians can’t get enough of the high-quality A&W meals.

This has allowed A&W to recover rather rapidly, especially since it also doesn’t rely on dine-in eating. So, with the stock still down nearly 15% from its pre-pandemic high, and with its dividend now reinstated, now is a great time to gain some exposure to this high-potential restaurant stock.

One stock I would avoid

The optimism around an economic recovery has sent numerous stocks skyrocketing. One of the more peculiar outperformers recently has been Boston Pizza Royalties Income Fund (TSX:BPF.UN).

This chart shows perfectly just how badly the pandemic impacted Boston Pizza. And while the bigger discount may be more attractive, Boston Pizza has a lot more risk.

All of these funds collect top-line royalty payments from each restaurant, so the risk is limited that way. The funds only have to worry about sales numbers and not necessarily profitability.

However, if a wave of locations go out of business, the number of restaurants in Boston Pizza’s royalty pool would decline. This means that even once the operations have recovered post-pandemic, the total royalty income coming in would be considerably less.

This is a risk with Pizza Pizza and A&W as well. However, because dine-in restaurants are being a lot more impacted, it’s considerably more concerning with Boston Pizza.

So, even though its recovery numbers have looked strong up until now, a tough winter could really hurt Boston Pizza going forward. That’s’ why I’d avoid the stock for now.

Act Fast: 75 Only!

Act Fast: 75 Only!